Capital One 2002 Annual Report Download - page 27

Download and view the complete annual report

Please find page 27 of the 2002 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

25

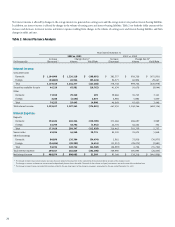

Service charges and other customer-related fees decreased by $110.3 million,

or 7%, to $1.5 billion for the year ended December 31, 2001. This decrease

was primarily due to the shift in the mix of the reported loan portfolio

toward a greater composition of lower fee-generating loans, offset by a 39%

increase in the average number of accounts in 2001.

Interchange Income

Interchange income increased $68.0 million, or 18%, to $447.8 million for

the year ended December 31, 2002, from $379.8 million in 2001. This

increase is primarily attributable to an increase in annual purchase volume.

Total interchange income is net of $104.9 million of costs related to the

Company’s rewards programs for the year ended December 31, 2002.

Interchange income increased $142.0 million, or 60%, to $379.8 million for

the year ended December 31, 2001, from $237.8 million in 2000. This

increase was a result of increased annual purchase volume and new account

growth for the year ended December 31, 2001. Total interchange income

was net of $110.9 of costs related to the Company’s rewards programs for the

year ended December 31, 2001.

Other Non-Interest Income

Other non-interest income includes gains on sale of securities, gains related

to the repurchase of senior notes, gains or losses associated with hedging

transactions, service provider revenue generated by the Company’s medical

procedures lending business and income earned related to the reaffirmation

of purchased charged-off loan portfolios.

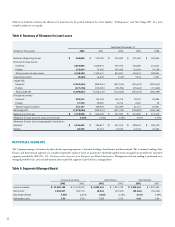

Other non-interest income increased $169.4 million or 159% to $275.9

million for 2002 compared to $106.5 million for 2001. The increase in other

non-interest income was primarily due to $77.5 million of gains on sales of

securities realized in 2002 in connection with the Company’s rebalancing of

its liquidity portfolio compared to $13.5 million realized in 2001. Other

factors in the increase included gains related to senior note repurchases of

$27.0 million realized during 2002, an increase in service provider revenue of

$9.4 million and an increase in income earned from reaffirmed purchased

charged-off loans of $24.1 million during the year ended December 31,

2002.

Other non-interest income increased $78.1 million or 275% to $106.5

million for 2001 compared to $28.4 million in 2000. The increase was

primarily due to an increase in income earned on reaffirmed purchased

charged-off loans of $26.2 million, gains on sales of securities earned in 2001

of $13.5 million compared with no gains in 2000 and a $16.3 million

increase in service provider revenue generated by the Company’s medical

procedures lending business.

Servicing and Securitization Income

In accordance with SFAS 140, the Company records gains or losses on the off-

balance sheet securitizations of consumer loan receivables on the date of sale

based on the estimated fair value of assets sold and retained and liabilities

incurred in the sale. Retained interests in securitized assets include interest-

only strips, retained subordinated interests in the transferred pool of

receivables, cash collateral accounts and accrued interest and fees on the

investors’ share of the pool of receivables. Gains represent the present value of

estimated excess cash flows the Company will receive over the estimated life of

the receivables and are included in servicing and securitizations income. This

excess cash flow essentially represents an interest-only strip, consisting of the

following estimates: the excess of finance charges and past-due fees over the

sum of the return paid to investors, contractual servicing fees and credit losses.

The credit risk exposure on retained interests exceeds the pro rata share of the

Company’s interest in the pool of receivables. However, exposure to credit

losses on the securitized loans is contractually limited to the retained interests.

Servicing and securitizations income represents servicing fees, excess spread

and other fees relating to consumer loan receivables sold through

securitization and other sale transactions, as well as gains and losses

recognized as a result of the securitization transactions, and fair value

adjustments to the interest-only strips. Servicing and securitizations income

increased $364.4 million, or 15%, to $2.8 billion for the year ended

December 31, 2002, from $2.4 billion in 2001. This increase was primarily

due to a 49% increase in the average off-balance sheet loan portfolio offset in

part by a reduction in the excess spread generated by the securitized loan

portfolio and a $33.1 million decrease in the fair value of interest-only strips.

Servicing and securitizations income increased $1.3 billion, or 112%, to $2.4

billion for the year ended December 31, 2001, from $1.2 billion in 2000.

This increase was primarily due to a 64% increase in the average off-balance

sheet loan portfolio and a shift in the mix of that portfolio towards higher

yielding, lower credit quality loans to more closely reflect the composition of

the managed portfolio.

Certain estimates inherent in the determination of the fair value of the

retained interests are influenced by factors outside the Company’s control,

and as a result, such estimates could materially change in the near term. Any

future gains that will be recognized in accordance with SFAS 140 will be

dependent on the timing and amount of future securitizations. The

Company intends to continuously assess the performance of new and existing

securitization transactions, and therefore the valuation of retained interests, as

estimates of future cash flows change.

Service Charges and Other Customer-Related Fees

Service charges and other customer-related fees increased by $401.4 million,

or 26%, to $1.9 billion for the year ended December 31, 2002. The increase

primarily reflects an increase in the reported loan portfolio of $7.0 billion or

33% over 2001 and a $44.4 million increase related to the one-time impact

of the 2002 change in the recoveries estimate (see “Change in Recoveries

Classification” above) offset by a shift in the mix of the reported loan

portfolio toward a greater composition of lower fee-generating loans.