Capital One 2002 Annual Report Download - page 70

Download and view the complete annual report

Please find page 70 of the 2002 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

68

GUARANTEES

Residual Value Guarantees

The Company has entered into synthetic lease transactions to finance several

facilities. A synthetic lease structure typically involves establishing a special

purpose vehicle (“SPV”) that owns the properties to be leased. The SPV is

funded and its equity is held by outside investors, and as a result, neither the

debt of nor the properties owned by the SPV have been included in the

accompanying consolidated financial statements. These transactions, as

described below, are accounted for as operating leases in accordance with

SFAS No. 13, Accounting for Leases. The Company has entered into

maximum residual value guarantee agreements with the lessors of the

Note P Commitments, Contingencies

and Guarantees

LINE OF CREDIT COMMITMENTS

As of December 31, 2002 the Company had outstanding lines of credit of

approximately $165.5 billion committed to its customers. Of that total

commitment, approximately $105.8 billion was unused. While this amount

represented the total available lines of credit to customers, the Company has

not experienced, and does not anticipate, that all of its customers will exercise

their entire available line at any given point in time. The Company generally

has the right to increase, reduce, cancel, alter or amend the terms of these

available lines of credit at any time.

LEASE COMMITMENTS

Certain premises and equipment have been leased under agreements that

expire at various dates through 2012, without taking into consideration

available renewal options. Many of these leases provide for payment by the

lessee of property taxes, insurance premiums, cost of maintenance and other

costs. In some cases, rentals are subject to increase in relation to a cost of

living index. Total rent expenses amounted to approximately $63.2 million,

$64.7 million and $66.1 million for the years ended December 31, 2002,

2001 and 2000, respectively.

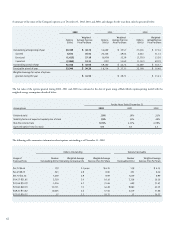

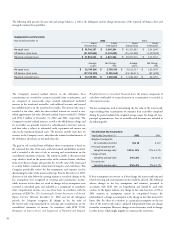

Future minimum rental commitments as of December 31, 2002, for all non-

cancelable operating leases with initial or remaining terms of one year or

more are as follows:

2003 $ 62,676

2004 44,650

2005 40,223

2006 35,502

2007 34,918

Thereafter 84,469

Total $ 302,438

properties (the SPVs established in the lease structures), whereby the

Company guarantees certain residual amounts to the lessors in the event of a

sale of the property or expiration of the lease. The amount of the deficiency is

recognized as rent expense on a straight-line basis over the remaining term of

the lease. The accrual for a deficiency is required regardless of whether the

Company expects to exercise a purchase option or renewal option at the end

of the lease term.

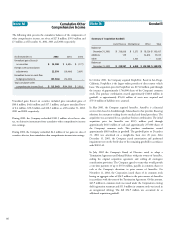

In December 2000, the Company entered into a 10-year agreement for the

lease of a headquarters building being constructed in McLean, Virginia. The

agreement calls for monthly rent to commence upon completion, which is

expected to occur in the first quarter of 2003, and is based on LIBOR rates

applied to the cost of the buildings funded. If, at the end of the lease term,

the Company does not purchase the property, the Company guarantees a

maximum residual value of up to $114.8 million representing approximately

72% of the estimated $159.5 million cost of the buildings in the lease

agreement. This agreement, made with a multi-purpose entity that is a

wholly-owned subsidiary of one of the Company’s lenders, provides that in

the event of a sale of the property, the Company’s obligation would be equal

to the sum of all amounts owed by the Company under a note issuance made

in connection with the lease inception. As of December 31, 2002, the

estimated cost of the building provided a reasonable approximation of the

fair value, and thus no deficiency existed and no liability related to the

maximum residual value guarantee was recorded relative to this property.

In 1999, the Company entered into two three-year agreements for the

construction and subsequent lease of four facilities located in Tampa, Florida

and Federal Way, Washington. The construction of all four of these facilities

was completed during 2001. The total cost of the buildings was

approximately $98.8 million. Monthly rent commenced upon completion of

each of the buildings and is based on LIBOR rates applied to the cost of the

facilities funded. The Company had one-year renewal options under the

terms of each of the leases, which were exercised during 2002 to extend the

life of the leases through September of 2003. If, at the end of the lease terms,

the Company does not purchase all of the properties, the Company

guarantees a maximum residual value to the lessor of up to $84.0 million

representing approximately 85% of the cost of the buildings in the lease

agreement. During the fourth quarter, the estimated fair value of the facilities

fell to a level below the maximum residual value guaranteed resulting in a

deficiency of $22.0 million. Correspondingly, the Company has recognized

$11.2 million as additional rent expense related to the deficiency as of

December 31, 2002.

In 1998, the Company entered into a five-year lease of five facilities in

Tampa, Florida and Richmond, Virginia. Monthly rent on the facilities is

based on a fixed interest rate of 6.87% per annum applied to the cost of the

buildings included in the lease of $86.8 million. The Company has two one-

year renewal options under the terms of the lease, which have been exercised

to extend the life of the lease through December of 2005. If, at the end of the

lease term, the Company does not purchase all of the properties, the

Company guarantees a maximum residual value to the lessor of up to $72.9

million representing approximately 84% of the costs of the buildings in the

lease agreement. As of December 31, 2002, the estimated fair value of the

facilities fell to a level below the maximum residual value guaranteed resulting

in a deficiency of $13.0 million. Correspondingly, the Company recognized

$.4 million as additional rent expense related to the deficiency as of

December 31, 2002.