Capital One 2002 Annual Report Download - page 41

Download and view the complete annual report

Please find page 41 of the 2002 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

39

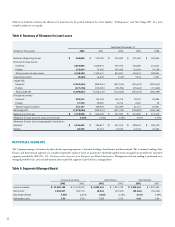

corrective action require the Bank and the Savings Bank to maintain specific

capital levels based upon quantitative measures of their assets, liabilities and

off-balance sheet items.

The most recent notifications received from the regulators categorized the

Bank and the Savings Bank as “well-capitalized.” As of December 31, 2002,

there were no conditions or events since these notifications that management

believes would have changed either the Bank or the Savings Bank’s capital

category.

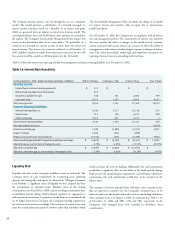

Since early 2001, the Bank and Savings Bank have treated a portion of their

loans as “subprime” under the Subprime Guidelines and have assessed their

capital and allowance for loan losses accordingly. In the second quarter of

2002, the Company adopted a revised application of the Subprime

Guidelines, the result of which was to require more capital and allowance for

loan losses to be held against subprime loans. Under the revised application

of the Subprime Guidelines, the Company has, for purposes of calculating

capital ratios, risk weighted subprime loans in targeted programs at 200%,

rather than the 100% risk weighting applied to loans not in targeted

subprime programs. The company has addressed the additional capital

requirements with available resources. Under the revised application of the

Subprime Guidelines, each of the Bank and Savings Bank exceeds the

requirements for a “well-capitalized” institution as of December 31, 2002.

For purposes of the Subprime Guidelines, the Company has treated as

“subprime” all loans in the Bank’s and the Savings Bank’s targeted subprime

programs to customers either with a FICO score of 660 or below or with no

FICO score. The Bank and the Savings Bank hold on average 200% of the

total risk-based capital charge that would otherwise apply to such assets. This

results in higher levels of regulatory capital at the Bank and the Savings Bank.

As of December 31, 2002, approximately $5.3 billion or 28.0% of the Bank’s,

and $3.8 billion or 32.4% of the Savings Bank’s, on-balance sheet assets were

treated as “subprime” for purposes of the Subprime Guidelines.

In November 2001, the Agencies adopted an amendment to the regulatory

capital standards regarding the treatment of certain recourse obligations,

direct credit substitutes (i.e., guarantees on third-party assets), residual

interests in asset securitizations, and certain other securitized transactions.

Effective January 1, 2002, this rule amended the Agencies’ regulatory capital

standards to create greater differentiation in the capital treatment of residual

interests. On May 17, 2002, the Agencies issued an advisory interpreting the

application of this rule to a residual interest commonly referred to as an

accrued interest receivable (the “AIR Advisory”). The effect of this AIR

Advisory is to require all insured depository institutions, including the Bank

an the Savings Bank, to hold significantly higher levels of regulatory capital

against accrued interest receivables beginning December 31, 2002. The Bank

and the Savings Bank have met this capital requirement and remain well

capitalized as the AIR Advisory became effective as of December 31, 2002.

The Company currently expects to operate each of the Bank and Savings

Bank in the future with a total capital ratio of at least 12%. The Corporation

has a number of alternatives available to meet any additional regulatory

capital needs of the Bank and the Savings Bank, including substantial

liquidity held at the Corporation and available for contribution.

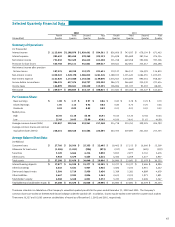

As such amounts amortize or are otherwise paid, the Company believes it can

securitize additional consumer loans, gather deposits, purchase federal funds

and establish other funding sources to fund new loan growth, although no

assurance can be given to that effect. Additionally, the Company maintains a

portfolio of high-quality securities such as U.S. Treasuries and other U.S.

government obligations, commercial paper, interest-bearing deposits with

other banks, federal funds and other cash equivalents in order to provide

adequate liquidity and to meet its ongoing cash needs. As of December 31,

2002, the Company had $5.3 billion of such securities.

Liability liquidity is measured by the Company’s ability to obtain borrowed

funds in the financial markets in adequate amounts and at favorable rates. As

of December 31, 2002, the Company, the Bank and the Savings Bank

collectively had over $2.8 billion in unused commitments under various

credit facilities available for liquidity needs.

Operational Risk

The Company is exposed to numerous types of operational risk. Operational

risk generally refers to the risk of loss resulting from the Company’s

operations, including, but not limited to, the risk of fraud by employees or

persons outside the Company, the execution of unauthorized transactions by

employees, errors relating to transaction processing and systems, and breaches

of the internal control, system and compliance requirements. This risk of loss

also includes the potential legal actions that could arise as a result of the

operational deficiency or as result of noncompliance with applicable

regulatory standards.

The Company operates in a number of different businesses and markets and

places reliance on the ability of its employees and systems to process a high

number of transactions. In the event of a breakdown in the internal control

systems, improper operation of systems or improper employee actions, the

Company could suffer financial loss, face regulatory action and suffer damage

to its reputation. In order to address this risk, management maintains a

system of internal controls with the objective of providing proper transaction

authorization and execution, safeguarding of assets from misuse or theft, and

ensuring the reliability of financial and other data.

The Company maintains systems of control that provide management with

timely and accurate information about the operations of the Company.

These systems have been designed to manage operational risk at appropriate

levels given the Company’s financial strength, the environment in which it

operates, and considering factors such as competition and regulation. The

Company has also established procedures that are designed to ensure that

policies relating to conduct, ethics and business practices are followed on a

uniform basis. Management continually monitors and improves its internal

controls systems and Company-wide processes and procedures to reduce the

likelihood of losses related to operational risk.

CAPITAL ADEQUACY

The Bank and the Savings Bank are subject to capital adequacy guidelines

adopted by the Federal Reserve Board (the “Federal Reserve”) and the Office

of Thrift Supervision (the “OTS”) (collectively, the “regulators”), respectively.

The capital adequacy guidelines and the regulatory framework for prompt