Dollar General 2010 Annual Report Download

Download and view the complete annual report

Please find the complete 2010 Dollar General annual report below. You can navigate through the pages in the report by either clicking on the pages

listed below, or by using the keyword search tool below to find specific information within the annual report.

-

1

-

2

-

3

-

4

-

5

-

6

-

7

-

8

-

9

-

10

-

11

-

12

-

13

-

14

-

15

-

16

-

17

-

18

-

19

-

20

-

21

-

22

-

23

-

24

-

25

-

26

-

27

-

28

-

29

-

30

-

31

-

32

-

33

-

34

-

35

-

36

-

37

-

38

-

39

-

40

-

41

-

42

-

43

-

44

-

45

-

46

-

47

-

48

-

49

-

50

-

51

-

52

-

53

-

54

-

55

-

56

-

57

-

58

-

59

-

60

-

61

-

62

-

63

-

64

-

65

-

66

-

67

-

68

-

69

-

70

-

71

-

72

-

73

-

74

-

75

-

76

-

77

-

78

-

79

-

80

-

81

-

82

-

83

-

84

-

85

-

86

-

87

-

88

-

89

-

90

-

91

-

92

-

93

-

94

-

95

-

96

-

97

-

98

-

99

-

100

-

101

-

102

-

103

-

104

-

105

-

106

-

107

-

108

-

109

-

110

-

111

-

112

-

113

-

114

-

115

-

116

-

117

-

118

-

119

-

120

-

121

-

122

-

123

-

124

-

125

-

126

-

127

-

128

-

129

-

130

-

131

-

132

-

133

-

134

-

135

-

136

-

137

-

138

-

139

-

140

-

141

-

142

-

143

-

144

-

145

-

146

-

147

-

148

-

149

-

150

-

151

-

152

-

153

-

154

-

155

-

156

-

157

-

158

-

159

-

160

-

161

-

162

-

163

-

164

-

165

-

166

-

167

-

168

-

169

-

170

-

171

-

172

-

173

-

174

-

175

-

176

-

177

-

178

-

179

-

180

-

181

-

182

-

183

-

184

-

185

-

186

-

187

-

188

-

189

-

190

-

191

-

192

-

193

-

194

-

195

-

196

Table of contents

-

Page 1

-

Page 2

-

Page 3

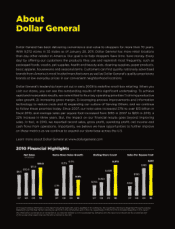

... by offering a wide selection of quality items at value prices in conveniently located easy-to-shop stores. It is by adhering to this strategy that Dollar General produced record financial results in fiscal 2010, including record sales, gross profit, operating profit, operating cash flows and net...

-

Page 4

-

Page 5

... of record at the close of business on March 16, 2011 By Order of the Board of Directors,

6APR201023125201

Goodlettsville, Tennessee April 5, 2011 Christine L. Connolly Corporate Secretary

Please vote your proxy as soon as possible even if you expect to attend the annual meeting in person. You may...

-

Page 6

-

Page 7

Proxy Statement

-

Page 8

DOLLAR GENERAL CORPORATION

Proxy Statement for 2011 Annual Meeting of Shareholders

Proxy

TABLE OF CONTENTS General Information ...Voting Matters ...Proposal 1: Election of Directors ...Corporate Governance ...Director Compensation ...Director Independence ...Transactions with Management and Others...

-

Page 9

...annual meeting, on the ''Investor Information'' portion of our web site located at www.dollargeneral.com. What is Dollar General Corporation and where is it located? We operate convenient-sized stores to deliver everyday low prices on products that families use every day. We are the largest discount...

-

Page 10

...? We have posted Dollar General governance-related information on the ''Investor Information- Corporate Governance'' portion of our web site located at www.dollargeneral.com, including without limitation our Corporate Governance Guidelines, Code of Business Conduct and Ethics, the charter of...

-

Page 11

...your proxies have authority to vote as they think best, including to adjourn the meeting. Who is entitled to vote? You may vote if you owned shares of Dollar General common stock at the close of business on March 16, 2011. As of that date, there were 341,521,858 shares of Dollar General common stock...

-

Page 12

... of future votes on our executive compensation, the option of one year, two years or three years that receives the highest number of votes cast by shareholders will be the frequency that has been selected by shareholders. However, because this vote is advisory and not binding on Dollar General or...

-

Page 13

... disclosed either within Dollar General or to third parties, except (1) as necessary to meet applicable legal requirements; (2) in a dispute regarding authenticity of proxies and ballots; (3) in the case of a contested proxy solicitation, if the other party soliciting proxies does not agree...

-

Page 14

... and related entities. Mr. Agrawal is a director of Colonial Pipeline Company and El Paso Midstream Investment Corp. Mr. Bryant served as the President and Chief Executive Officer of Longs Drug Stores Corporation, a retail drugstore chain on the West Coast and in Hawaii, from 2002 through 2008 and...

-

Page 15

... served as the Executive Vice President, Chief Financial Officer and Chief Administrative Officer of CVS Caremark Corporation, a retail pharmacy chain and provider of healthcare services and pharmacy benefits management, from September 1999 until his retirement in December 2009. Prior to joining...

-

Page 16

... annual meeting. Specifically, KKR 2006 Fund L.P., KKR PEI Investments, L.P., KKR Partners III, L.P., 8 North America Investor LP and their respective permitted transferees (collectively, the ''KKR Shareholders'') have the right to designate the following percentage of the number of total directors...

-

Page 17

... long-term interests of all Dollar General shareholders. For as long as we continue to qualify as a ''controlled company'' under NYSE listing standards, we do not have to comply with the general NYSE rule that a majority of the Board be independent. The Nominating and Corporate Governance Committee...

-

Page 18

... years of experience in managing and analyzing companies owned by private equity companies, including over 3.5 years with Dollar General. He has a strong understanding of corporate finance and strategic business planning activities. While serving as a member of KKR's Retail and Energy industry teams...

-

Page 19

... shareholders' agreement, has 13 years of experience in governing private equity portfolio companies, including over 3.5 years with Dollar General. His 17 years at Goldman, Sachs & Co. have provided him with extensive understanding of corporate finance and strategic business planning activities. In...

-

Page 20

... the nominee and about the nominee, which generally includes:

Proxy

• the nominee's name, age, business address and residence address; • the nominee's principal occupation or employment; • the class and number of shares of Dollar General stock that are beneficially owned by the nominee...

-

Page 21

... model for Dollar General because, given Mr. Dreiling's day-to-day involvement with and intimate understanding of our specific business, industry and management team, Mr. Dreiling is particularly suited to effectively identify strategic priorities, lead the discussion and execution of strategy...

-

Page 22

... the annual audited and quarterly unaudited financial statements with management and the independent registered public accounting firm • Discusses types of information to be disclosed in earnings press releases and provided to analysts and rating agencies • Discusses policies governing the...

-

Page 23

... compensation and benefits programs • Recommends any changes in our incentive compensation and equity-based plans that are subject to Board approval • Reviews and discusses with management, prior to the filing of the proxy statement, the disclosure regarding executive compensation, including...

-

Page 24

... each met 5 times and our Nominating and Corporate Governance Committee met once. Each director attended at least 75% of the total of all meetings of the Board and all committees on which he served. What is Dollar General's policy regarding Board member attendance at the annual meeting? Our Board of...

-

Page 25

... Nominating and Corporate Governance Committee, Mr. Rhodes received pro rated payment for his interim service as the Chairman of the Audit Committee for a portion of the first calendar quarter and payment for 3 excess meetings, and Mr. Rickard received an annual retainer for service as the Chairman...

-

Page 26

... and related expenses related to Dollar General business. We may allow directors to travel on the Dollar General airplane for those purposes.

Proxy

Each non-employee director receives quarterly payment of the following cash compensation, as applicable: • $75,000 annual retainer for service as...

-

Page 27

... INDEPENDENCE

Is Dollar General subject to the NYSE governance rules regarding director independence?

Proxy

Buck Holdings, L.P. controls a majority of our outstanding common stock. As a result, we are a ''controlled company'' within the meaning of the NYSE corporate governance standards. Under...

-

Page 28

... does not exceed 2% of the entity's total annual receipts and no related party who is an individual participates in the grant decision or receives any special compensation or benefit as a result. • Transactions where the interest arises solely from share ownership in Dollar General and all of our...

-

Page 29

... Dollar General and exceed $120,000, and in which a related party had or has a direct or indirect material interest. Relationships with Management. Simultaneously with the closing of our 2007 merger and, thereafter, in connection with our offering equity awards to our employees under our 2007 Stock...

-

Page 30

... his promotion to Executive Vice President in April 2010, Mr. Flanigan was offered the opportunity, and elected, to purchase 5,388 shares of Dollar General common stock under our 2007 Stock Incentive Plan. The shares were purchased at a per share price that equaled the closing price of our common...

-

Page 31

...agreement and the demand registration rights thereunder, secondary offerings of our common stock were completed in April 2010 and December 2010 for which affiliates of KKR and of Goldman, Sachs & Co. served as underwriters. Dollar General did not sell shares of common stock, receive proceeds, or pay...

-

Page 32

...We opened 600 new stores, remodeled or relocated 504 stores, and closed 56 stores, resulting in a store count of 9,372 on January 28, 2011. • Adjusted EBITDA, as defined and calculated for purposes of both our annual Teamshare bonus program and our outstanding performance-based stock option awards...

-

Page 33

... protection offered to named executive officers at other companies and help to ensure continuity and aid in retention. The employment agreements also provide for standard protections to both the executive and to Dollar General should the executive's employment terminate. In 2010, after achieving...

-

Page 34

... applicable time period. In addition to services relating to director and executive compensation, from time to time Hewitt has provided consulting services to management for various projects and assignments pertaining to general employee compensation, benefits, and other matters. Under the agreement...

-

Page 35

... internal equity adjustment, a promotion or a change in responsibilities or similar one-time adjustment is required. Actual annual base salary determinations are discussed under ''Elements of Named Executive Compensation-Base Salary'' below. Use of Market Benchmarking Data. We must pay compensation...

-

Page 36

... executive officer's total compensation. The employment agreements between Dollar General and the named executive officers set forth minimum base salary levels, but the Compensation Committee retains sole discretion to increase these levels from time to time. In 2010 and 2011, to determine annual...

-

Page 37

... shareholder return), expense targets, margins, operating efficiency, customer satisfaction, working capital targets, economic value added, volume, capital expenditures, market share, costs, regulatory ratings, asset quality, net worth, or safety. The Committee administers the Annual Incentive Plan...

-

Page 38

...a market maker registration statement; (b) any costs, fees and expenses directly related to any transaction that results in a Change in Control (within the meaning of our 2007 Stock Incentive Plan) or related to any primary or secondary offering of our common stock or other security; (c) share-based...

-

Page 39

... to arrive at the ROIC target performance level.

Proxy

The bonus payable to each named executive officer if we reached the 2010 target performance levels for each of the adjusted EBITDA and ROIC financial performance measures is equal to the applicable percentage of each executive's salary as set...

-

Page 40

... be discussed in detail in our proxy statement for the 2012 annual meeting. The applicable percentage of each named executive officer's salary upon which his or her bonus is based for the 2011 Teamshare plan is also the same as in 2010, except for Mr. Dreiling whose target, as discussed above, was...

-

Page 41

... those options will vest, provided that the executive continues to be employed by us over the applicable performance periods. These terms are further discussed below. Equity awards are made under our Amended and Restated 2007 Stock Incentive Plan for Key Employees of Dollar General Corporation and...

-

Page 42

... investment and number of options generally granted under the existing program to persons in senior vice president and executive vice president positions over the period of time each such officer had served as a senior vice president and will serve as an executive vice president during the five-year...

-

Page 43

... the 2010 annual adjusted EBITDA performance target. Over the last year, the Committee has been working with its consultant and with management to develop a new long-term equity incentive structure under the 2007 Stock Incentive Plan that is more in line with typical public company equity structures...

-

Page 44

... benefit to all executive officers who report directly to the CEO, including the named executive officers. This program provides each named executive officer with various personal financial support services, including financial planning, estate planning and tax preparation services, in an annual...

-

Page 45

... named executive officers, except for the provisions related to long-term equity incentives under our 2007 Stock Incentive Plan. As required by applicable securities laws, we have included a summary of our severance and change in control arrangements as they existed as of the end of fiscal year 2010...

-

Page 46

..., signing bonuses or other annual compensation paid or imputed to the executive officers covered by Section 162(m) that causes non-performance-based compensation to exceed the $1 million limit will not be deductible by Dollar General. The Committee administers our executive compensation program with...

-

Page 47

... & Chief Financial Officer Kathleen R. Guion, Executive Vice President, Division President, Store Operations & Store Development John W. Flanigan, Executive Vice President, Global Supply Chain Robert D. Ravener, Executive Vice President & Chief People Officer

Year 2010 2009 2008 2010 2009 2008 2010...

-

Page 48

... associated fees, supplies and catering costs. (6) Amount has been adjusted from the amount reported in the prior year proxy statement to add the following amount for a tax gross-up related to the financial and estate planning perquisite in 2009 that was not determinable until the end of 2010: Mr...

-

Page 49

...named executive officers. See ''Short-Term Cash Incentive Plan'' in ''Compensation Discussion and Analysis'' above for further discussion of the fiscal 2010 Teamshare program.

Estimated Future Payouts Other Option Exercise Grant Date Estimated Possible Payouts Under Equity All Awards: Number or Base...

-

Page 50

...see Note 11 of the annual consolidated financial statements included in our 2010 Form 10-K. Represents a grant of a time-based, non-qualified stock option under the 2007 Stock Incentive Plan made in connection with the renewal of Mr. Dreiling's employment contract. The option is scheduled to vest in...

-

Page 51

Outstanding Equity Awards at 2010 Fiscal Year-End The table below sets forth information regarding outstanding equity awards held by our named executive officers as of the end of fiscal 2010, including (1) equity awards granted under our 2007 Stock Incentive Plan; and (2) Rollover Options, as ...

-

Page 52

...Control'' below. (2) These options were granted under our 2007 Stock Incentive Plan and vested 331â„3% per year on July 6, 2008, July 6, 2009, and July 6, 2010. (3) These options were granted under our 2007 Stock Incentive Plan and are scheduled to vest 50% per year on July 6, 2011 and July 6, 2012...

-

Page 53

... the terms of such options to reflect the effects of the special dividend on such options. The exercise prices listed in the table above reflect the exercise price adjustments for the options granted under our 2007 Stock Incentive Plan in connection with the special dividend. On October 12, 2009, we...

-

Page 54

... were withheld in a net share settlement in payment of the exercise price and taxes for Mr. Tehle and Ms. Guion, respectively. (2) Value realized is calculated by multiplying the gross number of options exercised by the difference between the closing market price of our common stock on the date of...

-

Page 55

... percentage is based on age, years of service and job grade. The fiscal 2010 contribution percentage for each eligible named executive officer was 7.5% for Mr. Dreiling, Ms. Guion and Mr. Flanigan and 9.5% for Mr. Tehle. As a result of our 2007 merger, which constituted a change-in-control under the...

-

Page 56

...the aggregate exercise price of the vested options. In the event of death, each named executive officer's beneficiary will receive payments under our group life insurance program in an amount, up to a maximum of $3 million, equal to 2.5 times the named executive officer's annual base salary. We have...

-

Page 57

.../SERP Plan, ''disability'' means total and permanent disability for purposes of entitlement to Social Security disability benefits. For purposes of each named executive officer's stock option agreement(s), ''disability'' has the same definition as that which is set forth in such officer's employment...

-

Page 58

.... Unless we purchase any then vested options (including Rollover Options) in total at a price equal to the fair market value of the shares underlying the vested options, less the aggregate exercise price of the vested options, the named executive officer generally may exercise vested options for the...

-

Page 59

... officer's employment agreement: • Continuation of base salary, as in effect immediately before the termination, for 24 months payable in accordance with our normal payroll cycle and procedures. • A lump sum payment equal to 2 times the average percentage of the named executive officer's target...

-

Page 60

..., Casey's General Stores and The Pantry, Inc. Sam's Club, Big Lots, Walgreens, Rite-Aid and CVS are not specifically listed in Mr. Dreiling's employment agreement), or any person then planning to enter the deep discount consumable basics retail business, if the named executive officer is required...

-

Page 61

... the Employment Agreement'' above. Payments After a Change in Control Upon a change in control (as defined under each applicable governing document), regardless of whether the named executive officer's employment terminates: • Under the 2007 Stock Incentive Plan, (1) all time-vested options will...

-

Page 62

... equity discussed above, a change in control generally means (as more fully described in the Management Stockholder's Agreement between us and the named executive officers) one or a series of related transactions described below which results in us, KKR and its affiliates or an employee benefit plan...

-

Page 63

... Tax and Gross-Up Life Insurance Proceeds Total Mr. Tehle Vested Options Prior to Event Option Vesting Due to Event SERP Benefits Prior to Event SERP Benefits Due to Event Deferred Comp Plan Balance Prior to and After Event Cash Severance Health Payment(3) Outplacement(4) 280(G) Excise Tax and Gross...

-

Page 64

...Due to Event SERP Benefits Prior to Event SERP Benefits Due to Event Deferred Comp Plan Balance Prior to and After Event Cash Severance Health Payment(3) Outplacement(4) 280(G) Excise Tax and Gross-Up Life Insurance Proceeds Total Mr. Ravener Vested Options Prior to Event Option Vesting Due to Event...

-

Page 65

... use of a company-wide performance measure for the short-term annual incentive plan and as a vesting condition for the performance-based stock options granted under the long-term equity incentive plan; • A minimum share purchase requirement for participation in the long-term equity incentive plan...

-

Page 66

... to guide Dollar General during a period of significant growth and transformation, and have been instrumental in helping us achieve strong financial performance in the last three fiscal years. We are asking our shareholders to indicate their support for our named executive officer compensation as...

-

Page 67

... that each of those persons filed, on a timely basis, the reports required by Section 16(a) of the Securities Exchange Act of 1934, except that (1) Mr. John Flanigan filed 1 late Form 4 to report a purchase of Dollar General common stock directly from the Company and filed an amended Form 3 to...

-

Page 68

..., 2011. Buck Holdings, L.P. (''Buck LP'') directly holds 241,997,057 shares. The general partner of Buck Holdings, L.P. is Buck Holdings, LLC (''Buck LLC''), the membership interests of which are held by a private investor group, including affiliates of KKR and Goldman, Sachs & Co. and other equity...

-

Page 69

... floor, New York, New York 10004. The address of GS Capital Partners VI GmbH & Co. KG is Messeturm, Friedrich-Ebert-Anlage 49 60323, Frankfurt/Main, Germany. (2) Based solely on Statement on Schedule 13G filed on February 9, 2011 and supplemental information received from T. Rowe Price Associates...

-

Page 70

... Mr. Jones holds the shares reported in the table for the benefit of the GS Group. (4) Includes the following number of shares underlying restricted stock units that are settleable within 60 days of March 16, 2011, over which the person will not have voting or investment power until the restricted...

-

Page 71

... from Dollar General and its management. Based on these reviews and discussions, the Audit Committee unanimously recommended to the Board of Directors that Dollar General's audited financial statements be included in the Annual Report on Form 10-K for the fiscal year ended January 28, 2011 for...

-

Page 72

... common stock by certain of our shareholders. 2009 fees include fees for services related to our initial public offering. (2) 2010 and 2009 fees include services relating to the employee benefit plan audit. (3) 2010 and 2009 fees include work opportunity tax credit assistance and examination reviews...

-

Page 73

... Shareholder proposals should be mailed to Corporate Secretary, Dollar General Corporation, 100 Mission Ridge, Goodlettsville, TN 37072. Shareholder proposals that are not included in our proxy materials will not be considered at any annual meeting of shareholders unless such proposals have complied...

-

Page 74

-

Page 75

10-K

-

Page 76

-

Page 77

..., D.C. 20549

FORM 10-K

ANNUAL REPORT PURSUANT TO SECTION 13 OR 15(d) OF THE SECURITIES EXCHANGE ACT OF 1934

For the fiscal year ended January 28, 2011 Commission file number: 001-11421

DOLLAR GENERAL CORPORATION

(Exact name of registrant as specified in its charter) TENNESSEE (State or other...

-

Page 78

10-K

-

Page 79

... fiscal years ending or ended February 3, 2012, January 28, 2011, January 29, 2010, January 30, 2009, February 1, 2008 and February 2, 2007, respectively. All of the discussion and analysis in this report should be read with, and is qualified in its entirety by, the Consolidated Financial Statements...

-

Page 80

...history of profitable growth is founded on a commitment to a relatively simple business model: providing a broad base of customers with their basic everyday and household needs, supplemented with a variety of general merchandise items, at everyday low prices in conveniently located, small-box stores...

-

Page 81

...than two years. Our stringent market analysis, real estate site selection and new store approval processes as well as our new store marketing programs help us optimize financial returns and minimize the risks of opening unprofitable stores. Our lean store staffing model and centralized management of...

-

Page 82

... by our business model. We believe we continue to have significant opportunities to drive profitable growth through increasing same-store sales, expanding our operating profit rate and growing our store base. Increasing Same-Store Sales. We believe the combination of our necessity-driven product mix...

-

Page 83

...and new markets. In 2011, we plan to enter three new states, Connecticut, New Hampshire and Nevada. We have confidence in our real estate disciplines and in our ability to identify, open and operate successful new stores. As a result, we believe that at least our present level of new store growth is...

-

Page 84

... strong cash flows and investment returns. In 2010, the average cost of equipment and fixtures in our leased stores was approximately $165,000. Initial inventory, net of payables, increases the investment in a new store by approximately $75,000. We generally have not encountered difficulty locating...

-

Page 85

... Our business is seasonal to a certain extent. Generally, our highest sales volume occurs in the fourth quarter, which includes the Christmas selling season, and the lowest occurs in the first quarter. In addition, our quarterly results can be affected by the timing of new store openings and store...

-

Page 86

...the third quarter of 2008. Our Competition We operate in the basic discount consumer goods market, which is highly competitive with respect to price, store location, merchandise quality, assortment and presentation, in-stock consistency, and customer service. We compete with discount stores and with...

-

Page 87

... DC 20549. The public may obtain information on the operation of the Public Reference Room by calling the SEC at 1-800-SEC-0330. The SEC maintains an internet site that contains reports, proxy and information statements and other information regarding issuers, such as Dollar General, that file...

-

Page 88

... factors, also affect our cost of goods sold and our selling, general and administrative expenses, which may adversely affect our sales or profitability. We have limited or no ability to control many of these factors. We saw product costs begin to escalate in our 2010 fourth quarter as a result of...

-

Page 89

... impact our financial performance. The retail business is highly competitive. We operate in the basic discount consumer goods market, which is competitive with respect to price, store location, merchandise quality, assortment and presentation, in-stock consistency, and customer service. This...

-

Page 90

operations by slowing store growth, which may in turn reduce revenue growth. In addition, the planned construction of a new distribution center in 2011, and any future distribution-related construction or expansion projects, entail risks which could cause delays and cost overruns, such as: shortages...

-

Page 91

... of operations. Our business is subject to the risk of litigation by employees, consumers, suppliers, competitors, shareholders, government agencies and others through private actions, class actions, administrative proceedings, regulatory actions or other litigation. The number of employment-related...

-

Page 92

... our control. In addition, our credit ratings, combined with tighter lending practices, have made financing more challenging for our real estate developers in today's market. These unfavorable lending trends could potentially impact the timing of our store openings and build-to-suit program. Delays...

-

Page 93

... of our new supply chain solution, or with maintenance or adequate support of existing systems could also disrupt or reduce the efficiency of our operations. Failure to attract and retain qualified employees, particularly field, store and distribution center managers, and to control labor costs, as...

-

Page 94

... generally recognize our highest volume of net sales during the Christmas selling season, which occurs in the fourth quarter of our fiscal year. In anticipation of this holiday, we purchase substantial amounts of seasonal inventory and hire many temporary employees. An excess of seasonal merchandise...

-

Page 95

...insurance policies with respect to our executive officers or key personnel. We face risks related to protection of customers' credit and debit card data and private data relating to us or our customers or employees. In connection with credit card sales, we transmit confidential credit and debit card...

-

Page 96

...to be dedicated to the payment of principal and interest on our indebtedness, therefore reducing our ability to use our cash flow to fund our operations, capital expenditures and future business opportunities or pay dividends; • limiting our ability to pursue our growth strategy; • placing us at...

-

Page 97

... of proposed new accounting standards may require extensive systems, internal process and other changes that could increase our operating costs, and may also result in changes to our financial statements. In particular, the implementation of expected future accounting standards related to leases, as...

-

Page 98

... a result of sales of a large number of shares of common stock in the market, or the perception that such sales could occur. These sales, or the possibility that these sales may occur, also might make it more difficult for us to issue equity securities in the future at a time and at a price that we...

-

Page 99

... new stores have been subject to build-to-suit arrangements, including approximately 72% of our new stores in 2010. As of February 25, 2011, we operated nine distribution centers, as described in the following table:

Location Year Opened Approximate Square Footage Approximate Number of Stores Served...

-

Page 100

... to Executive Vice President, Division President, Store Operations and Store Development in November 2005. From 2000 until joining Dollar General, Ms. Guion served as President and Chief Executive Officer of Duke and Long Distributing Company. Prior to that time, she served as an operating partner...

-

Page 101

... public trading market for our common stock after our merger that occurred on July 6, 2007 until our initial public offering of our common stock (''IPO'') on November 13, 2009. The range of the high and low sales prices of our common stock during our fourth quarter of fiscal 2009, as reported...

-

Page 102

... stock made during the quarter ended January 28, 2011 by or on behalf of Dollar General or any ''affiliated purchaser,'' as defined by Rule 10b-18(a)(3) of the Securities Exchange Act of 1934:

Total Number of Shares Purchased as Part of Publicly Announced Plans or Programs Maximum Number of Shares...

-

Page 103

... financial statements included elsewhere in this report. The selected historical statement of operations data and statement of cash flows data for the fiscal years or periods, as applicable, ended February 1, 2008, July 6, 2007 and February 2, 2007 and balance sheet data as of January 30, 2009...

-

Page 104

...stores, selling square feet, and net sales per square foot) Year Ended January 28, 2011 January 29, 2010 January 30, 2009 March 6, 2007 through February 1, 2008(1)(2)

Predecessor February 3, 2007 through July 6, 2007(2) Year Ended February 2, 2007(2)

Statement of Operations Data: Net sales ...Cost...

-

Page 105

...414 stores located in 35 states as of February 25, 2011, primarily in the southern, southwestern, midwestern and eastern United States. We offer a broad selection of merchandise, including consumable products such as food, paper and cleaning products, health and beauty products and pet supplies, and...

-

Page 106

... Our fourth priority is to strengthen and expand Dollar General's culture of serving others. For customers this means helping them ''Save time. Save money. Every day!'' by providing clean, well-stocked stores with quality products at low prices. For employees, this means creating an environment that...

-

Page 107

... operating activities. We have used a portion of these cash flows to pay down debt and to invest in new store growth through our traditional leased stores. During 2010 we made a strategic decision to purchase certain of our leased stores. We believe that the current environment in the real estate...

-

Page 108

... store openings, our criteria are based on numerous factors including, among other things, availability of appropriate sites, expected sales, lease terms, population demographics, competition, and the employment environment. We use various real estate site selection tools to determine target markets...

-

Page 109

...store sales growth; • Sales per square foot; • Gross profit, as a percentage of sales; • Operating profit; • Inventory turnover;

10-K

• Cash flow; • Net income; • Earnings per share; • Earnings before interest, income taxes, depreciation and amortization; and • Return on invested...

-

Page 110

....5

10-K

Net sales ...Cost of goods sold ...% of net sales ...Gross profit ...% of net sales ...Selling, general and administrative expenses ...% of net sales ...Litigation settlement and related costs, net ...% of net sales ...Operating profit ...% of net sales ...Interest income ...% of net sales...

-

Page 111

... as our category management efforts and increased sales volumes which have contributed to our ability to reduce purchase costs from our vendors. Our merchandising team continues to work closely with our vendors to provide quality merchandise at value prices to meet our customers' demands. In 2010 we...

-

Page 112

... a class action lawsuit filed in response to our 2007 merger, and includes a $40.0 million settlement plus related expenses of $2.0 million, net of $10.0 million of insurance proceeds received in the fourth quarter of 2008. Interest Expense. The decrease in interest expense in 2010 compared to 2009...

-

Page 113

...impact that the non-deductible, merger-related lawsuit settlement had on the 2008 rate. This reduction in the effective tax rate was partially offset by a decrease in the tax rate benefit related to federal jobs credits. While the total amount of jobs credits earned in 2009 was similar to the amount...

-

Page 114

certain strategic decisions which slowed our store growth in 2007 and 2008, but we reaccelerated store growth beginning in 2009 and currently plan to continue that strategy in 2011 and beyond. At January 28, 2011, we had total outstanding debt (including the current portion of long-term obligations)...

-

Page 115

...secured credit agreement for the Term Loan Facility requires us to prepay outstanding term loans, subject to certain exceptions, with: • 50% of our annual excess cash flow (as defined in the credit agreement) which will be reduced to 25% and 0% if we achieve and maintain a total net leverage ratio...

-

Page 116

... senior secured credit agreements contain a number of covenants that, among other things, restrict, subject to certain exceptions, our ability to: • incur additional indebtedness;

10-K

• sell assets; • pay dividends and distributions or repurchase our capital stock; • make investments or...

-

Page 117

...(ii) operating cash flows determined in accordance with U.S. GAAP. Additionally, EBITDA and Adjusted EBITDA are not intended to be measures of free cash flow for management's discretionary use, as they do not consider certain cash requirements such as interest payments, tax payments and debt service...

-

Page 118

... clearance activities, net of purchase accounting adjustments Advisory and consulting fees to affiliates ...Non-cash expense for share-based awards ...Indirect merger-related costs ...Other non-cash charges (including LIFO) ...

Total Adjustments ...Adjusted EBITDA ...Interest Rate Swaps

We use...

-

Page 119

... terms, market prices, yield curves, credit curves, measures of volatility, and correlations of such inputs. For our derivatives, all of which trade in liquid markets, model inputs can generally be verified and model selection does not involve significant management judgment. We incorporate credit...

-

Page 120

... for interest payments on long-term debt and capital lease obligations, and includes projected interest on variable rate long-term debt, using 2010 year end rates. (b) We retain a significant portion of the risk for our workers' compensation, employee health insurance, general liability, property...

-

Page 121

... necessary for our self-insured programs. Cash flows Cash flows from operating activities. A significant component of our increase in cash flows from operating activities in 2010 compared to 2009 was the increase in net income due to greater sales, higher gross margins and lower SG&A expenses...

-

Page 122

... for information systems upgrades and technology-related projects. During 2008 we opened 207 new stores and remodeled or relocated 404 stores. Purchases and sales of short-term investments equal to net sales of $51.6 million in 2008 primarily reflected investment activities in our captive insurance...

-

Page 123

... RIM to a group of products that is not fairly uniform in terms of its cost and selling price relationship and turnover; • applying the RIM to transactions over a period of time that include different rates of gross profit, such as those relating to seasonal merchandise; • inaccurate estimates...

-

Page 124

... may include projecting future cash flows, determining appropriate discount rates and other assumptions. Projections are based on management's best estimates given recent financial performance, market trends, strategic plans and other available information which in recent years have been materially...

-

Page 125

... future cash flows (discounted at our credit adjusted risk-free rate) or other reasonable estimates of fair market value in accordance with U.S. GAAP. During 2010, 2009 and 2008 we recorded pre-tax impairment charges of $1.7 million, $5.0 million and $4.0 million, respectively, for certain store...

-

Page 126

... related to these options. These assumptions include an estimate of the fair value of our common stock, the term that the options are expected to be outstanding, an estimate of the volatility of our stock price (which is based on a peer group of publicly traded companies), applicable interest rates...

-

Page 127

... the fact that our stock has been publicly traded for a relatively short period of time in relation to the expected term of outstanding options. Other factors involving judgments that affect the expensing of share-based payments include estimated forfeiture rates of share-based awards. Historically...

-

Page 128

... Rate Risk We manage our interest rate risk through the strategic use of fixed and variable interest rate debt and, from time to time, derivative financial instruments. Our principal interest rate exposure relates to outstanding amounts under our Credit Facilities. As of January 28, 2011, our Credit...

-

Page 129

... 28, 2011 and January 29, 2010, and the related consolidated statements of income, shareholders' equity, and cash flows for the years ended January 28, 2011, January 29, 2010 and January 30, 2009. These financial statements are the responsibility of the Company's management. Our responsibility...

-

Page 130

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES CONSOLIDATED BALANCE SHEETS (In thousands, except per share amounts)

January 28, 2011 January 29, 2010

ASSETS Current assets: Cash and cash equivalents ...Merchandise inventories ...Income taxes receivable ...Prepaid expenses and other current assets .

...

-

Page 131

... STATEMENTS OF INCOME (In thousands, except per share amounts)

For the Year Ended January 29, January 30, 2010 2009

January 28, 2011

Net sales ...Cost of goods sold ...Gross profit ...Selling, general and administrative expenses ...Litigation settlement and related costs, net ...Operating profit...

-

Page 132

..., net of income tax expense of $2,553 ...Comprehensive income ...Issuance of common stock ...Cash dividends, $0.7525 per common share, and related amounts ...Share-based compensation expense ...Tax benefit from stock option exercises . Issuance of common stock under stock incentive plans ...Equity...

-

Page 133

... revolving credit facility ...Issuance of long-term obligations ...Repayments of long-term obligations ...Payment of cash dividends and related amounts ...Repurchases of common stock and settlement of equity awards, net of employee taxes paid ...Tax benefit of stock options ...

...

Net cash used...

-

Page 134

... financial statements include all subsidiaries of the Company, except for its not-for-profit subsidiary which the Company does not control. Intercompany transactions have been eliminated.

10-K

Business description The Company sells general merchandise on a retail basis through 9,372 stores...

-

Page 135

... subsequently liquidated certain investments totaling $48.6 million during 2008. For the years ended January 28, 2011, January 29, 2010 and January 30, 2009, gross realized gains and losses on the sales of available-for-sale securities were not material. The cost of securities sold is based upon the...

-

Page 136

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

1. Basis of presentation and accounting policies (Continued) Vendor rebates The Company accounts for all cash consideration received from vendors in accordance with applicable accounting standards ...

-

Page 137

... certain of its stores' assets. Such action was deemed necessary based on the Company's evaluation that such amounts would not be recoverable primarily due to insufficient sales or excessive costs resulting in negative current and projected future cash flows at these locations. Capitalized interest...

-

Page 138

... 2011 and January 29, 2010, respectively. Other than for reserves assumed in a business combination, the Company's policy is to record self-insurance reserves on an undiscounted basis. Operating leases and related liabilities Rent expense is recognized over the term of the lease. The Company records...

-

Page 139

... expected to terminate lease agreements, estimates related to the sublease potential of closed locations, and estimation of other related exit costs. Liabilities are reviewed periodically and adjusted when necessary. The current portion of the closed store rent liability is reflected in Accrued...

-

Page 140

... fixed cash payments (or receipts) and the discounted expected variable cash receipts (or payments). The variable cash receipts (or payments) are based on an expectation of future interest rates (forward curves) derived from observable market interest rate curves. The Company incorporates credit...

-

Page 141

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

1. Basis of presentation and accounting policies (Continued) by counterparty portfolio, the Company has determined that the CVAs are not significant to the overall portfolio valuations, as the CVAs ...

-

Page 142

...stores at the time the customer takes possession of merchandise. All sales are net of discounts and estimated returns and are presented net of taxes assessed by governmental authorities that are imposed concurrent with those sales. The liability for retail merchandise returns is based on the Company...

-

Page 143

... that have been recognized in the Company's consolidated financial statements or income tax returns. Deferred income tax expense or benefit is the net change during the year in the Company's deferred income tax assets and liabilities. The Company includes income tax related interest and penalties as...

-

Page 144

... financial statements. Reclassifications Certain reclassifications of the 2008 and 2009 amounts have been made to conform to the 2010 presentation. 2. Initial public offering and special dividend On November 18, 2009, the Company completed the initial public offering of its common stock. The Company...

-

Page 145

...record on September 8, 2009. The special dividend was paid with cash generated from operations. Pursuant to the terms of the Company's stock option plans, holders of stock options received either a pro-rata adjustment to the terms of their share-based awards or a cash payment (totaling approximately...

-

Page 146

... net income by the weighted average number of shares of common stock outstanding during the year. Diluted earnings per share was determined based on the dilutive effect of share-based awards using the treasury stock method. Options to purchase shares of common stock that were outstanding at the end...

-

Page 147

... ...Net property and equipment ...

Depreciation expense related to property and equipment was approximately $215.7 million, $201.1 million and $190.5 million for 2010, 2009 and 2008. Amortization of capital lease assets is included in depreciation expense. 6. Income taxes The provision (benefit...

-

Page 148

...Dollars in thousands) 2010 2009 2008

U.S. federal statutory rate on earnings before income taxes ...State income taxes, net of federal income tax benefit ...Jobs credits, net of federal income taxes ...Increase (decrease) in valuation allowances ...Income tax related interest expense (benefit), net...

-

Page 149

... 28, 2011 January 29, 2010

Deferred tax assets: Deferred compensation expense ...Accrued expenses and other ...Accrued rent ...Accrued insurance ...Accrued bonuses ...Interest rate hedges ...Tax benefit of income tax and interest reserves related to uncertain tax positions ...Other ...State tax net...

-

Page 150

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

6. Income taxes (Continued) The Company has state net operating loss carryforwards as of January 28, 2011 that total approximately $136.7 million which will expire in 2022 through 2029. The Company ...

-

Page 151

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

6. Income taxes (Continued) The consolidated statements of income for the respective years reflected below include the following amounts:

(In thousands) 2010 2009 2008

Income tax expense (benefit) ...

-

Page 152

.... The Company also must pay customary letter of credit fees. The senior secured credit agreement for the Term Loan Facility requires the Company to prepay outstanding term loans, subject to certain exceptions, with percentages of excess cash flow, proceeds of non-ordinary course asset sales or...

-

Page 153

..., sell assets, incur additional liens, pay dividends, make investments or acquisitions, or repay certain indebtedness. Under the ABL facility, for the years ended January 28, 2011 and January 29, 2010, the Company had no borrowings or repayments; for the year ended January 30, 2009, the Company had...

-

Page 154

... to protect against future price changes related to transportation costs associated with forecasted distribution of inventory. Cash flow hedges of interest rate risk The Company's objectives in using interest rate derivatives are to add stability to interest expense and to manage its exposure to...

-

Page 155

... counterparty bank. The Company continues to report the net gain or loss related to the discontinued cash flow hedge in OCI and such net gain or loss is being reclassified into earnings during the original contractual terms of the swap agreement as the hedged interest payments are expected to occur...

-

Page 156

... instruments (Continued) The tables below present the pre-tax effect of the Company's derivative financial instruments on the consolidated statement of operations (including OCI) for the years ended January 28, 2011 and January 29, 2010: Tabular Disclosure of the Effect of Derivative Instruments on...

-

Page 157

..., 2011, the Company was committed under operating lease agreements for most of its retail stores. Many of the Company's stores are subject to build-to-suit arrangements with landlords which typically carry a primary lease term of 10-15 years with multiple renewal options. The Company also has stores...

-

Page 158

.... The Company opposed the plaintiff's motion. On March 23, 2007, the court conditionally certified a nationwide class. On December 2, 2009, notice was mailed to over 28,000 current or former Dollar General store managers, and approximately 3,860 individuals opted into the lawsuit. In September 2010...

-

Page 159

DOLLAR GENERAL CORPORATION AND SUBSIDIARIES NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

9. Commitments and contingencies (Continued) The Company believes that its store managers are and have been properly classified as exempt employees under the FLSA and that the Richter action is not ...

-

Page 160

...'s financial statements as a whole. On June 16, 2010, a lawsuit entitled Shaleka Gross, et al v. Dollar General Corporation was filed in the United States District Court for the Southern District of Mississippi (Civil Action No. 3:10CV340WHB-LR) in which three former non-exempt store employees...

-

Page 161

... time to time, the Company is a party to various other legal actions involving claims incidental to the conduct of its business, including actions by employees, consumers, suppliers, government agencies, or others through private actions, class actions, administrative proceedings, regulatory actions...

-

Page 162

... the Dollar General Corporation CDP/SERP Plan, for a select group of management and highly compensated employees. The SERP is a noncontributory defined contribution plan with annual Company contributions ranging from 2% to 10% of base pay plus bonus depending upon age, years of service and job grade...

-

Page 163

... the closing of the Merger and were settled in cash, canceled or, in limited circumstances, certain stock options held by Company management were exchanged for new options to purchase common stock in the Company (the ''Rollover Options''). The exercise price of the Rollover Options and the number of...

-

Page 164

... in this report or the Company's other SEC filings. The Company records expense for Time Options on a straight-line basis over the term of the management stockholder's agreement (generally five years). Each of the Company's management-owned shares, Rollover Options, and vested new options include...

-

Page 165

... NOTES TO CONSOLIDATED FINANCIAL STATEMENTS (Continued)

11. Share-based payments (Continued) net of tax) was related to equity appreciation rights and less than $0.1 million was related to restricted stock units as discussed in more detail below. For the year ended January 29, 2010, the fair value...

-

Page 166

... 100,000 options to its Chief Executive Officer with an exercise price of $29.38 and a vesting period of one year from the date of grant. The total intrinsic value of all stock options repurchased by the Company under terms of the management stockholders' agreements during 2010, 2009 and 2008 was...

-

Page 167

... FINANCIAL STATEMENTS (Continued)

11. Share-based payments (Continued) The Company currently believes that the performance targets related to the unvested Performance Options will be achieved. If such goals are not met, and there is no change in control or certain public offerings of the Company...

-

Page 168

... management fees and other expenses incurred for the years ended January 28, 2011, January 29, 2010 and January 30, 2009 totaled $0.2 million, $68.0 million and $6.6 million, respectively. In addition, on July 6, 2007, the Company entered into a separate indemnification agreement with the parties...

-

Page 169

...226 825,574 $10,457,668

10-K

Net sales ...14. Quarterly financial data (unaudited)

The following is selected unaudited quarterly financial data for the fiscal years ended January 28, 2011 and January 29, 2010. Each quarterly period listed below was a 13-week accounting period. The sum of the four...

-

Page 170

... 11, in the fourth quarter of 2009 the Company incurred share-based compensation expenses of $9.4 million ($5.8 million net of tax, or $0.02 per diluted share) for the accelerated vesting of certain share-based awards in conjunction with the Company's initial public offering, which is included in...

-

Page 171

...condensed financial information on a combined basis, in thousands.

January 28, 2011 DOLLAR GENERAL GUARANTOR OTHER CONSOLIDATED CORPORATION SUBSIDIARIES SUBSIDIARIES ELIMINATIONS TOTAL BALANCE SHEET: ASSETS Current assets: Cash and cash equivalents Merchandise inventories . . Income taxes receivable...

-

Page 172

... STATEMENTS (Continued)

15. Guarantor subsidiaries (Continued)

January 29, 2010 DOLLAR GENERAL GUARANTOR OTHER CONSOLIDATED CORPORATION SUBSIDIARIES SUBSIDIARIES ELIMINATIONS TOTAL

BALANCE SHEET: ASSETS Current assets: Cash and cash equivalents . Merchandise inventories ...Income taxes receivable...

-

Page 173

... net of taxes ...Net income ...

For the year ended January 29, 2010 DOLLAR GENERAL GUARANTOR OTHER CONSOLIDATED CORPORATION SUBSIDIARIES SUBSIDIARIES ELIMINATIONS TOTAL

STATEMENTS OF INCOME: Net sales ...Cost of goods sold ...Gross profit ...Selling, general and administrative expenses ...Operating...

-

Page 174

..., 2009 DOLLAR GENERAL GUARANTOR OTHER CONSOLIDATED CORPORATION SUBSIDIARIES SUBSIDIARIES ELIMINATIONS TOTAL

STATEMENTS OF INCOME: Net sales ...Cost of goods sold ...Gross profit ...Selling, general and administrative expenses ...Litigation settlement and related costs, net ...Operating profit (loss...

-

Page 175

... taxes ...Tax benefit of stock options ...Loss on debt retirement, net ...Non-cash share-based compensation ...Noncash inventory adjustments and asset impairments ...Other non-cash gains and losses . . Equity in subsidiaries' earnings, net ...Change in operating assets and liabilities: Merchandise...

-

Page 176

... taxes ...Tax benefit of stock options ...Loss on debt retirement, net ...Non-cash share-based compensation . Noncash inventory adjustments and asset impairments ...Other non-cash gains and losses ...Equity in subsidiaries' earnings, net . Change in operating assets and liabilities: Merchandise...

-

Page 177

... taxes ...Tax benefit of stock options ...Gain on debt retirement, net ...Non-cash share-based compensation . Noncash inventory adjustments and asset impairments ...Other non-cash gains and losses ...Equity in subsidiaries' earnings, net . Change in operating assets and liabilities: Merchandise...

-

Page 178

... ''Exchange Act''). Based on this evaluation, our principal executive officer and our principal financial officer concluded that our disclosure controls and procedures were effective as of the end of the period covered by this report. (b) Management's Annual Report on Internal Control Over Financial...

-

Page 179

... January 28, 2011 and January 29, 2010, and the related consolidated statements of income, shareholders' equity, and cash flows for the years ended January 28, 2011, January 29, 2010, and January 30, 2009 of Dollar General Corporation and subsidiaries and our report dated March 22, 2011 expressed an...

-

Page 180

... to Dollar General Corporation, c/o Investor Relations Department, 100 Mission Ridge, Goodlettsville, TN 37072. We intend to provide any required disclosure of an amendment to or waiver from the Code of Business Conduct and Ethics that applies to our principal executive officer, principal financial...

-

Page 181

...'' and ''Executive Compensation'' in the 2011 Proxy Statement, which information under such captions is incorporated herein by reference. ITEM 12. SECURITY OWNERSHIP OF CERTAIN BENEFICIAL OWNERS AND MANAGEMENT AND RELATED STOCKHOLDER MATTERS

(a) Equity Compensation Plan Information. The following...

-

Page 182

... Statements of Shareholders' Equity Consolidated Statements of Cash Flows Notes to Consolidated Financial Statements All schedules for which provision is made in the applicable accounting regulations of the SEC are not required under the related instructions, are inapplicable or the information...

-

Page 183

... of the Securities Exchange Act of 1934, the registrant has duly caused this report to be signed on its behalf by the undersigned, thereunto duly authorized. DOLLAR GENERAL CORPORATION

Date: March 22, 2011

By:

/s/ RICHARD W. DREILING Richard W. Dreiling, Chairman and Chief Executive Officer

We...

-

Page 184

Name

Title

Date

/s/ WILLIAM C. RHODES, III WILLIAM C. RHODES, III

Director

March 22, 2011

/s/ DAVID B. RICKARD DAVID B. RICKARD

Director

March 15, 2011

10-K

106

-

Page 185

... 3.2 to Dollar General Corporation's Current Report on Form 8-K dated November 18, 2009, filed with the SEC on November 18, 2009 (file no. 001-11421)) Form of Stock Certificate for Common Stock (incorporated by reference to Exhibit 4.1 to Dollar General Corporation's Registration Statement on Form...

-

Page 186

... institutions from time to time party thereto (incorporated by reference to Exhibit 4.2 to Dollar General Corporation's Current Report on Form 8-K dated July 6, 2007, filed with the SEC on July 12, 2007 (file no. 001-11421)) Guarantee to the Credit Agreement, dated as of July 6, 2007, among certain...

-

Page 187

...Credit Agreement, dated as of August 30, 2010, by and between Retail Property Investments, LLC and Citicorp North America, Inc., as Collateral Agent (incorporated by reference to Exhibit 4.57 to Dollar General Corporation's Registration Statement on Form S-3 (file no. 333-165799)) Security Agreement...

-

Page 188

... as Subsidiary Borrowers, The CIT Group/Business Credit Inc., as ABL Administrative Agent, and the other lending institutions from time to time party thereto (incorporated by reference to Exhibit 4.6 to Dollar General Corporation's Current Report on Form 8-K dated July 6, 2007, filed with the SEC on...

-

Page 189

...-161464))* Form of Stock Option Agreement between Dollar General Corporation and certain officers of Dollar General Corporation granting stock options pursuant to the 2007 Stock Incentive Plan (incorporated by reference to Exhibit 10.2 to Dollar General Corporation's Registration Statement on Form...

-

Page 190

... Statement on Form S-4 (file no. 333-148320))* Waiver of Certain Limitations Pertaining to Options Previously Granted under the Amended and Restated 2007 Stock Incentive Plan, effective August 26, 2010 (incorporated by reference to Exhibit 10.2 to Dollar General Corporation's Quarterly Report...

-

Page 191

... on June 8, 2010 (file no. 001-11421))* Summary of Dollar General Corporation Life Insurance Program as Applicable to Executive Officers (incorporated by reference to Exhibit 10.19 to Dollar General Corporation's Annual Report on Form 10-K for the fiscal year ended February 2, 2007, filed with the...

-

Page 192

... Dollar General Corporation's Annual Report on Form 10-K for the fiscal year ended January 29, 2010, filed with the SEC on March 24, 2009 (file no. 001-11421))* Employment Agreement, effective March 24, 2010, by and between Dollar General Corporation and John Flanigan* Stock Option Agreement, dated...

-

Page 193

...and Information Sharing Agreement, dated as of June 30, 2009, among Kohlberg Kravis Roberts & Co. L.P., the funds named therein and Dollar General Corporation (incorporated by reference to Exhibit 10.42 to Dollar General Corporation's Registration Statement on Form S-1 (file no. 333-161464)) List of...

-

Page 194

... Chief Executive Officer Longs Drug Stores Corporation Michael M. Calbert (2)*(3)*â€

Member Kohlberg Kravis Roberts & Co.

John W. Flaniganâ€

Global Supply Chain

Mary Winn Gordon

Investor Relations and Public Relations

Kathleen R. Guionâ€

Division President, Store Operations & Store Development...

-

Page 195

-

Page 196