Capital One 2002 Annual Report Download - page 23

Download and view the complete annual report

Please find page 23 of the 2002 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

21

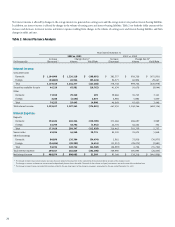

Year Ended December 31, 2002 Compared

to Year Ended December 31, 2001

Net income increased to $899.6 million, or $3.93 per share, for the year

ended December 31, 2002, compared to net income of $642.0 million, or

$2.91 per share, in 2001. This represents 40% net income growth and 35%

earnings per share growth in 2002. The growth in earnings for 2002 was

primarily attributable to the growth in the Company’s managed loan

portfolio, combined with gains on

sale of securities and the

repurchase of senior notes, offset

by a reduction in the managed net

interest margin, significant

increases in the provision for loan

losses, write-downs of interest-

only strips, certain one-time

charges, and the impact of the

change in recoveries classification.

Managed loans consist of the Company’s reported loan portfolio combined

with the off-balance sheet securitized loan portfolio. The Company has

retained servicing rights for its securitized loans and receives servicing fees in

addition to the excess spread generated from the securitized loan portfolio.

Average managed loans increased 48% to $52.8 billion for 2002 from $35.6

billion for 2001. Total managed loans increased 32% to $59.7 billion at

December 31, 2002 from $45.3 billion at December 31, 2001.

During 2002, the Company realized after-tax gains on the sale of securities

totaling $48.1 million, compared with similar after tax gains in 2001 of $8.4

million. In addition, during 2002 the Company realized after-tax gains on

the repurchase of senior notes of $16.7 million.

The managed net interest margin for the year ended December 31, 2002,

decreased to 9.23% from 9.40% for the year ended December 31, 2001. This

decrease was primarily the result of a 124 basis point decrease in consumer

loan yield to 14.64% for 2002, from 15.88% in 2001, largely offset by a

decrease in the cost of funds. This decline in yield was due to a shift in the mix

of the managed portfolio to lower yielding, higher credit quality loans, an

increase in low introductory rate accounts as compared to the prior year and

reduced pricing on many of the Company’s new loans in response to lower

funding costs and increased competitive pressure.

During 2002, the provision for loan losses increased by $1.0 billion over

2001. The ratio of allowance for loan losses to reported loans increased to

6.18% at December 31, 2002, compared to 4.02% at December 31, 2001.

The increase in the provision for loan losses and corresponding build in the

allowance for loan losses reflects an increase in the reported loan portfolio of

$7.0 billion or 33% over 2001, the change in the treatment of recoveries of

charged-off accounts, the adoption of a revised application of regulatory

guidelines related to subprime loans, as well as an increase in forecasted

charge-off rates.

Gains on securitization transactions represent the present value of estimated

excess cash flows the Company will receive over the estimated life of the

receivables. This excess cash flow essentially represents an interest-only strip,

consisting of the following estimates: interest rate movements on yields of

receivables and securities issued to determine the excess of finance charges

and past-due fees over the sum of the return paid to investors, contractual

servicing fees and credit losses. To the extent assumptions used by

management do not prevail, fair value estimates of the interest-only strip

could differ significantly, resulting in either higher or lower future income

from servicing and securitization non-interest income, as applicable.

Finance Charge and Fee Revenue Recognition

Consistent with its practice since the fourth quarter of 1997, as a revenue

recognition policy, the Company reduces reported revenue (including both

interest and non-interest income components of reported revenue) for the

portion of finance charge and fees billed to customers that it deems

uncollectible. In addition, the Company reduces consumer loans outstanding

for such uncollectible amounts. As discussed below, the 2002 change in

recoveries estimate resulted in an $82.7 million reduction of finance charges

and fees deemed uncollectible for the year ended December 31, 2002.

Change in Recoveries Classification

During 2002, the Company changed its financial statement presentation of

recoveries of charged-off loans. The change was made in response to

guidelines that were published by the Federal Financial Institutions

Examination Council (“FFIEC”) with respect to credit card account

management. Previously, the Company recognized all recoveries of charged-

off loans in the allowance for loan losses and provision for loan losses. The

Company now classifies the portion of recoveries related to finance charges

and fees as revenue. All prior period recoveries have been reclassified to

conform to the current financial statement presentation of recoveries. This

reclassification had no impact on prior period earnings.

The change in the classification of recoveries resulted in a change to the

recoveries estimate used as part of the calculation of the Company’s allowance

for loan losses and finance charge and fee revenue. The change in the

recoveries estimate resulted in an increase to the allowance for loan losses and

a reduction of the amount of finance charges and fees deemed uncollectible

under the Company’s revenue recognition policy for the year ended

December 31, 2002. The change in estimate resulted in an increase of $38.4

million (pre-tax) to interest income and $44.4 million (pre-tax) to non-

interest income offset by an increase in the provision for loan losses of $133.4

million (pre-tax) for the year ended December 31, 2002. Therefore, net

income for the year ended December 31, 2002, was negatively impacted by

$31.4 million or $.14 per diluted share as a result of the change in estimate.

CONSOLIDATED EARNINGS SUMMARY

The following discussion provides a summary of 2002 results compared to

2001 results and 2001 results compared to 2000 results. Each component is

discussed in further detail in subsequent sections of this analysis.

NET INCOME ($ in millions)

900

20022001

642

2000

470