Capital One 2002 Annual Report Download - page 75

Download and view the complete annual report

Please find page 75 of the 2002 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

73

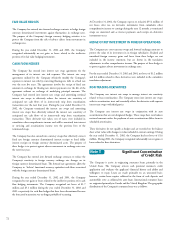

Accounts receivable from securitizations

The carrying amount approximated fair value.

Derivatives

The carrying amount of derivatives approximated fair value and was

represented by the estimated unrealized gains as determined by quoted

market prices. This value generally reflects the estimated amounts that the

Corporation would have received to terminate the interest rate swaps,

currency swaps and forward foreign currency exchange (“f/x”) contracts at

the respective dates, taking into account the forward yield curve on the swaps

and the forward rates on the currency swaps and f/x contracts. These

derivatives are included in other assets on the balance sheet.

FINANCIAL LIABILITIES

Interest-bearing deposits

The fair value of interest-bearing deposits was calculated by discounting the

future cash flows using estimates of market rates for corresponding

contractual terms.

Other borrowings

The carrying amount of federal funds purchased and resale agreements and

other short-term borrowings approximated fair value. The fair value of

secured borrowings was calculated by discounting the future cash flows using

estimates of market rates for corresponding contractual terms and assumed

maturities when no stated final maturity was available. The fair value of the

junior subordinated capital income securities was determined based on

quoted market prices.

Senior notes

The fair value of senior notes was determined based on quoted market prices.

Interest payable

The carrying amount approximated the fair value of this asset due to its

relatively short-term nature.

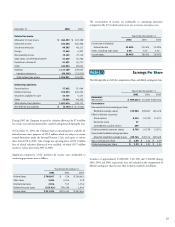

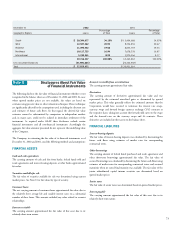

December 31 2002 2001

Percentage Percentage

Geographic Region: Loans of Total Loans of Total

South $ 20,394,077 34.13% $ 15,404,688 34.03%

West 12,507,242 20.93 9,354,934 20.67

Midwest 11,396,942 19.08 8,855,719 19.56

Northeast 10,117,735 16.94 7,678,378 16.97

International 5,330,541 8.92 3,970,244 8.77

59,746,537 100.00% 45,263,963 100.00%

Less securitized balances (31,892,885 ) (24,342,949)

Total $ 27,853,652 $ 20,921,014

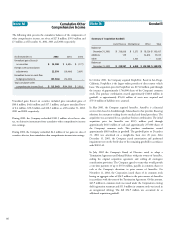

Note U Disclosures About Fair Value

of Financial Instruments

The following discloses the fair value of financial instruments whether or not

recognized in the balance sheets as of December 31, 2002 and 2001. In cases

where quoted market prices are not available, fair values are based on

estimates using present value or other valuation techniques. Those techniques

are significantly affected by the assumptions used, including the discount rate

and estimates of future cash flows. In that regard, the derived fair value

estimates cannot be substantiated by comparison to independent markets

and, in many cases, could not be realized in immediate settlement of the

instrument. As required under GAAP, these disclosures exclude certain

financial instruments and all non-financial instruments. Accordingly, the

aggregate fair value amounts presented do not represent the underlying value

of the Company.

The Company, in estimating the fair value of its financial instruments as of

December 31, 2002 and 2001, used the following methods and assumptions:

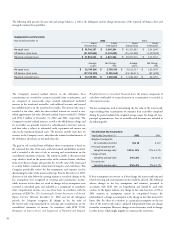

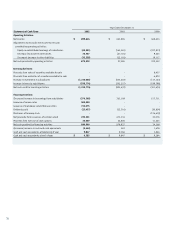

FINANCIAL ASSETS

Cash and cash equivalents

The carrying amounts of cash and due from banks, federal funds sold and

resale agreements and interest-bearing deposits at other banks approximated

fair value.

Securities available for sale

The fair value of securities available for sale was determined using current

market prices. See Note C for fair values by type of security.

Consumer loans

The net carrying amount of consumer loans approximated fair value due to

the relatively short average life and variable interest rates on a substantial

number of these loans. This amount excluded any value related to account

relationships.

Interest receivable

The carrying amount approximated the fair value of this asset due to its

relatively short-term nature.