Capital One 2002 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2002 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54

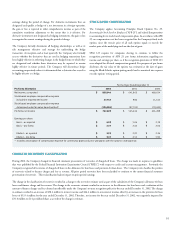

SEGMENTS

The Company maintains three distinct operating segments: Consumer

Lending, Auto Finance and International. The Consumer Lending segment

primarily consists of domestic credit card and installment lending activities.

The Auto Finance segment consists of automobile lending activities. The

International segment is comprised primarily of credit card lending activities

outside the United States. The Consumer Lending, Auto Finance and

International segments are considered reportable segments based on

quantitative thresholds applied to the managed loan portfolio for reportable

segments provided by SFAS No. 131, Disclosures about Segments of an

Enterprise and Related Information.

The accounting policies of these segments are the same as those described

above. Management measures the performance of and resource allocation to

each line of business within each reportable segment based on a wide range of

indicators to include both historical and forecasted operating results. All

revenue considered for the quantitative thresholds is generated from external

customers.

DERIVATIVE INSTRUMENTS AND HEDGING ACTIVITIES

The Company adopted SFAS No. 133, Accounting for Derivative Instruments

and Hedging Activities, as amended by SFAS No. 137, Accounting for

Derivative Instruments and Hedging Activities – Deferral of Effective Date of

FASB Statement No. 133, and SFAS No. 138, Accounting for Certain

Derivative Instruments and Certain Hedging Activities, (collectively, “SFAS

133”) on January 1, 2001. SFAS 133 required the Company to recognize all

of its derivative instruments as either assets or liabilities in the balance sheet at

fair value. The accounting for changes in the fair value (i.e., gains and losses)

of a derivative instrument depends on whether it has been designated and

qualifies as part of a hedging relationship and, further, on the type of hedging

relationship. For those derivative instruments that are designated and qualify

as hedging instruments, a company must designate the hedging instrument,

based upon the exposure being hedged, as a fair value hedge, a cash flow

hedge or a hedge of a net investment in a foreign operation. The adoption of

SFAS 133 resulted in a 2001 cumulative-effect adjustment decreasing other

comprehensive income by $27.2 million, net of an income tax benefit of

$16.7 million.

For derivative instruments that are designated and qualify as fair value hedges

(i.e., hedging the exposure to changes in the fair value of an asset or a liability

or an identified portion thereof that is attributable to a particular risk), the

gain or loss on the derivative instrument as well as the offsetting loss or gain

on the hedged item attributable to the hedged risk is recognized in current

earnings during the period of the change in fair values. For derivative

instruments that are designated and qualify as cash flow hedges (i.e., hedging

the exposure to variability in expected future cash flows that is attributable to

a particular risk), the effective portion of the gain or loss on the derivative

instrument is reported as a component of other comprehensive income and

reclassified into earnings in the same period or periods during which the

hedged transaction affects earnings. The remaining gain or loss on the

derivative instrument in excess of the cumulative change in the present value

of future cash flows of the hedged item, if any, is recognized in current

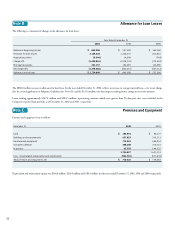

ALLOWANCE FOR LOAN LOSSES

The allowance for loan losses is maintained at the amount estimated to be

sufficient to absorb probable losses, net of principal recoveries (including

recovery of collateral), inherent in the existing reported loan portfolio. The

provision for loan losses is the periodic cost of maintaining an adequate

allowance. The amount of allowance necessary is determined primarily based

on a migration analysis of delinquent and current accounts and forward loss

curves. The entire balance of an account is contractually delinquent if the

minimum payment is not received by the payment due date. In evaluating

the sufficiency of the allowance for loan losses, management takes into

consideration the following factors: recent trends in delinquencies and

charge-offs including bankrupt, deceased and recovered amounts; forecasting

uncertainties and size of credit risks; the degree of risk inherent in the

composition of the loan portfolio; economic conditions; credit evaluations

and underwriting policies.

The Company charges off credit card loans (net of any collateral) at 180 days

past the due date, and generally charges off other consumer loans at 120 days

past the due date. Bankrupt consumers’ accounts are generally charged-off

within 30 days of receipt of the bankruptcy petition. Amounts collected on

previously charged-off accounts related to principal are included in recoveries

for the determination of net charge-offs. Costs to recover previously charged-

off accounts are recorded as collection expense in non-interest expenses.

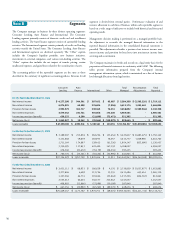

PREMISES AND EQUIPMENT

Premises and equipment are stated at cost less accumulated depreciation and

amortization. The Company capitalizes direct costs (including external

costs for purchased software, contractors, consultants and internal staff costs)

for internally developed software projects that have been identified as being

in the application development stage. Depreciation and amortization

expenses are computed generally by the straight-line method over the

estimated useful lives of the assets. Useful lives for premises and equipment

are as follows: buildings and improvements — 5-39 years; furniture and

equipment — 3-10 years; computers and software — 3 years.

MARKETING

The Company expenses marketing costs as incurred. Television advertising

costs are expensed during the period in which the advertisements are aired.

CREDIT CARD FRAUD LOSSES

The Company experiences fraud losses from the unauthorized use of credit

cards. Transactions suspected of being fraudulent are charged to non-interest

expense after a sixty-day investigation period.

INCOME TAXES

Deferred tax assets and liabilities are determined based on differences

between the financial reporting and tax bases of assets and liabilities, and are

measured using the enacted tax rates and laws that will be in effect when the

differences are expected to reverse.