Capital One 2002 Annual Report Download - page 31

Download and view the complete annual report

Please find page 31 of the 2002 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

29

The Company also offers other

credit card products. Examples of

such products include secured

cards, lifestyle cards, co-branded

cards, student cards and other

cards marketed to certain

consumer populations that the

Company believes are underserved

by its competitors. These products

do not have a significant, immediate impact on managed loan balances;

rather they typically consist of lower credit limit accounts and balances that

build over time. The terms of these customized card products tend to include

membership fees and higher annual finance charge rates. The profile of the

consumer populations that these products are marketed to, in some cases,

may also tend to result in higher account delinquency rates and consequently

higher past-due and overlimit fees as a percentage of loan receivables

outstanding than the low non-introductory rate products.

The Company markets its card

products to specific consumer

populations. The terms of each

card product are actively

managed to achieve a balance

between risk and expected

performance, while obtaining the

expected return. For example,

card product terms include the

ability to reprice individual accounts upwards or downwards based on the

consumer’s performance. In addition, since 1998, the Company has

aggressively marketed low non-introductory rate cards to consumers with

the best established credit profiles to take advantage of the favorable risk

return characteristics of this consumer type. Industry competitors have

continuously solicited the Company’s customers with similar interest

rate strategies. Management believes the competition has placed, and will

continue to place, pressure on the Company’s pricing strategies.

5.4

RISK ADJUSTED REVENUE

($ in billions)

6.9

200220012000

4.1

MANAGED RISK

ADJUSTED MARGIN (%)

12.09

20022001

13.95

2000

16.77

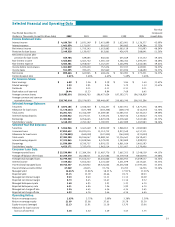

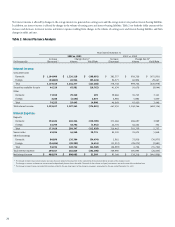

Table 5: Managed Risk Adjusted Revenue

Year Ended December 31

(Dollars in Thousands) 2002 2001 2000

Managed Income Statement:

Net interest income(2) $ 5,284,338 $ 3,633,817 $ 2,710,859

Non-interest income(2) 4,411,174 3,413,777 2,411,496

Net charge-offs (2,769,249) (1,655,947) (1,031,590)

Risk adjusted revenue $ 6,926,263 $ 5,391,647 $ 4,090,765

Ratios(1):

Net interest margin(2) 9.23% 9.40% 11.11%

Non-interest income(2) 7.70 8.83 9.89

Net charge-offs (4.84) (4.28) (4.23)

Risk adjusted margin(2) 12.09% 13.95% 16.77%

(1) As a percentage of average managed earning assets.

(2) Net interest income and non-interest income include $38.4 million and $44.4 million, respectively, related to the one-time impact of the change in recoveries assumption.

This resulted in a 7 basis point increase in the managed net interest margin, a 7 basis point increase in non-interest income and a 14 basis point increase in the risk adjusted margin.

Table 5 provides income statement data and ratios for the Company’s managed consumer loan portfolio. The causes of increases and decreases in the various

components of risk adjusted revenue are discussed in sections previous to this analysis.

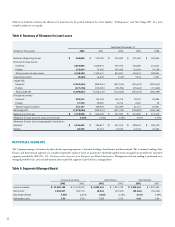

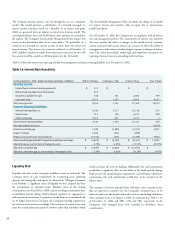

ASSET QUALITY

The asset quality of a portfolio is generally a function of the initial underwriting criteria used, levels of competition, account management activities and demographic

concentration, as well as general economic conditions. The seasoning of the accounts is also an important factor in the delinquency and loss levels of the portfolio.

Accounts tend to exhibit a rising trend of delinquency and credit losses as they season. As of December 31, 2002 and 2001, 45% and 58% of managed accounts,

respectively, each representing 51% of the total managed loan balance, were less than eighteen months old. Accordingly, it is likely that the Company’s managed loan

portfolio could experience increased levels of delinquency and credit losses as the average age of the Company’s accounts increases during 2003.

Changes in the rates of delinquency and credit losses can also result from a shift in the product mix. As discussed in “Risk Adjusted Revenue and Margin,” certain

customized card products have, in some cases, higher delinquency and higher charge-off rates. In the case of secured card loans, collateral, in the form of cash

deposits, reduces any ultimate charge-offs. The costs associated with higher delinquency and charge-off rates are considered in the pricing of individual products.