Capital One 2002 Annual Report Download - page 29

Download and view the complete annual report

Please find page 29 of the 2002 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

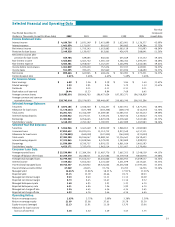

27

Year Ended December 31

(In Thousands) 2002 2001 2000 1999 1998

Year-End Balances:

Reported consumer loans:

Domestic $ 25,044,101 $ 18,546,426 $ 12,591,561 $ 7,783,535 $ 4,569,664

International 2,809,551 2,374,588 2,521,151 2,130,014 1,587,447

Total 27,853,652 20,921,014 15,112,712 9,913,549 6,157,111

Off-balance sheet consumer loans:

Domestic 29,371,895 22,747,293 13,961,714 10,013,424 10,933,984

International 2,520,990 1,595,656 449,600 309,615 304,031

Total 31,892,885 24,342,949 14,411,314 10,323,039 11,238,015

Managed consumer loan portfolio:

Domestic 54,415,996 41,293,719 26,553,275 17,796,959 15,503,648

International 5,330,541 3,970,244 2,970,751 2,439,629 1,891,478

Total $ 59,746,537 $ 45,263,963 $ 29,524,026 $ 20,236,588 $ 17,395,126

Average Balances:

Reported consumer loans:

Domestic $ 22,711,141 $ 14,648,298 $ 9,320,165 $ 5,784,662 $ 4,336,757

International 2,828,855 2,636,008 2,167,611 1,882,693 1,011,802

Total 25,539,996 17,284,306 11,487,776 7,667,355 5,348,559

Off-balance sheet consumer loans:

Domestic 25,348,865 17,718,683 10,804,845 10,062,771 9,773,284

International 1,910,705 609,328 342,241 316,787 87,694

Total 27,259,570 18,328,011 11,147,086 10,379,558 9,860,978

Managed consumer loan portfolio:

Domestic 48,060,006 32,366,981 20,125,010 15,847,433 14,110,041

International 4,739,560 3,245,336 2,509,852 2,199,480 1,099,496

Total $ 52,799,566 $ 35,612,317 $ 22,634,862 $ 18,046,913 $ 15,209,537

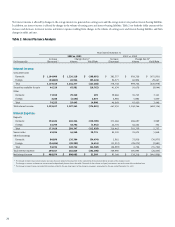

The Company actively engages in off-balance sheet consumer loan

securitization transactions. Securitizations involve the transfer of a pool of

loan receivables by the Company to an entity created for securitizations,

generally a trust or other special purpose entity (“the trusts”). The credit

quality of the receivables is supported by credit enhancements, which may be

in various forms including interest-only strips, subordinated interests in the

pool of receivables, cash collateral accounts, and accrued interest and fees on

the investor’s share of the pool of receivables. Securities ($31.9 billion

outstanding as of December 31, 2002) representing undivided interests in

the pool of consumer loan receivables are sold to the public through an

underwritten offering or to private investors in private placement

transactions. The Company receives the proceeds of the sale as payment for

the receivables transferred. In certain securitizations, the Company retains an

interest in the entity to which it transferred receivables (“seller’s interest”)

equal to the amount of the outstanding receivables transferred to the trust in

excess of the principal balance of the securities outstanding. For

securitizations backed by a revolving pool of assets, the Company’s seller’s

interest varies as the amount of the excess receivables in the trusts fluctuates

as the accountholders make principal payments and incur new charges on the

selected accounts. A securitization backed by non-revolving amortizing assets,

such as auto loans, generally does not include a seller’s interest, as obligor

principal payments are generally paid to investors on a monthly basis. A

securitization accounted for as a sale in accordance with SFAS 140 results in

the removal of the receivables, other than any applicable seller’s interest, from

the Company’s balance sheet for financial and regulatory accounting

purposes and recording of any additional retained interests.

Table 3 summarizes the Company’s managed consumer loan portfolio.

Table 3: Managed Consumer Loan Portfolio