Capital One 2002 Annual Report Download - page 62

Download and view the complete annual report

Please find page 62 of the 2002 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

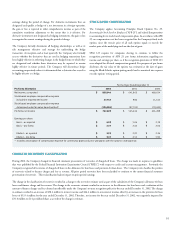

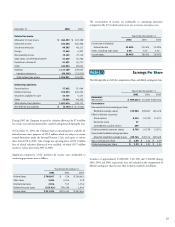

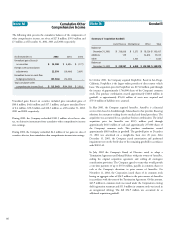

PeopleFirst, a subsidiary of COAF, currently maintains four agreements to

transfer pools of consumer loans accounted for as secured borrowings. The

agreements were entered into between 1999 and 2000 relating to the transfer

of pools of consumer loans totaling approximately $886.0 million. Principal

payments on the borrowings are based on principal collections, net of losses,

on the transferred consumer loans. The secured borrowings accrue interest at

fixed rates and mature between September 2003 and September 2007, or

earlier depending upon the repayment of the underlying consumer loans. At

December 31, 2002 and 2001, $243.0 million and $477.3 million of the

secured borrowings were outstanding.

Junior Subordinated Capital Income Securities

In January 1997, Capital One Capital I, a subsidiary of the Bank created as a

Delaware statutory business trust, issued $100.0 million aggregate amount of

Floating Rate Junior Subordinated Capital Income Securities that mature on

February 1, 2027. The securities represent a preferred beneficial interest in

the assets of the trust.

Other Short-Term Borrowings

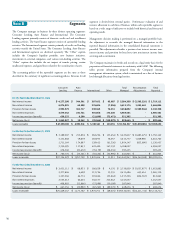

Domestic Revolving Credit Facility

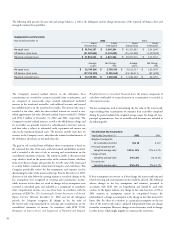

The Domestic Revolving Credit Facility (the “Credit Facility”) is available for

general corporate purposes of the Company. The Credit Facility is

comprised of two tranches: a $810.0 million Tranche A facility available to

the Bank and the Savings Bank, including an option for up to $250.0

million in multicurrency availability; and a $390.0 Tranche B facility

available to the Corporation, the Bank and the Savings Bank, including an

option for up to $150.0 million in multicurrency availability. All borrowings

under the Credit Facility are based on varying terms of LIBOR. The Bank

has irrevocably undertaken to honor any demand by the lenders to repay any

borrowings which are due and payable by the Savings Bank but have not

been paid. The Credit Facility has a total capacity of $1.2 billion all of

which was available at December 31, 2002. The Credit Facility expires in

May of 2003.

Multicurrency Facility

The Multicurrency Facility is intended to finance the Bank’s business in

Europe and was initially comprised of two Tranches, each in the amount of

Euro 300.0 million. The Tranche A facility terminated August of 2001. The

Tranche B facility terminates August 2004. The Corporation serves as

guarantor of all borrowings by Capital One Bank (Europe) plc under the

Multicurrency Facility. Internationally, the Company has funding programs

designed for foreign investors or to raise funds in foreign currencies allowing

the Company to borrow from the U.S. and non-U.S. lenders, including

foreign currency funding options under the Credit Facility discussed above.

The Company funds its foreign assets by directly or synthetically borrowing

or securitizing in the local currency to mitigate the financial statement effect

of currency translations. The Multicurrency Facility has a total capacity of

Euro 300.0 million ($315.0 million equivalent based on the exchange rate at

closing) all of which was available at December 31, 2002.

the Upper Decs®by substituting, as pledged securities, specifically identified

treasury securities that will pay $50 on the relevant stock purchase date,

which is the amount due on that date under each forward purchase contract.

In February 2005, the senior notes will be remarketed, and the interest rate

will be reset based on interest rates in effect at the time of remarketing. The

holders will use the proceeds of the remarketing to fund their obligations to

purchase shares of the Company’s common stock under the forward purchase

contract, with such number of shares to be determined based upon the

average closing price per share of the Company’s common stock for 20

consecutive trading days ending on the third trading day immediately

preceding the stock purchase date at a minimum per share price of $63.91

and a maximum per share price of $78.61.

Corporation Shelf Registration Statements

As of December 31, 2002, the Corporation had two effective shelf

registration statements under which the Corporation from time to time may

offer and sell senior or subordinated debt securities, preferred stock, common

stock, common equity units and stock purchase contracts. The Corporation

Shelf Registration statements had a total capacity of $2.2 billion all of which

was available at December 31, 2002. There was $587.2 million available at

December 31, 2001.

On November 11, 2002, the Corporation issued shares of its common stock

having an aggregate value of $54.9 million to certain former shareholders of

AmeriFee Corporation (“AmeriFee”) in connection with the termination of

the stock purchase agreement relating to the Corporation’s acquisition of

AmeriFee. Of this amount, $43.9 million of the Corporation’s common

stock was issued through its shelf registration statement and $11.0 million

was issued in an unregistered offering.

In January 2002, the Company issued $300.0 million of five-year senior

notes with a coupon rate of 8.75%.

During 2001, the Corporation issued 6,750,390 shares of common stock in

a public offering under the shelf registration statement that resulted in

proceeds of $412.8 million.

OTHER BORROWINGS

Secured Borrowings

COAF, a subsidiary of the Company, currently maintains seven agreements

to transfer pools of consumer loans accounted for as secured borrowings.

The agreements were entered into between 1999 and 2002, relating to the

transfers of pools of consumer loans totaling $6.2 billion. Principal payments

on the borrowings are based on principal collections, net of losses, on the

transferred consumer loans. The secured borrowings accrue interest

predominantly at fixed rates and mature between June 2006 and September

2008, or earlier depending upon the repayment of the underlying consumer

loans. At December 31, 2002 and 2001, $4.6 billion and $2.5 billion,

respectively, of the secured borrowings were outstanding.

60