Capital One 2002 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2002 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

56

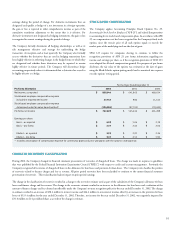

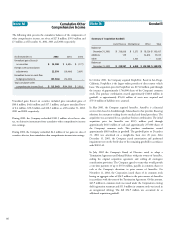

Note B Segments

The Company manages its business by three distinct operating segments:

Consumer Lending, Auto Finance and International. The Consumer

Lending segment primarily consists of domestic credit card and installment

lending activities. The Auto Finance segment consists of automobile lending

activities. The International segment consists primarily of credit card lending

activities outside the United States. The Consumer Lending, Auto Finance

and International segments are disclosed separately. The “Other” caption

includes the Company’s liquidity portfolio, new business initiatives,

investments in external companies, and various non-lending activities. The

“Other” caption also includes the net impact of transfer pricing, certain

unallocated expenses, and gains/losses related to the securitization of assets.

The accounting policies of the reportable segments are the same as those

described in the summary of significant accounting policies. Revenue for all

segments is derived from external parties. Performance evaluation of and

resource allocation to each line of business within each reportable segment is

based on a wide range of indicators to include both historical and forecasted

operating results.

Management decision making is performed on a managed portfolio basis.

An adjustment to reconcile the managed financial information to the

reported financial information in the consolidated financial statements is

provided. This adjustment reclassifies a portion of net interest income, non-

interest income and provision for loan losses into non-interest income from

servicing and securitization.

The Company maintains its books and records on a legal entity basis for the

preparation of financial statements in conformity with GAAP. The following

tables present information prepared from the Company’s internal

management information system, which is maintained on a line of business

level through allocations from legal entities.

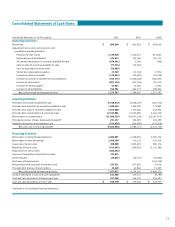

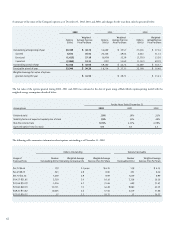

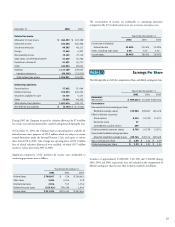

Consumer Auto Total Securitization Total

Lending Finance International Other Managed Adjustments Reported

For the Year Ended December 31, 2002

Net interest income $ 4,277,298 $ 544,501 $ 397,452 $ 65,087 $ 5,284,338 $ (2,565,226) $ 2,719,112

Non-interest income 4,076,925 65,509 276,696 (7,956) 4,411,174 1,055,662 5,466,836

Provision for loan losses 2,992,579 361,717 230,345 74,251 3,658,892 (1,509,564) 2,149,328

Non-interest expenses 3,679,342 231,741 501,068 173,430 4,585,581 - 4,585,581

Income tax provision (benefit) 639,275 6,290 (21,699) (72,471) 551,395 - 551,395

Net income (loss) $ 1,043,027 $ 10,262 $ (35,566) $ (118,079) $ 899,644 $ - $ 899,644

Loans receivable $ 47,290,100 $ 6,992,541 $ 5,330,541 $ 133,355 $ 59,746,537 $ (31,892,885) $ 27,853,652

For the Year Ended December 31, 2001

Net interest income $ 3,189,207 $ 215,838 $ 282,226 $ (53,454) $ 3,633,817 $ (1,883,675) $ 1,750,142

Non-interest income 3,131,868 19,879 183,973 78,057 3,413,777 1,049,985 4,463,762

Provision for loan losses 1,711,164 174,897 129,412 (61,326) 1,954,147 (833,690) 1,120,457

Non-interest expenses 3,350,595 117,853 422,420 167,159 4,058,027 - 4,058,027

Income tax provision (benefit) 478,540 (21,672) (35,179) (28,234) 393,455 - 393,455

Net income (loss) $ 780,776 $ (35,361) $ (50,454) $ (52,996) $ 641,965 $ - $ 641,965

Loans receivable $37,324,079 $ 3,957,729 $ 3,970,244 $ 11,911 $ 45,263,963 $(24,342,949) $20,921,014

For the Year Ended December 31, 2000

Net interest income $ 2,431,111 $ 88,933 $ 186,639 $ 4,176 $ 2,710,859 $ (1,057,977) $ 1,652,882

Non-interest income 2,277,806 6,609 113,726 13,355 2,411,496 653,614 3,065,110

Provision for loan losses 1,107,246 64,774 101,046 (55,842) 1,217,224 (404,363) 812,861

Non-interest expenses 2,525,612 64,626 344,577 212,842 3,147,657 - 3,147,657

Income tax provision (benefit) 408,903 (12,866) (57,998) (50,199) 287,840 - 287,840

Net income (loss) $ 667,156 $ (20,992) $ (87,260) $ (89,270) $ 469,634 $ - $ 469,634

Loans receivable $25,449,167 $ 1,173,782 $ 2,970,751 $ (69,674) $ 29,524,026 $(14,411,314) $15,112,712