Dollar General 2010 Annual Report Download - page 149

Download and view the complete annual report

Please find page 149 of the 2010 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

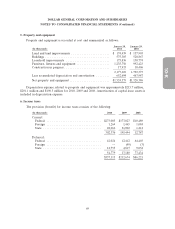

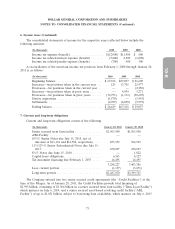

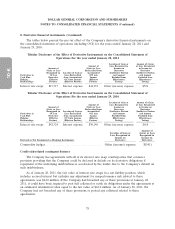

6. Income taxes (Continued)

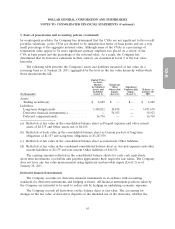

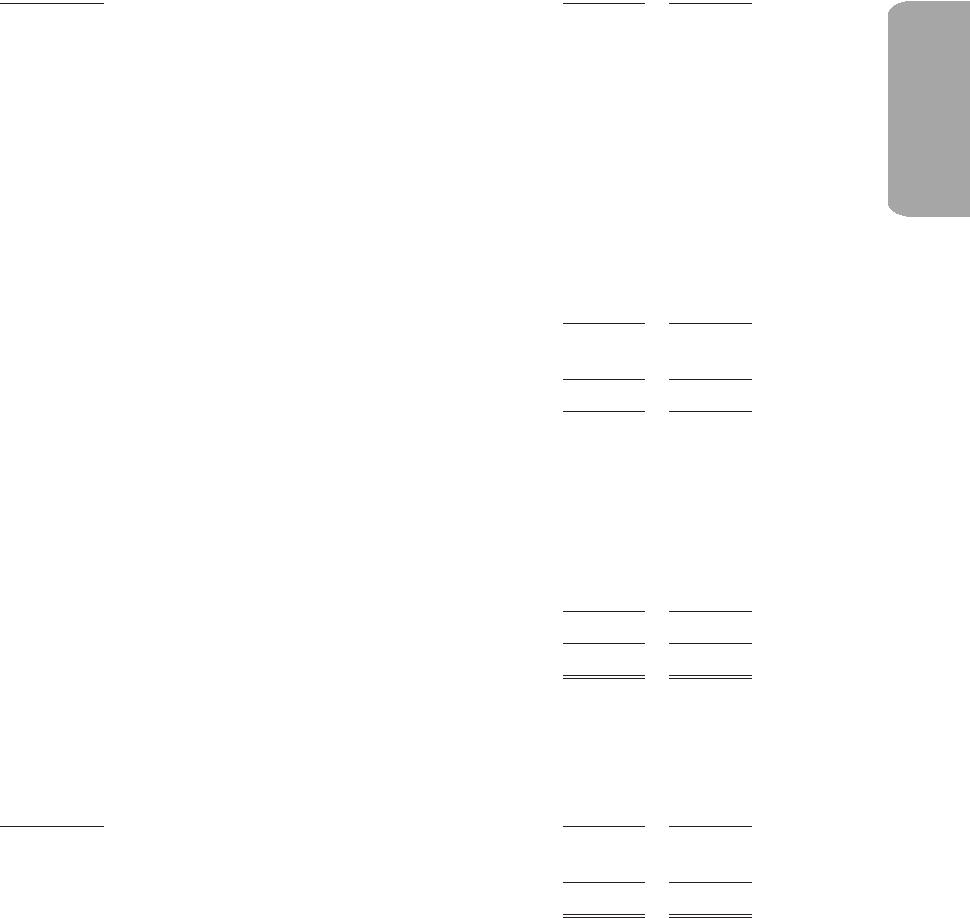

Deferred taxes reflect the effects of temporary differences between carrying amounts of assets and

liabilities for financial reporting purposes and the amounts used for income tax purposes. Significant

components of the Company’s deferred tax assets and liabilities are as follows:

January 28, January 29,

(In thousands) 2011 2010

Deferred tax assets:

Deferred compensation expense .................... $ 6,653 $ 7,214

Accrued expenses and other ...................... 4,798 4,223

Accrued rent .................................. 8,581 5,329

Accrued insurance .............................. 67,634 67,124

Accrued bonuses ............................... 20,116 26,112

Interest rate hedges ............................. 13,650 22,249

Tax benefit of income tax and interest reserves related to

uncertain tax positions ......................... 2,520 9,498

Other ....................................... 16,321 15,399

State tax net operating loss carryforwards, net of federal

tax ....................................... 4,697 7,000

State tax credit carryforwards, net of federal tax ........ 12,511 15,696

157,481 179,844

Less valuation allowances .......................... (7,083) (8,086)

Total deferred tax assets ........................... 150,398 171,758

Deferred tax liabilities:

Property and equipment ......................... (222,757) (177,171)

Inventories ................................... (68,314) (66,002)

Trademarks ................................... (435,543) (435,336)

Amortizable assets ............................. (21,288) (31,724)

Insurance related tax method change ................ (14,844) (30,059)

Bonus related tax method change ................... (19,520) —

Other ....................................... (3,551) (2,699)

Total deferred tax liabilities ......................... (785,817) (742,991)

Net deferred tax liabilities .......................... $(635,419) $(571,233)

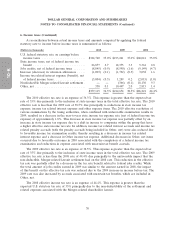

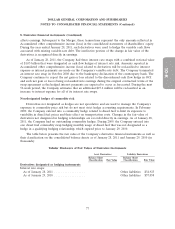

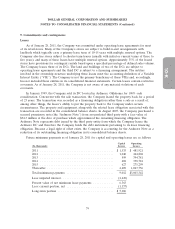

Net deferred tax liabilities are reflected separately on the consolidated balance sheets as current

and noncurrent deferred income taxes. The following table summarizes net deferred tax liabilities as

recorded in the consolidated balance sheets:

January 28, January 29,

(In thousands) 2011 2010

Current deferred income tax liabilities, net .............. $ (36,854) $ (25,061)

Noncurrent deferred income tax liabilities, net ........... (598,565) (546,172)

Net deferred tax liabilities .......................... $(635,419) $(571,233)

71