Capital One 2002 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2002 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

33

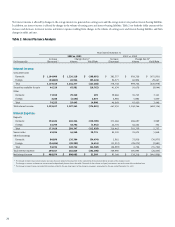

Consumer Lending Segment

The Consumer Lending segment consists primarily of domestic credit card

and installment lending activities. Total Consumer Lending segment loans

increased 27% to $47.3 billion at December 31, 2002, compared to $37.3

billion at December 31, 2001. The achieved loan growth in this segment

reflects the Company’s substantial opportunity to grow loans using IBS.

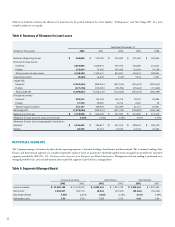

Net charge-offs of Consumer Lending segment loans increased $875.8

million, or 60%, while average Consumer Lending segment loans for the

year ended December 31, 2002 grew 41% compared to the same period in

the prior year. For the year ended December 31, 2002, the Consumer

Lending segment’s net charge-offs as a percentage of average Consumer

Lending segment loans outstanding were 5.54%, compared to 4.87% for the

prior year. This increase was consistent with management’s expectations and

was driven by the seasoning of loans in the portfolio and the relatively lower

loan growth experienced in the second half of 2002.

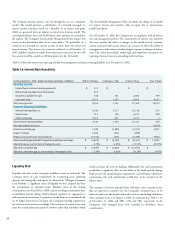

The 30-plus day delinquency rate for the Consumer Lending segment was

5.54% as of December 31, 2002, up 54 basis points from 5.00% as of

December 31, 2001. The increase in delinquencies is due to the seasoning of

the portfolio in addition to the recent downturn in the U.S. economy and

increased unemployment rates.

During the third quarter of 2002, the Company expensed $38.8 million

related to the early termination of leases, unused facility capacity, and

accelerated depreciation of related fixed assets. The Company allocated $35.5

million of these expenses to the Consumer Lending segment.

Auto Finance Segment

The Auto Finance segment consists of automobile lending activities. Total

Auto Finance segment loans outstanding increased 77% to $7.0 billion at

December 31, 2002, compared to $4.0 billion at December 31, 2001. The

increase in auto loans outstanding was the result of expanded organizational

capabilities and increased reliance on proven IBS concepts, which attracted

new dealer-sourced and direct loan volume.

Net charge-offs of Auto Finance segment loans increased $132.9 million, or

154%, while average Auto Finance loans for the year ended December 31,

2002 grew 183%, compared to the same period in the prior year. For the

year ended December 31, 2002, the Auto Finance segment’s net charge-offs

as a percentage of average Auto Finance segment loans outstanding were

3.82% compared to 4.25% for the prior year. The decrease is primarily the

result of improved credit quality on the Company’s average loan portfolio for

2003. The decrease occurred despite deterioration in used car values, which

caused higher loss severity.

The 30-plus day delinquency rate for the Auto Finance segment was 7.15% as

of December 31, 2002, up 156 basis points from 5.59% as of December 31,

2001. The increase in delinquencies was primarily the result of an increase in

higher yielding, lower credit quality loans and higher unemployment.

During the year, the Company sold $1.5 billion of auto loans to multiple

buyers. These transactions resulted in gains of $28.2 million for the Auto

Finance segment. These gains were offset in part by compensation expense of

$14.5 million ($9.0 million after taxes) that was recognized and allocated to

the Auto Finance segment for the accelerated vesting provisions of certain

restricted stock issued in connection with the acquisition of PeopleFirst.

International Segment

The International segment consists of all non-domestic consumer lending

activities. Total International segment loans outstanding increased 34% to

$5.3 billion at December 31, 2002, compared to $4.0 billion at December

31, 2001. The increase in total outstandings was principally the result of the

successful application of its IBS to originate loans in the United Kingdom

and Canada.

Net charge-offs of International segment loans increased $61.3 million, or

53% while average International segment loans for the year ended December

31, 2002 grew 46%, compared to the same period in the prior year. For the

year ended December 31, 2002, the International segment’s net charge-offs

as a percentage of average International segment loans outstanding were

3.76% compared to 3.59% for the prior year. The increase was driven

primarily by greater charge-offs compared to loan growth for the Canadian

market.

The 30-plus day delinquency rate for the International segment was 4.18%

as of December 31, 2002, up 34 basis points from 3.84% as of December

31, 2001. International delinquencies increased primarily as a result of the

seasoning of the Canadian credit portfolio and slower Canadian loan growth.

During 2002, the Company realigned certain aspects of its European

operations. Charges related to the realignment of $12.5 million were

recognized and allocated to the International segment.