Capital One 2002 Annual Report Download - page 52

Download and view the complete annual report

Please find page 52 of the 2002 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

50

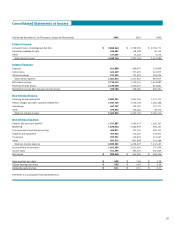

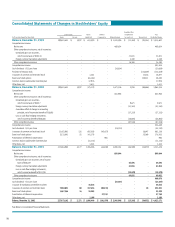

Consolidated Statements of Changes in Stockholders’ Equity

Cumulative Other

Common Stock Paid-In Deferred Comprehensive Total

(In Thousands, Except Per Share Data) Shares Amount Capital, Net Compensation Retained Earnings Income (Loss) TreasuryStock Stockholders’ Equity

Balance, December 31, 1999

199,670,421 $ 1,997 $ 613,590 $ - $ 1,022,296 $ (31,262) $ (91,014) $ 1,515,607

Comprehensive income:

Net income - - - - 469,634 - - 469,634

Other comprehensive income, net of income tax:

Unrealized gains on securities,

net of income taxes of $19,510 - - - - - 31,831 - 31,831

Foreign currency translation adjustments - - - - - 2,349 - 2,349

Other comprehensive income - - - - - 34,180 - 34,180

Comprehensive income - - - - - - - 503,814

Cash dividends - $.11 per share - - - - (20,824) - - (20,824)

Purchase of treasury stock - - - - - - (134,619) (134,619)

Issuances of common and restricted stock - - 1,441 - - - 17,436 18,877

Exercise of stock options - - (61,261) - - - 119,511 58,250

Common stock issuable under incentive plan - - 17,976 - - - - 17,976

Other items, net - - 3,433 - - - - 3,433

Balance, December 31, 2000

199,670,421 1,997 575,179 - 1,471,106 2,918 (88,686) 1,962,514

Comprehensive income:

Net income - - - - 641,965 - - 641,965

Other comprehensive income, net of income tax:

Unrealized gains on securities,

net of income taxes of $5,927 - - - - - 9,671 - 9,671

Foreign currency translation adjustments - - - - - (23,161) - (23,161)

Cumulative effect of change in accounting

principle, net of income tax benefit of $16,685 - - - - - (27,222) - (27,222)

Loss on cash flow hedging instruments,

net of income tax benefit of $28,686 - - - - - (46,804) - (46,804)

Other comprehensive loss - - - - - (87,516) - (87,516)

Comprehensive income - - - - - - - 554,449

Cash dividends - $.11 per share - - - - (22,310) - - (22,310)

Issuances of common and restricted stock 12,453,961 125 687,828 (45,472) - - 18,647 661,128

Exercise of stock options 5,532,603 55 141,178 - - - 35,069 176,302

Amortization of deferred compensation - - - 984 - - - 984

Common stock issuable under incentive plan - - (11,134) - - - - (11,134)

Other items, net - - 1,545 - - - - 1,545

Balance, December 31, 2001

217,656,985 2,177 1,394,596 (44,488) 2,090,761 (84,598) (34,970) 3,323,478

Comprehensive income:

Net income - - - - 899,644 -- 899,644

Other comprehensive income, net of income tax:

Unrealized gains on securities, net of income

taxes of $28,619 - - - - - 46,694 - 46,694

Foreign currency translation adjustments - - - - - 41,816 - 41,816

Loss on cash flow hedging instruments,

net of income tax benefit of $11,938 - - - - - (19,478) - (19,478)

Other comprehensive income - - - - - 69,032 - 69,032

Comprehensive income - - - - - - - 968,676

Cash dividends - $.11 per share - - - - (23,457) - - (23,457)

Issuance of mandatory convertible securities - - 36,616 - - - - 36,616

Issuances of common and restricted stock 7,968,831 80 317,454 (85,231) - - 18 232,321

Exercise of stock options 1,447,346 14 55,585 ----55,599

Amortization of deferred compensation - - - 27,749 - - - 27,749

Other items, net - - 2,189 - - - - 2,189

Balance, December 31, 2002 227,073,162 $ 2,271 $ 1,806,440 $ (101,970) $ 2,966,948 $ (15,566) $ (34,952) $ 4,623,171

See Notes to Consolidated Financial Statements.