Capital One 2002 Annual Report Download - page 54

Download and view the complete annual report

Please find page 54 of the 2002 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

Replacement of SFAS No. 125 (“SFAS 140”), are accomplished through

qualifying special purpose entities and such transactions are not subject to the

provisions of FIN 46. The Company is currently evaluating FIN 46 and the

corresponding impact to its financial statements.

In December 2002, the FASB issued Statement of Financial Accounting

Standard No. 148, Accounting for Stock-Based Compensation – Transition and

Disclosure – an Amendment of SFAS No. 123, (“SFAS 148”). SFAS 148

amends current guidance to provide alternative methods of transition for a

voluntary change to the fair value based method of accounting for stock-

based employee compensation. The statement also amends the disclosure

requirements of SFAS No. 123, Accounting for Stock-Based Compensation

(“SFAS 123”), to require prominent disclosures in both annual and interim

financial statements about the method of accounting for stock-based

employee compensation and the effect of the method used on reported

results. SFAS 148 is effective for fiscal years ending after December 15, 2002.

The Company has adopted and incorporated the applicable disclosure

provisions of SFAS 148 in its consolidated financial statements for the year

ended December 31, 2002.

In November 2002, the FASB issued FASB Interpretation No. 45 (“FIN

45”), Guarantor’s Accounting and Disclosure Requirements for Guarantees,

Including Indirect Guarantees of Indebtedness of Others, an interpretation of

FASB Statements No. 5, 57, and 107 and rescission of FASB Interpretation No.

34. FIN 45 elaborates on the disclosures to be made by a guarantor in its

interim and annual financial statements about its obligations under certain

guarantees that it has issued. It also clarifies that a guarantor is required to

recognize, at the inception of a guarantee, a liability for the fair value of the

obligation undertaken in issuing the guarantee. FIN 45 requires the initial

disclosure of applicable guarantees in all issuances of financial statements of

interim or annual periods ending after December 15, 2002. The additional

provisions for initial recognition and measurement are effective on a

prospective basis for guarantees that are issued or modified after December

31, 2002, irrespective of a guarantor’s year-end. The Company has adopted

the disclosure provisions required by FIN 45 in its consolidated financial

statements for the year ended December 31, 2002, and will adopt the

recognition and measurement provisions for new or modified contracts

subsequent to December 31, 2002. See Note P, Commitments,

Contingencies and Guarantees, for discussion of special purpose vehicles used

in synthetic lease transactions.

In July of 2002, the FASB issued SFAS No. 146, Accounting for Costs

Associated with Exit or Disposal Activities (“SFAS 146”). SFAS 146 requires

that a liability for a disposal obligation be recognized and measured at its fair

value when it is incurred rather then at the date to the Company’s

commitment to an exit plan, and severance pay in many cases be recognized

over time rather than up front. The provisions of SFAS 146 are effective for

exit or disposal activities that are initiated after December 31, 2002. The

adoption of SFAS 146 is not expected to have a material impact on the

consolidated earnings or financial position of the Company.

Notes to Consolidated Financial Statements

(Currencies in Thousands, Except Per Share Data)

NOTE A Significant Accounting Policies

BUSINESS

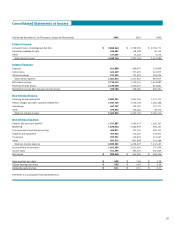

The Consolidated Financial Statements include the accounts of Capital One

Financial Corporation (the “Corporation”) and its subsidiaries. The

Corporation is a holding company whose subsidiaries market a variety of

financial products and services to consumers. The principal subsidiaries are

Capital One Bank (the “Bank”), which offers credit card products, Capital

One, F.S.B. (the “Savings Bank”), which offers consumer lending (including

credit cards) and deposit products, and Capital One Auto Finance, Inc.

(“COAF”) which offers auto loans. The Corporation and its subsidiaries are

collectively referred to as the “Company.”

BASIS OF PRESENTATION

The accompanying Consolidated Financial Statements have been prepared in

accordance with accounting principles generally accepted in the United States

(“GAAP”) that require management to make estimates and assumptions that

affect the amounts reported in the financial statements and accompanying

notes. Actual results could differ from these estimates.

All significant intercompany balances and transactions have been eliminated.

Certain prior years’ amounts have been reclassified to conform to the 2002

presentation.

The following is a summary of the significant accounting policies used in

preparation of the accompanying Consolidated Financial Statements.

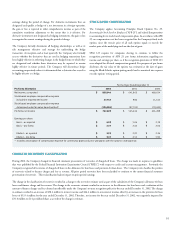

RECENT ACCOUNTING PRONOUNCEMENTS

In January 2003, the Financial Accounting Standards Board (“FASB”) issued

FASB Interpretation No. 46 (“FIN 46”), Consolidation of Variable Interest

Entities, an Interpretation of ARB No. 51. This interpretation addresses

consolidation of business enterprises of variable interest entities, which have

certain characteristics. These characteristics include either that the equity

investment at risk is not sufficient to permit the entity to finance its activities

without additional subordinated financial support from other parties; or that

the equity investors in the entity lack one or more of the essential

characteristics of a controlling financial interest. FIN 46 is designed to

improve financial reporting by enterprises involved with variable interest

entities by providing guidance and standards for consolidation of such

entities in the financial statements. FIN 46 applies immediately to variable

interest entities created after January 31, 2003, and on July 1, 2003 for

variable interests acquired before February 1, 2003. See Note P,

Commitments, Contingencies and Guarantees, for discussion of special

purpose vehicles used in synthetic lease transactions. All securitization

transactions that receive sale treatment under SFAS No. 140, Accounting for

Transfers and Servicing of Financial Assets and Extinguishment of Liabilities – a