Capital One 2002 Annual Report Download - page 60

Download and view the complete annual report

Please find page 60 of the 2002 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

58

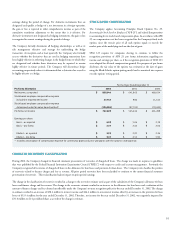

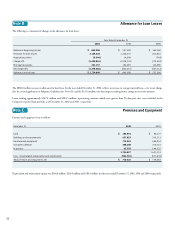

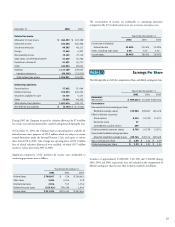

Note D Allowance for Loan Losses

The following is a summary of changes in the allowance for loan losses:

Year Ended December 31

2002 2001 2000

Balance at beginning of year $ 840,000 $ 527,000 $ 342,000

Provision for loan losses 2,149,328 1,120,457 812,861

Acquisitions/other (9,644) 14,800 (549)

Charge-offs (1,490,841) (1,018,350) (772,402)

Principal recoveries 231,157 196,093 145,090

Net charge-offs (1,259,684) (822,257) (627,312)

Balance at end of year $ 1,720,000 $ 840,000 $ 527,000

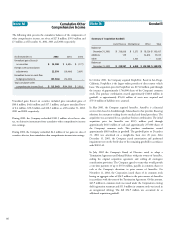

Note E Premises and Equipment

Premises and equipment were as follows:

December 31 2002 2001

Land $ 103,954 $ 90,377

Buildings and improvements 437,023 305,312

Furniture and equipment 773,092 680,942

Computer software 298,208 216,361

In process 92,550 144,527

1,704,827 1,437,519

Less: Accumulated depreciation and amortization (934,501) (677,836)

Total premises and equipment, net $ 770,326 $ 759,683

Depreciation and amortization expense was $264.8 million, $236.0 million and $180.3 million, for the years ended December 31, 2002, 2001 and 2000, respectively.

The $880.0 million increase in allowance for loan losses for the year ended December 31, 2002, reflects an increase in average reported loans, a rise in net charge-

offs, the revised application of Subprime Guidelines (see Note O), and the $133.4 million one-time impact resulting from a change in recoveries estimate.

Loans totaling approximately $567.4 million and $284.5 million, representing amounts which were greater than 90 days past due, were included in the

Company’s reported loan portfolio as of December 31, 2002 and 2001, respectively.