Capital One 2002 Annual Report Download - page 39

Download and view the complete annual report

Please find page 39 of the 2002 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

37

DERIVATIVE INSTRUMENTS

The Company enters into interest rate swap agreements in order to manage

interest rate exposure. In most cases, this exposure is related to the funding of

fixed rate assets with floating rate obligations, including off-balance sheet

securitizations. The Company also enters into forward foreign currency

exchange contracts and cross currency swaps to reduce sensitivity to changing

foreign currency exchange rates. The hedging of foreign currency exchange

rates is limited to certain intercompany obligations related to international

operations. These derivatives expose the Company to certain credit risks. The

Company has established policies and limits, as well as collateral agreements,

to manage credit risk related to derivative instruments.

Additional information regarding derivative instruments can be found in

Note S to the Consolidated Financial Statements.

RISK MANAGEMENT

Risk is an inherent part of the Company’s business and activities. The

Company’s ability to properly and effectively identify, assess, monitor and

manage risk in its business activities is critical to its safe and sound operation

and profitability. The Company’s business activities generate credit risk,

liquidity risk, interest rate risk and operational risk, each of which is

described below.

Credit Risk

Credit risk is one of the Company’s most important risk categories.

Consequently, as part of the Company’s risk management process, stronger

central control of credit policies and programs has been established, while

maintaining the ability of the Company’s operating units to respond flexibly

to changing market and competitive conditions. In 2002, the Company

appointed a dedicated Chief Credit Officer, expanded its central Credit Risk

Management staff and strengthened its Credit Policy Committee. The credit

committee and staff group ensure that the Company’s credit decisions are

made on a conservative basis, that each of its operating units apply best

practices in measuring and managing credit risk, and that all relevant factors,

including credit outlook, profitability, and the competitive, economic and

regulatory environment are considered in making credit decisions.

In addition to strong governance, another key element in the Company’s

management of credit risk is its use of IBS. In its credit policy, the Company

has identified six key principles which govern the use of IBS in credit

management. These principles are: (1) Empirical Evidence - that all decisions

shall be made on the basis of the best available data; (2) Inseparability - that it

is impossible to separate credit decisions from product terms and marketing

channels; (3) Expectation of Volatility - that the expectation that future credit

performance could be worse than past credit performance should be

explicitly factored into underwriting decisions; (4) Positive Net Present Value

- that all prospective and existing pools of accounts need to have a positive

net present value when solicited or when the terms of the loans are adjusted;

(5) Earnings Stability - that a loan shall only be booked if the Company will

be satisfied with the loan’s performance during each discrete period of the

loan’s life; and (6) Constrained Optimization - that individual credit

programs will sometimes be limited to insure that the overall portfolio and

specific individual account characteristics conform to limits established by the

Company and its Board of Directors.

These principles are the foundation of the Company’s credit decision making

approach. They govern the selection of customers, and the approach to

pricing, credit line management, customer management, collections and

recoveries. They provide a framework in which the Company can apply a

very high degree of analytical rigor to decision making while preserving the

flexibility to respond quickly to changing market and economic conditions.

The Company’s credit risk profile is managed to maintain better than average

credit quality, strong risk-adjusted returns and increased diversification. This

is accomplished by increasing growth in the prime and superprime card

business, while reducing growth in the subprime card business, by

customizing credit lines and product terms to each consumer segment to

ensure appropriate returns, by diversification into consumer lending,

products such as automobile financing and unsecured installment lending

and by international expansion. The centralized Credit Risk Management

group monitors overall composition and quality of the credit portfolio. The

Company takes into consideration potential future economic conditions

when monitoring and assessing its credit portfolio to understand its credit

risk profile under various stressful conditions.

The Company’s guiding principles, strengthened central governance and

Board-directed risk tolerances, ensure that senior executives are well-informed

of credit trends and can make appropriate credit and business decisions for the

Company. The Company ensures day-to-day market responsiveness and

flexibility by empowering its business line managers to develop credit strategies

and programs aligned with the objective of long-term business profitability.

The credit program development process considers the evolving needs of the

target market, the competitive environment and the economic outlook. It is

highly analytical and uses the Company’s extensive database of past test results.

Senior Credit Officers, who are appointed by the Credit Policy Committee,

oversee all credit program development. Large new programs or program

changes are reviewed by the Credit Policy Committee or its subcommittee.

Most of the Company’s credit strategies rely heavily on the use of

sophisticated proprietary scoring models. These models consider many

variables, including credit scores developed by nationally recognized scoring

firms. The models are validated, monitored and maintained in accordance

with detailed policies and procedures to ensure their continued validity.

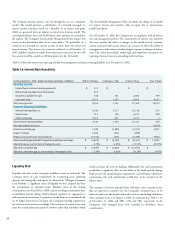

Interest Rate Risk

Interest rate risk refers to changes in earnings or the net present value of assets

and off-balance sheet positions less liabilities (termed “economic value of

equity”) due to interest rate changes. To the extent that managed interest

income and expense do not respond equally to changes in interest rates, or

that all rates do not change uniformly, earnings and economic value of equity

could be affected. The Company’s managed net interest income is affected

primarily by changes in LIBOR, as variable rate card receivables, securitization

bonds and corporate debts are repriced. The Company manages and mitigates

its interest rate sensitivity through several techniques, which include, but are

not limited to, changing the maturity, repricing and distribution of assets and

liabilities and by entering into interest rate swaps.