Dollar General 2010 Annual Report Download - page 141

Download and view the complete annual report

Please find page 141 of the 2010 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

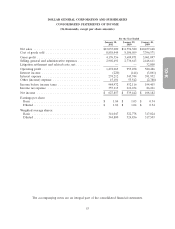

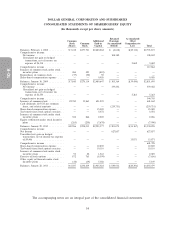

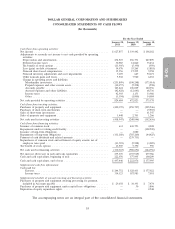

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

1. Basis of presentation and accounting policies (Continued)

by counterparty portfolio, the Company has determined that the CVAs are not significant to the overall

portfolio valuations, as the CVAs are deemed to be immaterial in terms of basis points and are a very

small percentage of the aggregate notional value. Although some of the CVAs as a percentage of

termination value appear to be more significant, primary emphasis was placed on a review of the

CVA in basis points and the percentage of the notional value. As a result, the Company has

determined that its derivative valuations in their entirety are classified in Level 2 of the fair value

hierarchy.

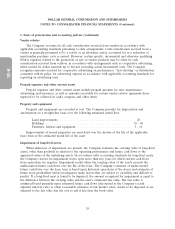

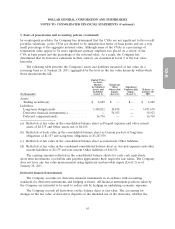

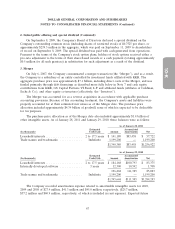

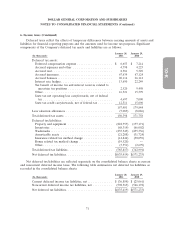

The following table presents the Company’s assets and liabilities measured at fair value on a

recurring basis as of January 28, 2011, aggregated by the level in the fair value hierarchy within which

those measurements fall.

Quoted Prices

in Active

Markets Significant

for Identical Other Significant

Assets and Observable Unobservable Balance at

Liabilities Inputs Inputs January 28,

(In thousands) (Level 1) (Level 2) (Level 3) 2011

Assets:

Trading securities(a) ..................... $ 8,289 $ — $— $ 8,289

Liabilities:

Long-term obligations(b) .................. 3,450,812 20,858 — 3,471,670

Derivative financial instruments(c) ........... — 34,923 — 34,923

Deferred compensation(d) ................. 16,710 — — 16,710

(a) Reflected at fair value in the consolidated balance sheet as Prepaid expenses and other current

assets of $2,179 and Other assets, net of $6,110.

(b) Reflected at book value in the consolidated balance sheet as Current portion of long-term

obligations of $1,157 and Long-term obligations of $3,287,070.

(c) Reflected at fair value in the consolidated balance sheet as noncurrent Other liabilities.

(d) Reflected at fair value in the condensed consolidated balance sheet as Accrued expenses and other

current liabilities of $2,179 and non-current Other liabilities of $14,531.

The carrying amounts reflected in the consolidated balance sheets for cash, cash equivalents,

short-term investments, receivables and payables approximate their respective fair values. The Company

does not have any fair value measurements using significant unobservable inputs (Level 3) as of

January 28, 2011.

Derivative financial instruments

The Company accounts for derivative financial instruments in accordance with accounting

standards for derivative instruments and hedging activities. All financial instrument positions taken by

the Company are intended to be used to reduce risk by hedging an underlying economic exposure.

The Company records all derivatives on the balance sheet at fair value. The accounting for

changes in the fair value of derivatives depends on the intended use of the derivative, whether the

63