Capital One 2002 Annual Report Download - page 63

Download and view the complete annual report

Please find page 63 of the 2002 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

61

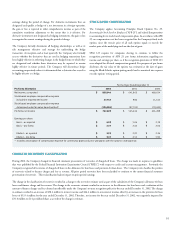

Collateralized Revolving Credit Facilities

In April 2002, COAF entered into a $2.2 billion revolving warehouse credit

facility collateralized by a security interest in certain consumer loan assets.

The warehouse credit facility has several participants each with a separate

renewal date. The facility does not have a final maturity date. Instead, each

participant may elect to renew the commitment for another set period of

time. All participants have renewal dates occurring in 2003. Interest on the

facility is based on commercial paper rates. At December 31, 2002, $894.0

million was outstanding under the facility.

In October 2001, PeopleFirst entered into a $500.0 million revolving credit

facility collateralized by a security interest in certain consumer loan assets.

Interest on the facility is based on London InterBank Offering Rates

(“LIBOR”). The facility matured in March 2002. At December 31, 2001,

$.4 million was outstanding under the facility.

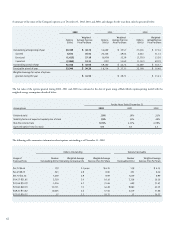

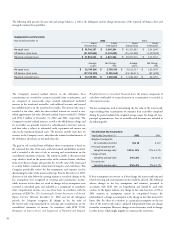

Interest-bearing deposits, senior notes and other borrowings as of December

31, 2002, mature as follows:

Interest-Bearing Other

Deposits Senior Notes Borrowings Total

2003 $ 4,880,378 $ 1,059,917 $ 2,747,137 $ 8,687,432

2004 3,498,878 1,030,198 1,423,781 5,952,857

2005 3,183,808 1,531,909 992,358 5,708,075

2006 2,398,802 1,244,389 717,988 4,361,179

2007 3,109,352 299,805 477,988 3,887,145

Thereafter 254,747 399,397 5,823 659,967

Total $ 17,325,965 $ 5,565,615 $ 6,365,075 $ 29,256,655

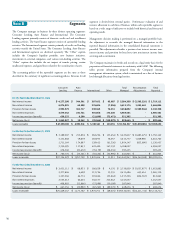

Note G Stock Plans

STOCK-BASED COMPENSATION PLANS

The Company has five stock-based compensation plans, three employee

plans and two non-employee directors plans. Under the plans, the Company

reserves common shares for the issuance in various forms to include incentive

stock options, nonstatutory stock options, stock appreciation rights,

restricted stock awards and incentive stock awards. The form of stock

compensation is specific to each plan. Generally the exercise price of each

stock option will equal or exceed the market price of the Company’s stock on

the date of grant, the maximum term will be ten years, and vesting is

determined at the time of grant, typically either 33 1/3 percent per year

beginning with the first anniversary of the grant date for options, three years

from the time of grant for restricted stock or accelerated vesting option grants

as described below.

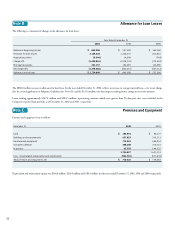

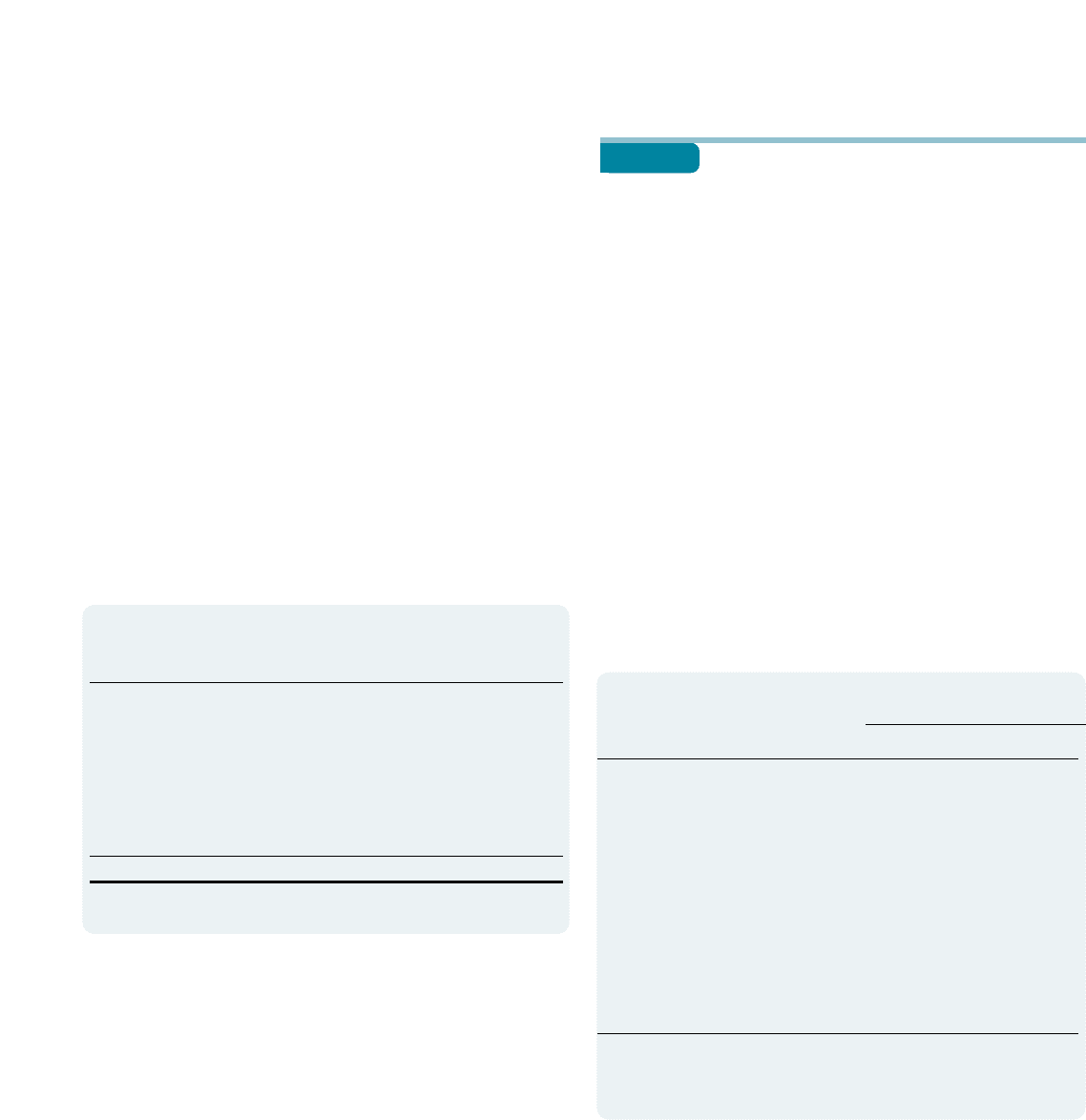

The following table provides the number of reserved common shares and the

number of common shares available for future issuance for each of the

Company’s stock-based compensation plans as of December 31, 2002, 2001

and 2000:

Available For Issuance

Shares

Plan Name Reserved 2002 2001 2000

2002 Non-Executive

Officer Stock

Incentive Plan 8,500,000 2,167,450 --

1999 Stock Incentive Plan 600,000 322,300 305,350 294,800

1994 Stock Incentive Plan 67,112,640 2,186,615 2,770,459 1,221,281

1999 Non-Employee

Directors Stock

Incentive Plan 825,000 220,000 22,510 27,510

1995 Non-Employee

Directors Stock

Incentive Plan(1) 600,000 - - -

(1 ) The plan’s ability to issue grants was terminated in 1999.

There are currently 457,500 options outstanding under the plan.