Capital One 2002 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2002 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55

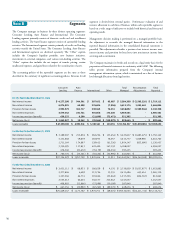

STOCK-BASED COMPENSATION

The Company applies Accounting Principles Board Opinion No. 25,

Accounting for Stock Issued to Employees (“APB 25”) and related Interpretations

in accounting for its stock-based compensation plans. In accordance with APB

25, no compensation cost has been recognized for the Company’s fixed stock

options, since the exercise price of all such options equals or exceeds the

market price of the underlying stock on the date of grant.

SFAS 123 requires for companies electing to continue to follow the

recognition provisions of APB 25, pro forma information regarding net

income and earnings per share, as if the recognition provisions of SFAS 123

were adopted for all stock compensation granted. For purposes of pro forma

disclosure, the fair value of the options was estimated at the date of grant

using the Black-Scholes option-pricing model and is amortized into expense

over the options’ vesting period.

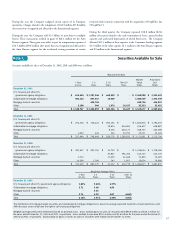

earnings during the period of change. For derivative instruments that are

designated and qualify as hedges of a net investment in a foreign operation,

the gain or loss is reported in other comprehensive income as part of the

cumulative translation adjustment to the extent that it is effective. For

derivative instruments not designated as hedging instruments, the gain or loss

is recognized in current earnings during the period of change.

The Company formally documents all hedging relationships, as well as its

risk management objective and strategy for undertaking the hedge

transaction. At inception and at least quarterly, the Company also formally

assesses whether the derivatives that are used in hedging transactions have

been highly effective in offsetting changes in the hedged items to which they

are designated and whether those derivatives may be expected to remain

highly effective in future periods. The Company will discontinue hedge

accounting prospectively when it is determined that a derivative has ceased to

be highly effective as a hedge.

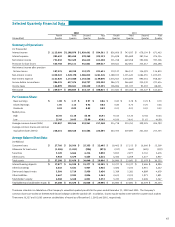

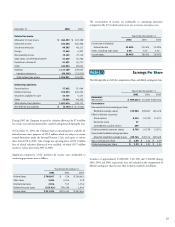

For the Years Ended December 31

Pro Forma Information 2002 2001 2000

Net income, as reported $ 899,644 $ 641,965 $ 469,634

Stock-based employee compensation expense

included in reported net income 27,749 984 11,145

Stock-based employee compensation expense

determined under fair value based method(1) (184,984 ) (97,705) (79,490)

Pro forma net income $ 742,409 $ 545,244 $ 401,289

Earnings per share:

Basic – as reported $ 4.09 $ 3.06 $ 2.39

Basic – pro forma $ 3.37 $ 2.60 $ 2.04

Diluted – as reported $ 3.93 $ 2.91 $ 2.24

Diluted – pro forma $ 3.37 $ 2.55 $ 1.95

(1) Includes amortization of compensation expense for current year grants and prior year grants over the options’ vesting period.

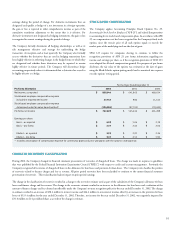

CHANGE IN RECOVERIES CLASSIFICATION

During 2002, the Company changed its financial statement presentation of recoveries of charged-off loans. The change was made in response to guidelines

that were published by the Federal Financial Institutions Examination Council (“FFIEC”) with respect to credit card account management. Previously, the

Company recognized all recoveries of charged-off loans in the allowance for loan losses and provision for loan losses. The Company now classifies the portion

of recoveries related to finance charges and fees as revenue. All prior period recoveries have been reclassified to conform to the current financial statement

presentation of recoveries. This reclassification had no impact on prior period earnings.

The change in the classification of recoveries resulted in a change to the recoveries estimate used as part of the calculation of the Company’s allowance for loan

losses and finance charge and fee revenue. The change in the recoveries estimate resulted in an increase to the allowance for loan losses and a reduction of the

amount of finance charges and fees deemed uncollectible under the Company’s revenue recognition policy for the year ended December 31, 2002. The change

in estimate resulted in an increase of $38.4 million to interest income and $44.4 million to non-interest income offset by an increase in the provision for loan

losses of $133.4 million for the year ended December 31, 2002. Therefore, net income for the year ended December 31, 2002, was negatively impacted by

$31.4 million or $.14 per diluted share as a result of the change in estimate.