Capital One 2002 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2002 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

72

FAIR VALUE HEDGES

The Company has entered into forward exchange contracts to hedge foreign

currency denominated investments against fluctuations in exchange rates.

The purpose of the Company’s foreign currency hedging activities is to

protect the Company from the risk of adverse affects from movements in

exchange rates.

During the year ended December 31, 2002 and 2001, the Company

recognized substantially no net gains or losses related to the ineffective

portions of its fair value hedging instruments.

CASH FLOW HEDGES

The Company has entered into interest rate swap agreements for the

management of its interest rate risk exposure. The interest rate swap

agreements utilized by the Company effectively modify the Company’s

exposure to interest rate risk by converting floating rate debt to a fixed rate

over the next five years. The agreements involve the receipt of fixed rate

amounts in exchange for floating rate interest payments over the life of the

agreement without an exchange of underlying principal amounts. The

Company had entered into interest rate swaps and amortizing notional

interest rate swaps to effectively reduce the interest rate sensitivity of

anticipated net cash flows of its interest-only strip from securitization

transactions over the next four years. During the year ended December 31,

2002, the Company terminated the interest rate swaps and amortizing

interest rate swaps that effectively reduced the interest rate sensitivity of

anticipated net cash flows of its interest-only strip from securitization

transactions. These derivative fair values, net of taxes, were included in

cumulative other comprehensive income and will be amortized into interest

or servicing and securitizations income over the previous lives of the

terminated swaps.

The Company has also entered into currency swaps that effectively convert

fixed rate foreign currency denominated interest receipts to fixed dollar

interest receipts on foreign currency denominated assets. The purpose of

these hedges is to protect against adverse movements in exchange rates over

the next four years.

The Company has entered into forward exchange contracts to reduce the

Company’s sensitivity to foreign currency exchange rate changes on its

foreign currency denominated loans. The forward rate agreements allow the

Company to “lock-in” functional currency equivalent cash flows associated

with the foreign currency denominated loans.

During the year ended December 31, 2002 and 2001, the Company

recognized no net gains or losses related to the ineffective portions of its cash

flow hedging instruments. The Company recognized net losses of $1.7

million and $5.1 million during the year ended December 31, 2002 and

2001, respectively, for cash flow hedges that have been discontinued because

the forecasted transaction was no longer probable of occurring.

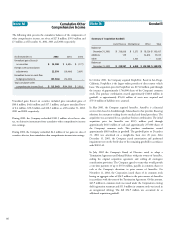

At December 31, 2002, the Company expects to reclassify $55.2 million of

net losses, after tax, on derivative instruments from cumulative other

comprehensive income to earnings during the next 12 months as terminated

swaps are amortized and as interest payments and receipts on derivative

instruments occur.

HEDGE OF NET INVESTMENT IN FOREIGN OPERATIONS

The Company uses cross-currency swaps and forward exchange contracts to

protect the value of its investment in its foreign subsidiaries. Realized and

unrealized foreign currency gains and losses from these hedges are not

included in the income statement, but are shown in the translation

adjustments in other comprehensive income. The purpose of these hedges is

to protect against adverse movements in exchange rates.

For the years ended December 31, 2002 and 2001, net losses of $3.2 million

and $.6 million related to these derivatives were included in the cumulative

translation adjustment.

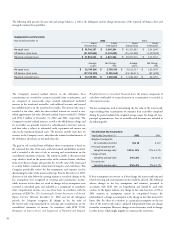

NON-TRADING DERIVATIVES

The Company uses interest rate swaps to manage interest rate sensitivity

related to loan securitizations. The Company enters into interest rate swaps

with its securitization trust and essentially offsets the derivative with separate

interest rate swaps with third parties.

The Company uses interest rate swaps in conjunction with its auto

securitizations that are not designated hedges. These swaps have zero balance

notional amounts unless the paydown of auto securitizations differs from its

scheduled amortization.

These derivatives do not qualify as hedges and are recorded on the balance

sheet at fair value with changes in value included in current earnings. During

the year ended December 31, 2002, the Company had net losses of $1.6

million. During 2001, the Company recognized substantially no net gains or

losses related to these derivatives.

Note T Significant Concentration

of Credit Risk

The Company is active in originating consumer loans, primarily in the

United States. The Company reviews each potential customer’s credit

application and evaluates the applicant’s financial history and ability and

willingness to repay. Loans are made primarily on an unsecured basis;

however, certain loans require collateral in the form of cash deposits and

automobiles serve as collateral for auto loans. International consumer loans

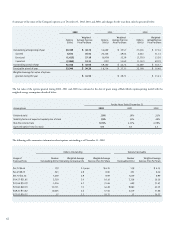

are originated primarily in Canada and the United Kingdom. The geographic

distribution of the Company’s consumer loans was as follows: