Capital One 2002 Annual Report Download - page 67

Download and view the complete annual report

Please find page 67 of the 2002 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

65

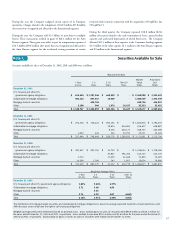

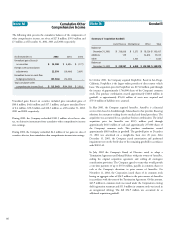

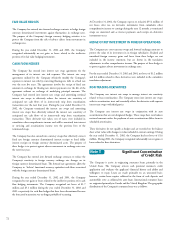

December 31 2002 2001

Deferred tax assets:

Allowance for loan losses $ 442,393 $ 107,389

Unearned income 323,404 260,208

Stock incentive plan 49,585 48,117

Foreign 17,469 4,203

Net operating losses 19,165 23,119

State taxes, net of federal benefit 61,649 50,786

Derivative instruments 61,491 45,371

Other 142,033 89,831

Subtotal 1,117,189 629,024

Valuation allowance (60,368) (52,933)

Total deferred tax assets 1,056,821 576,091

Deferred tax liabilities:

Securitizations 57,962 75, 084

Deferred revenue 915,953 624,254

Securities available for sale 33,735 5,453

Other 53,964 44,322

Total deferred tax liabilities 1,061,614 749,113

Net deferred tax liabilities $ (4,793) $ (173,022)

During 2002, the Company increased its valuation allowance by $7.4 million

for certain state and international loss carryforwards generated during the year.

At December 31, 2002, the Company had net operating losses available for

federal income taxes purposes of $55.0 million which are subject to certain

annual limitations under the Internal Revenue Code, and expire at various

dates from 2018 to 2020. Also, foreign net operating losses of $56.7 million

(net of related valuation allowances) were available, of which $55.7 million

expires at various dates from 2005 to 2008.

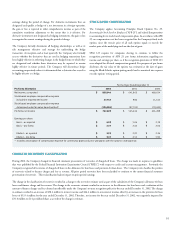

Significant components of the provision for income taxes attributable to

continuing operations were as follows:

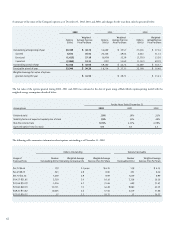

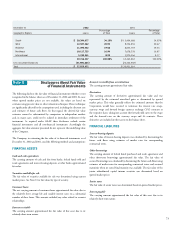

Year Ended December 31

2002 2001 2000

Federal taxes $ 708,667 $ 138 $ 284,661

State taxes 5,485 2,214 578

International taxes 2,654 555 1,156

Deferred income taxes (165,411) 390,548 1,445

Income taxes $ 551,395 $393,455 $ 287,840

The reconciliation of income tax attributable to continuing operations

computed at the U.S. federal statutory tax rate to income tax expense was:

Year Ended December 31

2002 2001 2000

Income tax at statutory

federal tax rate 35.00% 35.00% 35.00%

Other, including state taxes 3.00 3.00 3.00

Income taxes 38.00% 38.00% 38.00%

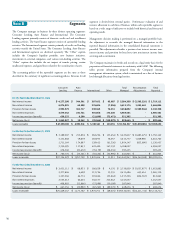

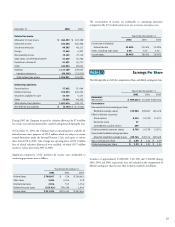

Note L Earnings Per Share

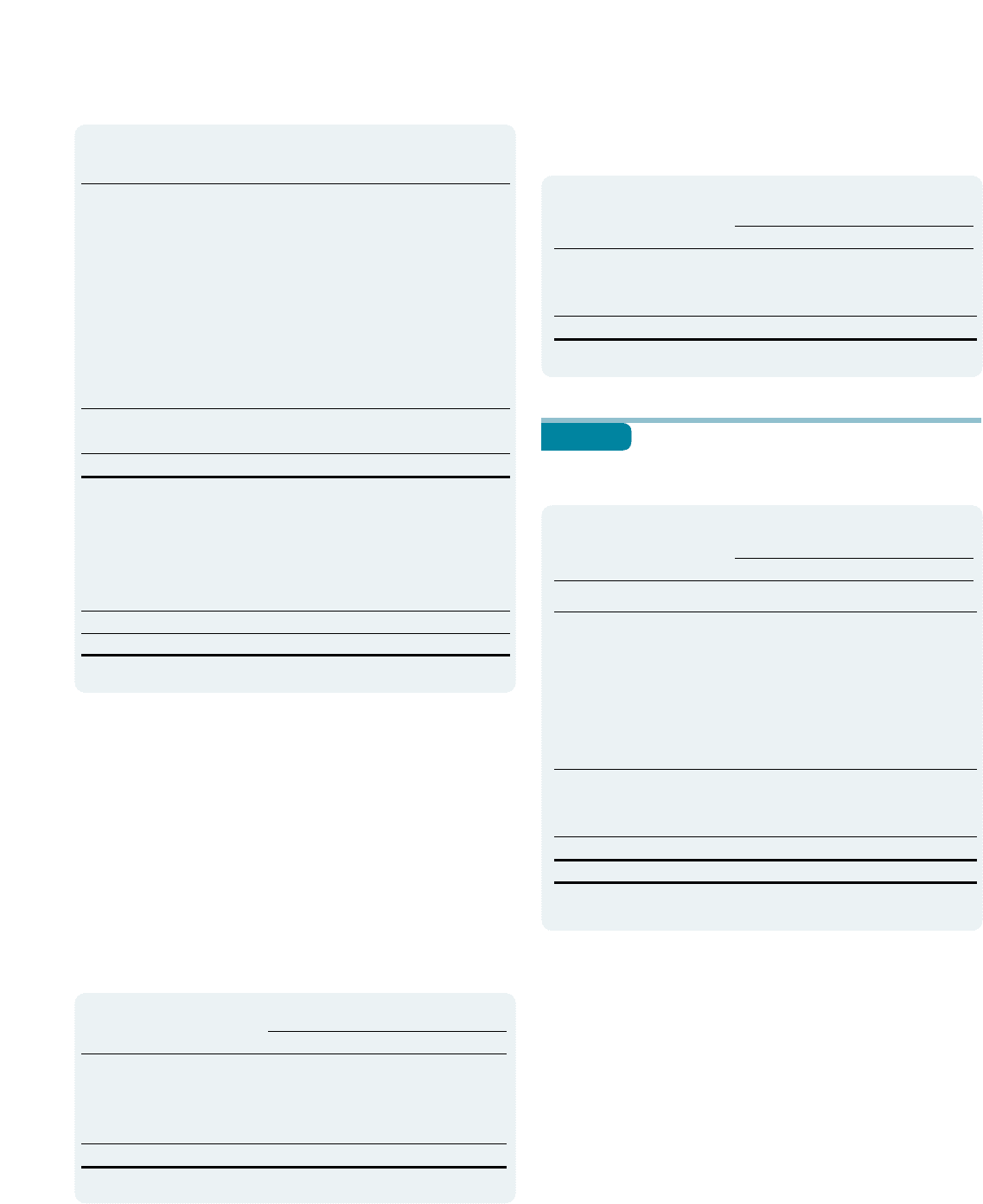

The following table sets forth the computation of basic and diluted earnings per share:

Year Ended December 31

2002 2001 2000

Numerator:

Net income $ 899,644 $ 641,965 $ 469,634

Denominator:

Denominator for basic earnings per share-

Weighted-average shares 219,984 209,867 196,478

Effect of dilutive securities:

Stock options 8,224 10,709 12,971

Restricted stock 37 --

Contingently issuable shares 499 --

Dilutive potential common shares 8,760 10,709 12,971

Denominator for diluted earnings per share-

Adjusted weighted-average shares 228,744 220,576 209,449

Basic earnings per share $ 4.09 $ 3.06 $ 2.39

Diluted earnings per share $ 3.93 $ 2.91 $ 2.24

Securities of approximately 23,000,000, 5,217,000 and 5,496,000 during

2002, 2001 and 2000, respectively, were not included in the computation of

diluted earnings per share because their inclusion would be antidilutive.