Capital One 2002 Annual Report Download - page 69

Download and view the complete annual report

Please find page 69 of the 2002 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

67

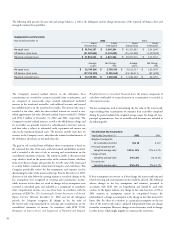

held against subprime loans. Under the revised application of the Subprime

Guidelines, the Company has, for purposes of calculating capital ratios,

risk weighted subprime loans in targeted programs at 200%, rather than the

100% risk weighting applied to loans not in targeted subprime programs.

The Company has addressed the additional capital requirements with

available resources. Under the revised application of the Subprime

Guidelines, each of the Bank and the Savings Bank exceeds the requirements

for a “well-capitalized” institution as of December 31, 2002.

For purposes of the Subprime Guidelines, the Company has treated as

“subprime” all loans in the Bank’s and the Savings Bank’s targeted subprime

programs to customers either with a Fair, Isaac and Company (“FICO”)

score of 660 or below or with no FICO score. The Bank and the Savings

Bank hold on average 200% of the total risk-based capital charge that would

otherwise apply to such assets. This results in higher levels of regulatory

capital at the Bank and the Savings Bank. As of December 31, 2002,

approximately $5.3 billion or 28.0% of the Bank’s, and $3.8 billion or

32.4% of the Savings Bank’s, on-balance sheet assets were treated as

“subprime” for purposes of the Subprime Guidelines.

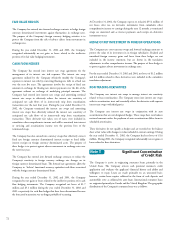

In November 2001, the regulators adopted an amendment to the regulatory

capital standards regarding the treatment of certain recourse obligations,

direct credit substitutes (i.e., guarantees on third-party assets), residual

interests in asset securitizations, and certain other securitized transactions.

Effective January 1, 2002, this rule amended the regulatory capital standards

to create greater differentiation in the capital treatment of residual interests.

On May 17, 2002, the regulators issued an advisory interpreting the

application of this rule to a residual interest commonly referred to as an

accrued interest receivable (the “AIR Advisory”). The effect of this AIR

Advisory is to require all insured depository institutions, including the Bank

and the Savings Bank, to hold significantly higher levels of regulatory capital

against accrued interest receivables beginning December 31, 2002. The Bank

and the Savings Bank have met this capital requirement and remain well

capitalized after applying the provisions of the AIR Advisory at December

31, 2002.

In August 2000, the Bank received regulatory approval and established a

subsidiary bank in the United Kingdom. In connection with the approval of

its former branch office in the United Kingdom, the Company committed to

the Federal Reserve that, for so long as the Bank maintains a branch or

subsidiary bank in the United Kingdom, the Company will maintain a

minimum Tier 1 Leverage ratio of 3.0%. As of December 31, 2002 and

2001, the Company’s Tier 1 Leverage ratio was 11.95% and 11.93%,

respectively.

Additionally, certain regulatory restrictions exist that limit the ability of the

Bank and the Savings Bank to transfer funds to the Corporation. As of

December 31, 2002, retained earnings of the Bank and the Savings Bank of

$924.4 million and $408.4 million, respectively, were available for payment

of dividends to the Corporation without prior approval by the regulators.

The Savings Bank, however, is required to give the OTS at least 30 days

advance notice of any proposed dividend and the OTS, in its discretion, may

object to such dividend.

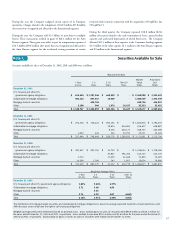

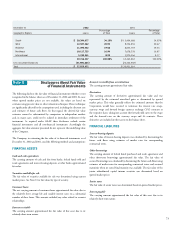

Note O Regulatory Matters

The Bank and the Savings Bank are subject to capital adequacy guidelines

adopted by the Federal Reserve Board (the “Federal Reserve”) and the Office

of Thrift Supervision (the “OTS”) (collectively, the “regulators”), respectively.

The capital adequacy guidelines and the regulatory framework for prompt

corrective action require the Bank and the Savings Bank to maintain specific

capital levels based upon quantitative measures of their assets, liabilities and

off-balance sheet items.

The most recent notifications received from the regulators categorized the

Bank and the Savings Bank as “well-capitalized.” To be categorized as “well-

capitalized,” the Bank and the Savings Bank must maintain minimum capital

ratios as set forth in the following table. As of December 31, 2002, there were

no conditions or events since the notifications discussed above that

management believes would have changed either the Bank or the Savings

Bank’s capital category.

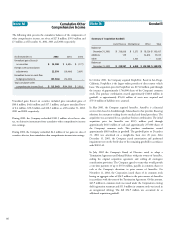

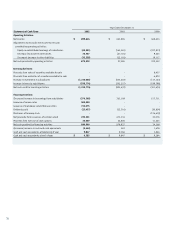

To Be “Well

Applying Minimum Capitalized”

Call Report Subprime for Capital Under Prompt

Basis Guidance Adequacy Corrective Action

Ratios Ratios Purposes Provisions

December 31, 2002

Capital One Bank

Tier 1 Capital 15.56% 11.50% 4.00% 6.00%

Total Capital 17.78 13.39 8.00 10.00

Tier 1 Leverage 13.79 13.79 4.00 5.00

Capital One, F.S.B.

Tier 1 Capital 15.10% 11.02% 4.00% 6.00%

Total Capital 16.80 12.59 8.00 10.00

Tier 1 Leverage 14.45 14.45 4.00 5.00

December 31, 2001

Capital One Bank

Tier 1 Capital 12.95% 4.00% 6.00%

Total Capital 15.12 8.00 10.00

Tier 1 Leverage 12.09 4.00 5.00

Capital One, F.S.B.

Tier 1 Capital 9.27% 4.00% 6.00%

Total Capital 11.21 8.00 10.00

Tier 1 Leverage 8.86 4.00 5.00

Since early 2001, the Bank and Savings Bank have treated a portion of their

loans as “subprime” under the “Expanded Guidance for Subprime Lending

Programs” (the “Subprime Guidelines”) and have assessed their capital and

allowance for loan losses accordingly. In the second quarter of 2002, the

Company adopted a revised application of the Subprime Guidelines, the

result of which is to require more capital and allowance for loan losses to be