Capital One 2002 Annual Report Download - page 30

Download and view the complete annual report

Please find page 30 of the 2002 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

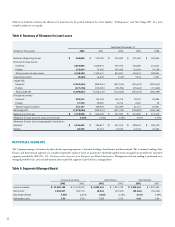

Collections received from securitized receivables are used to pay interest to

investors, servicing and other fees, and are available to absorb the investors’

share of credit losses. For revolving securitizations, amounts collected in excess

of that needed to pay the above amounts are remitted to the Company, as

described previously in “Servicing and Securitizations Income.” For amortizing

securitizations, amounts in excess of the amount that is used to pay interest, fees

and principal are generally remitted to the Company, but may be paid to

investors in further reduction of their outstanding principal as described below.

Investors in the Company’s revolving securitization program are generally

entitled to receive principal payments either in one lump sum after an

accumulation period or through monthly payments during an amortization

period. Amortization may begin sooner in certain circumstances, including

the possibility of the annualized portfolio yield (generally consisting of

interest and fees) for a three-month period dropping below the sum of the

security rate payable to investors, loan servicing fees and net credit losses

during the period. Increases in net credit losses and payment rates could

significantly decrease the spread and cause early amortization. This early

amortization would have a significant effect on the ability of the Bank and

the Savings Bank to meet the capital adequacy requirements as all off-balance

sheet loans experiencing such early amortization would have to be recorded

on the balance sheet. At December 31, 2002, the annualized portfolio yields

on the Company’s off-balance sheet securitizations sufficiently exceeded the

sum of the related security rates payable to investors, loan servicing fees and

net credit losses, and as such, early amortizations of its off-balance sheet

securitizations was not indicated or expected.

In revolving securitizations, prior to the commencement of the amortization or

accumulation period, the investors’ shares of the principal payments received on

the trusts’ receivables are reinvested in new receivables to maintain the principal

balance of the securities. During the amortization period, the investors’ share of

principal payments is paid to the security holders until the securities are repaid.

When the trust allocates principal payments to the security holders, the

Company’s reported consumer loans increase by the amount of any new

activity on the accounts. During the accumulation period, the investors’ share

of principal payments is paid into a principal funding account designed to

accumulate principal collections so the securities can be paid in full on the

expected final payment date.

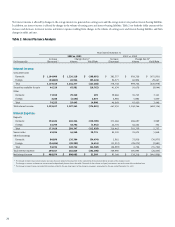

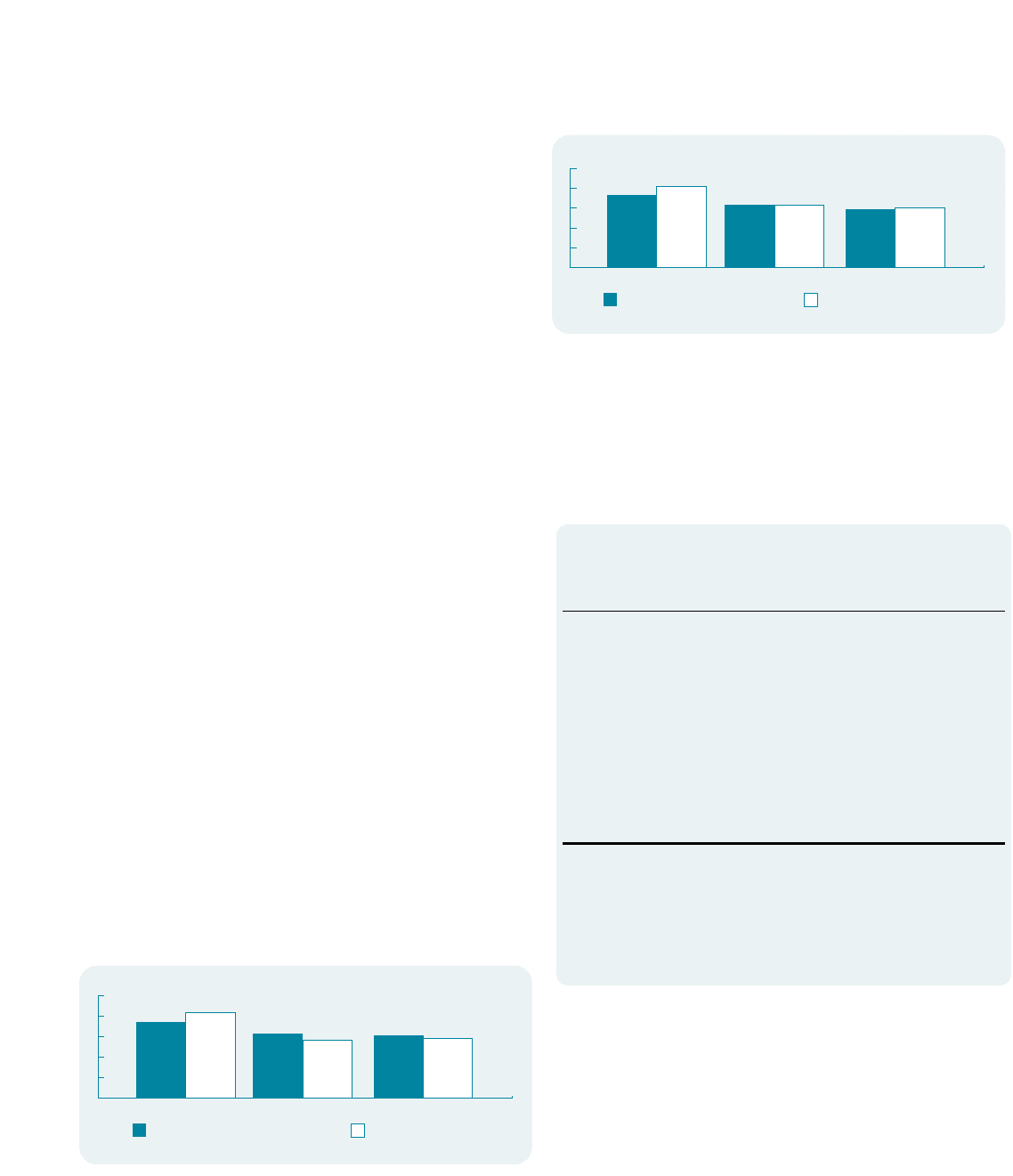

Table 4 indicates the impact of the consumer loan securitizations on average

earning assets, net interest margin and loan yield for the periods presented. The

Company intends to continue to securitize consumer loans.

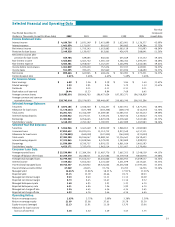

Table 4: Comparison of Managed and Reported

Operating Data and Ratios

Year Ended December 31

(Dollars in Thousands) 2002 2001 2000

Reported:

Average earning assets

$ 31,147,599 $ 20,706,172 $ 13,252,033

Net interest margin(1) 8.73% 8.45% 12.47%

Loan yield(2) 15.15 15.79 20.46

Managed:

Average earning assets

$ 57,266,637 $ 38,650,677 $ 24,399,119

Net interest margin(1) 9.23% 9.40% 11.11%

Loan yield(2) 14.64 15.88 18.25

(1) Reported and managed net interest margin increased 12 basis points and 7 basis points,

respectively as a result of the one-time impact of the change in recoveries assumption for the

year ended December 31, 2002.

(2) Reported and managed loan yield increased 15 basis points and 7 basis points, respectively as

a result of the one-time impact of the change in recoveries assumption for the year ended

December 31, 2002.

Risk Adjusted Revenue Margin

The Company’s products are designed with the objective of maximizing

customer value while optimizing revenue for the level of risk undertaken.

Management believes that comparable measures for external analysis are the

risk adjusted revenue and risk adjusted margin of the managed portfolio. Risk

adjusted revenue is defined as net interest income and non-interest income less net

charge-offs. Risk adjusted margin measures risk adjusted revenue as a percentage of

average earning assets. These measures consider not only the loan yield and net

interest margin, but also the fee income associated with these products. By

deducting net charge-offs, consideration is given to the risk inherent in the

Company’s portfolio.

28

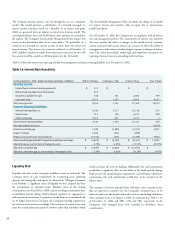

2001

9.23

2002

8.73

9.40 8.45

2000

11.11

12.47

MANAGED NET

INTEREST MARGIN

NET INTEREST MARGIN (%)

REPORTED NET

INTEREST MARGIN

MANAGED LOAN YIELD

2001

14.64

2002

15.15

15.88 15.79

2000

18.25 20.46

REPORTED LOAN YIELD

LOAN YIELD (%)