Dollar General 2010 Annual Report Download - page 172

Download and view the complete annual report

Please find page 172 of the 2010 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

10-K

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES

NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

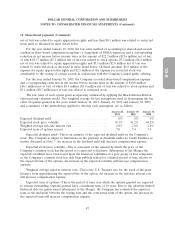

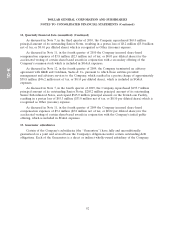

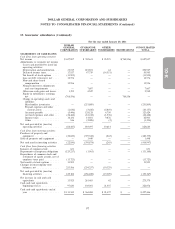

15. Guarantor subsidiaries (Continued)

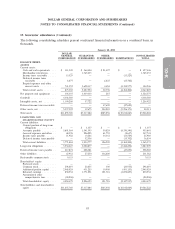

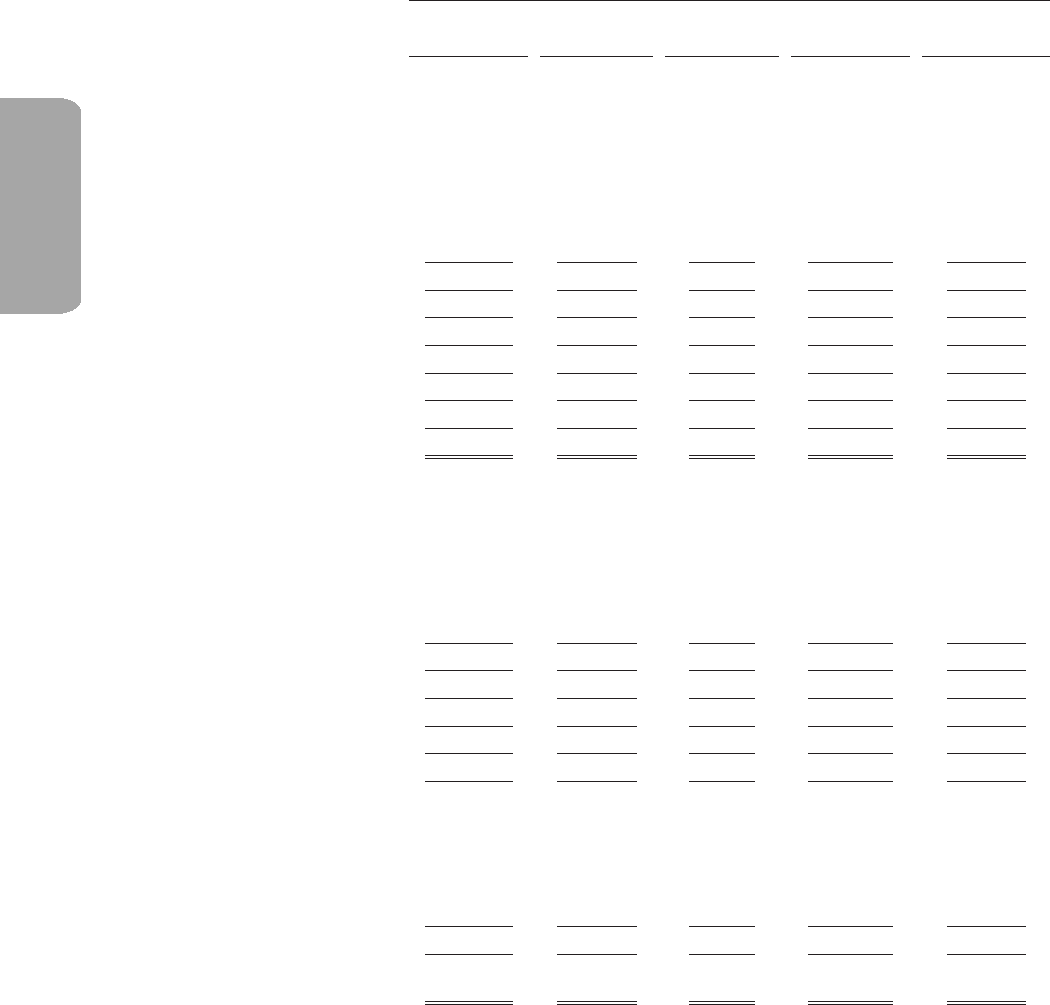

January 29, 2010

DOLLAR

GENERAL GUARANTOR OTHER CONSOLIDATED

CORPORATION SUBSIDIARIES SUBSIDIARIES ELIMINATIONS TOTAL

BALANCE SHEET:

ASSETS

Current assets:

Cash and cash equivalents . . . $ 97,620 $ 103,001 $ 21,455 $ — $ 222,076

Merchandise inventories ..... — 1,519,578 — — 1,519,578

Income taxes receivable ..... 9,924 1,645 — (4,026) 7,543

Deferred income taxes

receivable ............. 16,066 — 3,559 (19,625) —

Prepaid expenses and other

current assets .......... 625,157 3,040,792 704 (3,570,401) 96,252

Total current assets ........ 748,767 4,665,016 25,718 (3,594,052) 1,845,449

Net property and equipment . . . 99,452 1,228,829 105 — 1,328,386

Goodwill ................ 4,338,589 — — — 4,338,589

Intangible assets, net ........ 1,201,223 83,060 — — 1,284,283

Deferred income taxes receivable — — 36,405 (36,405) —

Other assets, net ........... 4,288,270 8,920 297,757 (4,528,135) 66,812

Total assets ............... $10,676,301 $5,985,825 $359,985 $(8,158,592) $8,863,519

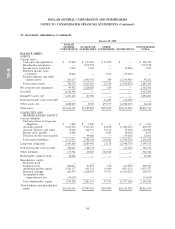

LIABILITIES AND

SHAREHOLDERS’ EQUITY

Current liabilities:

Current portion of long-term

obligations ............ $ 1,822 $ 1,849 $ — $ — $ 3,671

Accounts payable ......... 3,033,723 1,311,063 46,818 (3,560,651) 830,953

Accrued expenses and other . . 72,320 226,571 53,149 (9,750) 342,290

Income taxes payable ....... 4,086 — 4,465 (4,026) 4,525

Deferred income taxes payable — 44,686 — (19,625) 25,061

Total current liabilities ...... 3,111,951 1,584,169 104,432 (3,594,052) 1,206,500

Long-term obligations ........ 3,645,820 2,689,492 13,178 (2,948,775) 3,399,715

Deferred income taxes payable . . 394,045 188,532 — (36,405) 546,172

Other liabilities ............ 115,701 40,065 146,582 — 302,348

Redeemable common stock .... 18,486 — — — 18,486

Shareholders’ equity:

Preferred stock ........... — — — — —

Common stock ........... 298,013 23,855 100 (23,955) 298,013

Additional paid-in capital .... 2,923,377 431,253 19,900 (451,153) 2,923,377

Retained earnings ......... 203,075 1,028,459 75,793 (1,104,252) 203,075

Accumulated other

comprehensive loss ....... (34,167) — — — (34,167)

Total shareholders’ equity .... 3,390,298 1,483,567 95,793 (1,579,360) 3,390,298

Total liabilities and shareholders’

equity ................. $10,676,301 $5,985,825 $359,985 $(8,158,592) $8,863,519

94