Capital One 2002 Annual Report Download - page 77

Download and view the complete annual report

Please find page 77 of the 2002 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

75

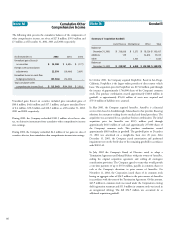

The Company maintains its books and records on a legal entity basis for the

preparation of financial statements in conformity with GAAP. Because

certain international operations are integrated with many of the Company’s

domestic operations, estimates and assumptions have been made to assign

certain expense items between domestic and foreign operations.

The information presented in Note B, Segments, is prepared from the

Company’s internal management information system used in performance

evaluation and resource allocation by management, which is maintained on a

line of business level through allocations from legal entities.

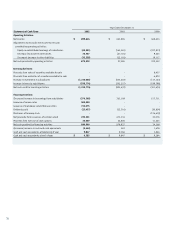

Note W Capital One Financial Corporation (Parent Company Only)

Condensed Financial Information

December 31

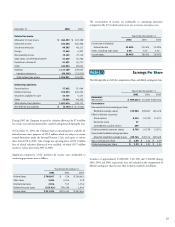

Balance Sheets 2002 2001

Assets:

Cash and cash equivalents $ 6,385 $ 9,847

Investment in subsidiaries 5,146,632 3,327,778

Loans to subsidiaries(1) 1,105,005 950,231

Other 157,648 164,923

Total assets $ 6,415,670 $ 4,452,779

Liabilities:

Senior notes $ 1,567,415 $ 549,187

Borrowings from subsidiaries 192,878 569,476

Other 32,206 10,638

Total liabilities 1,792,499 1,129,301

Stockholders’ equity 4,623,171 3,323,478

Total liabilities and stockholders’ equity $ 6,415,670 $ 4,452,779

(1) As of December 31, 2002 and 2001, includes $293.9 million and $122.1 million, respectively, of cash invested at the Bank instead of the open market.

Year Ended December 31

Statements of Income 2002 2001 2000

Domestic

Interest from temporary investments $ 44,220 $ 48,595 $ 41,321

Interest expense (124,097) (53,536) (46,486)

Dividends, principally from bank subsidiaries 880,069 125,000 250,000

Non-interest income 1,154 4,847 61

Non-interest expense (1,852) (45,223) (8,184)

Income before income taxes and equity in

undistributed earnings of subsidiaries 799,494 79,683 236,712

Income tax benefit 30,619 17,221 5,049

Equity in undistributed earnings of subsidiaries 69,531 545,061 227,873

Net income $ 899,644 $ 641,965 $ 469,634