Capital One 2002 Annual Report Download - page 68

Download and view the complete annual report

Please find page 68 of the 2002 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

66

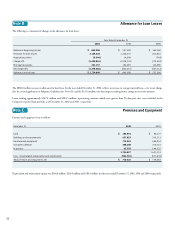

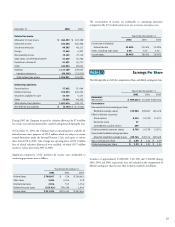

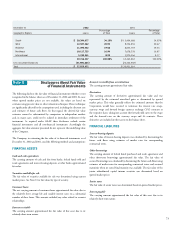

Note N Goodwill

Summary of Acquisition Goodwill

Auto Finance International Other Total

Balance at

December 31, 2001 $ 218,818 $ 5,273 $ 78,326 $ 302,417

Additions 139 - 54,874 55,013

Other - 1,545 - 1,545

Balance at

December 31, 2002 $ 218,957 $ 6,818 $ 133,200 $ 358,975

In October 2001, the Company acquired PeopleFirst. Based in San Diego,

California, PeopleFirst is the largest online provider of direct motor vehicle

loans. The acquisition price for PeopleFirst was $174.0 million, paid through

the issuance of approximately 3,746,000 shares of the Company’s common

stock. This purchase combination created approximately $166.0 million in

goodwill, as approximately $763.0 million of assets were acquired and

$755.0 million of liabilities were assumed.

In May 2001, the Company acquired AmeriFee. AmeriFee is a financial

services firm based in Southborough, Massachusetts that provides financing

solutions for consumers seeking elective medical and dental procedures. The

acquisition was accounted for as a purchase business combination. The initial

acquisition price for AmeriFee was $81.5 million, paid through

approximately $64.5 million of cash and approximately 257,000 shares of

the Company’s common stock. This purchase combination created

approximately $80.0 million in goodwill. The goodwill prior to December

31, 2001 was amortized on a straight-line basis over 20 years. After

December 31, 2001, the Company ceased amortization and performed

impairment tests on the book value of the remaining goodwill in accordance

with SFAS 142.

In July 2002 the Company’s Board of Directors voted to adopt a

Termination Agreement and Mutual Release with prior owners of AmeriFee,

ending the original acquisition agreement and settling all contingent

consideration provisions. The Company agreed to terms that would provide

a one-time payment of up to $55.0 million, payable in common shares or

cash at the Company’s discretion, to prior owners of AmeriFee. On

November 11, 2002, the Corporation issued shares of its common stock

having an aggregate value of $54.9 million to the prior owners of AmeriFee

in accordance with the terms of the Termination Agreement. Of this amount,

$43.9 million in common stock was issued under the Corporation’s existing

shelf registration statement and $11.0 million in common stock was issued in

an unregistered offering. The full $54.9 million was accounted for as

additional acquisition goodwill.

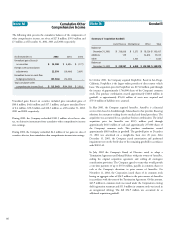

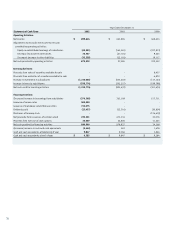

Note M Cumulative Other

Comprehensive Income

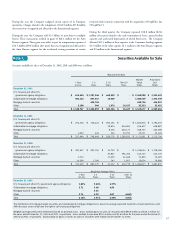

The following table presents the cumulative balances of the components of

other comprehensive income, net of tax of $27.8 million, $39.9 million and

$.5 million as of December 31, 2002, 2001 and 2000, respectively:

As of December 31 2002 2001 2000

Unrealized gains (losses)

on securities $ 55,588 $ 8,894 $ (777)

Foreign currency translation

adjustments 22,350 (19,466) 3,695

Unrealized losses on cash flow

hedging instruments (93,504) (74,026) -

Total cumulative other

comprehensive income (loss) $ (15,566) $(84,598) $ 2,918

Unrealized gains (losses) on securities included gross unrealized gains of

$80.6 million, $44.6 million and $17.1 million, and gross unrealized losses

of $.4 million, $30.2 million and $18.3 million, as of December 31, 2002,

2001 and 2000, respectively.

During 2002, the Company reclassified $101.5 million of net losses, after

tax, on derivative instruments from cumulative other comprehensive income

into earnings.

During 2002, the Company reclassified $4.2 million of net gains on sales of

securities, after tax, from cumulative other comprehensive income into earnings.