Capital One 2002 Annual Report Download - page 76

Download and view the complete annual report

Please find page 76 of the 2002 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

74

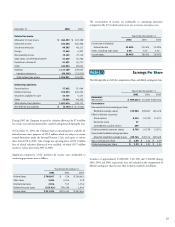

Note V International Activities

The Company’s international activities are primarily performed through Capital One Bank (Europe) plc, a subsidiary bank of the Bank that provides consumer

lending and other financial products in Europe and Capital One Bank - Canada Branch, a foreign branch office of the Bank that provides consumer lending

products in Canada. The total assets, revenue, income before income taxes and net income of the international operations are summarized below.

2002 2001 2000

Domestic

Total assets $ 34,420,099 $ 25,254,438 $ 15,719,760

Revenue(1) 7,604,075 5,738,433 4,430,700

Income before income taxes 1,436,706 1,064,420 906,732

Net income 899,429 660,809 562,174

International

Total assets 2,962,281 2,929,609 3,169,581

Revenue(1) 581,873 475,471 287,292

Income before income taxes 14,333 (29,000) (149,258)

Net income (loss) 215 (18,844) (92,540)

Total Company

Total assets $ 37,382,380 $ 28,184,047 $ 18,889,341

Revenue(1) 8,185,948 6,213,904 4,717,992

Income before income taxes 1,451,039 1,035,420 757,474

Net income 899,644 641,965 469,634

(1) Revenue equals net interest income plus non-interest income.

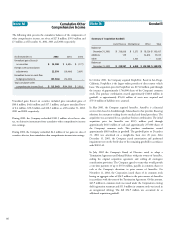

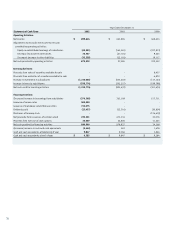

Derivatives

The carrying amount of derivatives approximated fair value and was represented by the estimated unrealized losses as determined by quoted market prices.

This value generally reflects the estimated amounts that the Corporation would have paid to terminate the interest rate swaps, currency swaps and f/x contracts

at the respective dates, taking into account the forward yield curve on the swaps and the forward rates on the currency swaps and f/x contracts. These

derivatives are included in other liabilities on the balance sheet.

2002 2001

Carrying Estimated Carrying Estimated

Amount Fair Value Amount Fair Value

Financial Assets

Cash and cash equivalents $ 918,778 $ 918,778 $ 707,238 $ 707,238

Securities available for sale 4,423,677 4,423,677 3,115,891 3,115,891

Net loans 26,133,652 26,133,652 20,081,014 20,081,014

Interest receivable 217,512 217,512 105,459 105,459

Accounts receivable from securitizations 3,096,827 3,096,827 2,452,548 2,452,548

Derivatives 435,383 435,383 91,474 91,474

Financial Liabilities

Interest-bearing deposits $ 17,325,965 $ 18,260,362 $ 12,838,968 $ 13,223,954

Senior notes 5,565,615 5,432,411 5,335,229 5,237,220

Other borrowings 6,365,075 6,446,669 3,995,528 4,047,865

Interest payable 236,081 236,081 188,160 188,160

Derivatives 500,471 500,471 199,976 199,976