Capital One 2002 Annual Report Download

Download and view the complete annual report

Please find the complete 2002 Capital One annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Annual Report 2002

2002

$899.6 million

earnings

2001

$642 million

2000

$469.6 million

1999

$363.1 million

1998

$275.2 million

earnings

Measures of Success

1680 Capital One Drive

McLean, VA 22102

(703) 720-1000

www.capitalone.com

Capital One Financial Corporation 2002 Annual Report

02

Table of contents

-

Page 1

2002 Measures of Success $899.6 million earnings 2001 $642 million 2000 $469.6 million 1999 1998 $363.1 million $275.2 million earnings Capital One Financial Corporation 2002 Annual Report 1680 Capital One Drive McLean, VA 22102 (703) 720-1000 www.capitalone.com 02 Annual Report 2002 -

Page 2

-

Page 3

... growth for Capital One. Headquartered in McLean, Virginia, Capital One Financial Corporation is a holding company operating through three principal subsidiaries: Capital One Bank; Capital One, F.S.B.; and Capital One Auto Finance, Inc. Its common stock trades on the New York Stock Exchange® under... -

Page 4

2002 billion managed loans 59.7 2001 45.3 billion 2000 1999 1998 29.5 billion 20.2 billion billion managed loans 17.4 Nigel Morris President and Chief Operating Officer Richard D. Fairbank Chairman and Chief Executive Officer -

Page 5

... off-balance sheet loans Year-end total managed loans Year-end total accounts (000s) Managed yield Reported yield Managed net interest margin Reported net interest margin Managed delinquency rate (30+ days) Reported delinquency rate (30+ days) Managed net charge-off rate Reported net charge-off rate... -

Page 6

2002 47.4 million total accounts 43.8 million 2001 33.8 million 2000 1999 23.7 million -

Page 7

... products that offer consumers more for their money. Capital One® made its mark years ago by pioneering balance transfer offers for credit card customers. Today our MilesOne® frequent flyer card is a terrific deal. It's redeemable on any airline. There are no blackout dates. The annual fee... -

Page 8

billion auto loans 7 2002 4 billion 1.2 billion auto loans 2001 2000 -

Page 9

... Internet originator of auto loans, Capital One Auto Finance gives superprime borrowers no-hassle service and convenient access to financing, features that are generating exceptionally high levels of customer satisfaction. In the $175 billion installment lending business, we market personal loans... -

Page 10

2002 96% brand awareness 2001 92% 2000 79% brand awareness -

Page 11

... league with the best-known brands in financial services. We've always offered the most innovative products, the best prices and hassle-free service, but Capital One wasn't a household name until we started marketing our brand with the same energy we put into marketing credit cards and loans. Now 96... -

Page 12

5.4 billion in international loans 2002 4 billion 2001 3 billion in international loans 2000 -

Page 13

... businesses in the U.K., Canada, South Africa and France. At year-end, international balances represented 9% of our loan portfolio. After six years in the U.K., we're one of the largest card issuers and one of the top two in terms of account growth, making steady gains in market share. Charge-offs... -

Page 14

Q1-2002 110.7 Consumer Confidence Index Q2-2002 106.3 Q3-2002 93.7 Q4-2002 80.7 Consumer Confidence Index Q1-2002 10403.94 Dow Jones 30 Industrials Q2-2002 9243.26 Q4-2002 8341.63 Q3-2002 Dow Jones 30 Industrials 7591.93 -

Page 15

.... Underwriting standards are rigorous. Credit lines are low. Accounts are closely managed. Conservatism is the hallmark of our accounting practices, and our capital now stands at an all-time high-7.9% of managed assets. While our core business, marketing credit cards to U.S. consumers, is strong... -

Page 16

-

Page 17

...our associates with accolades. But others keep beating us to it. Capital One® is a great place to work. In 2002 we again made the FORTUNE® Most Admired Companies list and the Forbes ® Platinum 400, the magazine's list of the best big companies in America, and Computerworld ® and The Sunday Times... -

Page 18

-

Page 19

... of Financial Condition and Results of Operations Selected Quarterly Financial Data Management's Report on Consolidated Financial Statements and Internal Controls Over Financial Reporting Report of Independent Auditors Consolidated Financial Statements Notes to Consolidated Financial Statements... -

Page 20

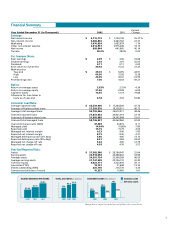

-

Page 21

...Average off-balance sheet loans Average total managed loans Interest income Year-end total managed loans Year-end total accounts (000s) Managed yield Reported yield Managed net interest margin Reported net interest margin Managed delinquency rate Reported delinquency rate Managed net charge-off rate... -

Page 22

... of servicing income on securitized loans, fees (such as annual membership, cash advance, cross-sell, interchange, overlimit and other fee income, collectively "fees") and gains on the securitizations of loans. Loan securitization transactions qualifying as sales under accounting principles... -

Page 23

... application of regulatory guidelines related to subprime loans, as well as an increase in forecasted charge-off rates. Finance Charge and Fee Revenue Recognition Consistent with its practice since the fourth quarter of 1997, as a revenue recognition policy, the Company reduces reported revenue... -

Page 24

... existing and new product opportunities. Salaries and associate beneï¬ts expense increased $368.7 million, or 36%, to $1.4 billion as a direct result of the cost of operations and expansion to manage the growth in the Company's accounts and products offered. In 2001, average accounts grew 39% over... -

Page 25

... Rate Average Balance 2001 Income/ Yield/ Expense Rate Average Balance 2000 Income/ Expense Yield/ Rate Assets: Earning assets Consumer loans(1) Domestic Foreign Total Securities available for sale Other Domestic Foreign Total Total earning assets Cash and due from banks Allowance for loan losses... -

Page 26

...Rate Increase (Decrease) 2001 vs. 2000 Change due to(1) Volume Yield/Rate (In thousands) Interest Income: Consumer loans Domestic Foreign Total Securities available for sale Other Domestic Foreign... Expense: Deposits Domestic Foreign Total Senior notes Other borrowings Domestic Foreign Total Total... -

Page 27

... gains on sale of securities, gains related to the repurchase of senior notes, gains or losses associated with hedging transactions, service provider revenue generated by the Company's medical procedures lending business and income earned related to the reaffirmation of purchased charged-off loan... -

Page 28

.... The effective rate includes both state and federal income tax components. MANAGED CONSUMER LOAN PORTFOLIO The Company's managed consumer loan portfolio is comprised of reported and off-balance sheet loans. Off-balance sheet loans are those which have been securitized and accounted for as sales in... -

Page 29

... amortizing assets, such as auto loans, generally does not include a seller's interest, as obligor principal payments are generally paid to investors on a monthly basis. A securitization accounted for as a sale in accordance with SFAS 140 results in the removal of the receivables, other than... -

Page 30

... investors' share of principal payments is paid into a principal funding account designed to accumulate principal collections so the securities can be paid in full on the expected ï¬nal payment date. LOAN YIELD (%) 18.25 20.46 15.88 15.79 14.64 15.15 2000 2001 2002 MANAGED LOAN YIELD REPORTED... -

Page 31

...a signiï¬cant, immediate impact on managed loan balances; rather they typically consist of lower credit limit accounts and balances that build over time. The terms of these customized card products tend to include membership fees and higher annual ï¬nance charge rates. The proï¬le of the consumer... -

Page 32

... consumer loan delinquency trends for the years presented on a reported and managed basis. The entire balance of an account is contractually delinquent if the minimum payment is not received by the payment due date. Delinquencies not only have the potential to impact earnings if the account charges... -

Page 33

... Guidance for Subprime Lending Programs" ("Subprime Guidelines") issued by the four federal banking agencies); credit evaluations and underwriting policies. NET CHARGE-OFF RATE (%) 5.46 4.56 4.65 4.76 5.24 4.93 2000 MANAGED NET CHARGE-OFF RATE 2001 2002 REPORTED NET CHARGE-OFF RATE For the year... -

Page 34

... REPORTABLE SEGMENTS The Company manages its business by three distinct operating segments: Consumer Lending, Auto Finance and International. The Consumer Lending, Auto Finance and International segments are considered reportable segments based on quantitative thresholds applied to the managed loan... -

Page 35

... of improved credit quality on the Company's average loan portfolio for 2003. The decrease occurred despite deterioration in used car values, which caused higher loss severity. The 30-plus day delinquency rate for the Auto Finance segment was 7.15% as of December 31, 2002, up 156 basis points from... -

Page 36

... three to ï¬ve years. The senior domestic bank note program has original terms of one to ten years. US dollar equivalent based on the USD/Euro exchange rate as of December 31, 2002. Maturity date refers to the date the facility terminates, where applicable. FUNDING ($ in millions) Interest-bearing... -

Page 37

... trading day immediately preceding the stock purchase date at a minimum per share price of $63.91 and a maximum per share price of $78.61. In January 2002, the Corporation issued $300.0 million of ï¬ve-year senior notes with a coupon rate of 8.75%. The Company continues to expand its retail deposit... -

Page 38

... and 2000. Table 12: Short-Term Borrowings Maximum Outstanding as of any Month-End (Dollars in Thousands) Outstanding as of Year-End Average Outstanding Average Year-End Interest Rate Interest Rate 2002: Federal funds purchased and resale agreements Other Total $ 1,741,911 1,418,184 $ 554,887... -

Page 39

... that senior executives are well-informed of credit trends and can make appropriate credit and business decisions for the Company. The Company ensures day-to-day market responsiveness and ï¬,exibility by empowering its business line managers to develop credit strategies and programs aligned with... -

Page 40

... rates rose by over 300 basis points or fell by as much as 140 basis points over the 12 months. The Asset/Liability Management Policy also limits the change in 12-month net interest income and economic value of equity, due to instantaneous parallel rate shocks. As of December 31, 2002, the Company... -

Page 41

...%, rather than the 100% risk weighting applied to loans not in targeted subprime programs. The company has addressed the additional capital requirements with available resources. Under the revised application of the Subprime Guidelines, each of the Bank and Savings Bank exceeds the requirements for... -

Page 42

... and generally requires that banks properly manage several elements of their credit-card lending programs, including line assignments, over-limit practices, minimum payment and negative amortization, workout and settlement programs and the accounting methodology used for various assets and... -

Page 43

... in the credit card industry, as measured by third-party ï¬rms. The Company believes the branded franchise that it is building strengthens and enables its IBS and mass customization strategies across product lines. The Company cautions however, that an increase or decrease in marketing expense or... -

Page 44

... superprime products, auto loans and credit cards in the United Kingdom ("U.K.") are discussed elsewhere. Overall, management expects to grow its prime and superprime assets, across all products and geographies, at an annual rate of 20% to 25%. Our Core Strategy: IBS The Company's core strategy has... -

Page 45

...purchaser to sell subprime auto loans originated via our subprime auto dealer network. These assets are sold at a premium, servicing released, no recourse, and have an additional performance payment in the future depending on asset performance over time. These assets are originated using the Company... -

Page 46

... of new products and services; • any signiï¬cant disruption of, or loss of public conï¬dence in, the U.S. mail system affecting response rates or customer payments; and • other factors listed from time to time in the our SEC reports, including, but not limited to, the Annual Report on Form... -

Page 47

... 0.78 $ 0.75 0.03 0.74 $ 0.70 0.03 0.70 0.66 0.03 Average Balance Sheet Data: (In Millions) Consumer loans Allowance for loan losses Securities Other assets Total assets Interest-bearing deposits Other borrowings Senior and deposit notes Other liabilities Stockholder's equity Total liabilities and... -

Page 48

... 31, 2002, in all material respects, the Company maintained effective internal controls over ï¬nancial reporting. Richard D. Fairbank Chairman and Chief Executive Officer Nigel W. Morris President and Chief Operating Officer David R. Lawson Senior Vice President and Chief Financial Officer 46 -

Page 49

REPORT OF INDEPENDENT AUDITORS The Board of Directors and Stockholders Capital One Financial Corporation We have audited the accompanying consolidated balance sheets of Capital One Financial Corporation as of December 31, 2002 and 2001, and the related consolidated statements of income, changes in ... -

Page 50

... Thousands, Except Per Share Data) 2002 2001 Assets: Cash and due from banks Federal funds sold and resale agreements Interest-bearing deposits at other banks Cash and cash equivalents Securities available for sale Consumer loans Less: Allowance for loan losses Net loans Accounts receivable from... -

Page 51

...Per Share Data) 2002 2001 2000 Interest Income: Consumer loans, including past-due fees Securities available for sale Other Total interest income $ 3,868,664 184,407 127,695 4,180,766 $ 2,729,519 138,188 53,442 2,921,149 $ 2,350,771 96,554 6,574 2,453,899 Interest Expense: Deposits Senior notes... -

Page 52

... Unrealized gains on securities, net of income taxes of $19,510 Foreign currency translation adjustments Other comprehensive income Comprehensive income Cash dividends - $.11 per share Purchase of treasury stock Issuances of common and restricted stock Exercise of stock options Common stock issuable... -

Page 53

...: Provision for loan losses Depreciation and amortization (Accretion) amortization of securities available for sale Gain on sales of securities available for sale Gain on repurchase of senior notes Stock plan compensation expense Increase in interest receivable Increase in accounts receivable from... -

Page 54

...principal subsidiaries are Capital One Bank (the "Bank"), which offers credit card products, Capital One, F.S.B. (the "Savings Bank"), which offers consumer lending (including credit cards) and deposit products, and Capital One Auto Finance, Inc. ("COAF") which offers auto loans. The Corporation and... -

Page 55

...by program members and the current average cost per point of redemption. The cost of these rewards programs is deducted from interchange income. The cost of the rewards programs related to securitized loans is deducted from servicing and securitizations income. Annual membership fees and direct loan... -

Page 56

... policies. The Company charges off credit card loans (net of any collateral) at 180 days past the due date, and generally charges off other consumer loans at 120 days past the due date. Bankrupt consumers' accounts are generally charged-off within 30 days of receipt of the bankruptcy petition... -

Page 57

...Stock Issued to Employees ("APB 25") and related Interpretations in accounting for its stock-based compensation plans. In accordance with APB 25, no compensation cost has been recognized for the Company's ï¬xed stock options, since the exercise price of all such options equals or exceeds the market... -

Page 58

Note B Segments The Company manages its business by three distinct operating segments: Consumer Lending, Auto Finance and International. The Consumer Lending segment primarily consists of domestic credit card and installment lending activities. The Auto Finance segment consists of automobile ... -

Page 59

...) were recognized and allocated to the International segment. During the year, the Company sold $1.5 billion of auto loans to multiple buyers. These transactions resulted in gains of $28.2 million for the Auto Finance segment. These gains were offset in part by compensation expense of $14.5 million... -

Page 60

...(549) (772,402) 145,090 (627,312) 527,000 The $880.0 million increase in allowance for loan losses for the year ended December 31, 2002, reï¬,ects an increase in average reported loans, a rise in net chargeoffs, the revised application of Subprime Guidelines (see Note O), and the $133.4 million one... -

Page 61

... Global Bank Note Program. SENIOR NOTES Bank Notes Senior and Subordinated Global Bank Note Program The Senior and Subordinated Global Bank Note Program gives the Bank the ability to issue securities to both U.S. and non-U.S. lenders and to raise funds in foreign currencies. The Senior and... -

Page 62

... by Capital One Bank (Europe) plc under the Multicurrency Facility. Internationally, the Company has funding programs designed for foreign investors or to raise funds in foreign currencies allowing the Company to borrow from the U.S. and non-U.S. lenders, including foreign currency funding options... -

Page 63

...shares available for future issuance for each of the Company's stock-based compensation plans as of December 31, 2002, 2001 and 2000: Interest-Bearing Deposits Senior Notes 2003 2004 2005 2006 2007 Thereafter Total Other Borrowings Total Available For Issuance Plan Name 2002 Non-Executive Officer... -

Page 64

... estimated at the date of grant using a Black-Scholes option-pricing model with the weighted average assumptions described below: For the Years Ended December 31 Assumptions Dividend yield Volatility factors of expected market price of stock Risk-free interest rate Expected option lives (in years... -

Page 65

... fair market value on the date of grant. The CEO and COO gave up their salaries, annual cash incentives, annual option grants and Senior Executive Retirement Plan contributions for the years 2002 and 2003 in exchange for their EntrepreneurGrant V options. Other members of senior management had the... -

Page 66

...dividend reinvestment and stock purchase plan ("1997 DRP"), which allows participating stockholders to purchase additional shares of the Company's common stock through automatic reinvestment of dividends or optional cash investments. The Company issued 3.0 million and .7 million shares of new common... -

Page 67

... Securities available for sale Other Total deferred tax liabilities Net deferred tax liabilities 57,962 915,953 33,735 53,964 75, 084 624,254 5,453 44,322 Numerator: Net income Denominator: Denominator for basic earnings per shareWeighted-average shares Effect of dilutive securities: Stock options... -

Page 68

... Auto Finance International Balance at December 31, 2001 $ 218,818 139 $ 218,957 $ 5,273 $ 78,326 $ 302,417 1,545 54,874 55,013 1,545 Additions Other Balance at December 31, 2002 $ 6,818 $ 133,200 $ 358,975 Other Total As of December 31 Unrealized gains (losses) on securities Foreign currency... -

Page 69

...%, rather than the 100% risk weighting applied to loans not in targeted subprime programs. The Company has addressed the additional capital requirements with available resources. Under the revised application of the Subprime Guidelines, each of the Bank and the Savings Bank exceeds the requirements... -

Page 70

...Tampa, Florida and Richmond, Virginia. Monthly rent on the facilities is based on a ï¬xed interest rate of 6.87% per annum applied to the cost of the buildings included in the lease of $86.8 million. The Company has two oneyear renewal options under the terms of the lease, which have been exercised... -

Page 71

... the ordinary course of business, executive officers and directors of the Company may have consumer loans issued by the Company. Pursuant to the Company's policy, such loans are issued on the same terms as those prevailing at the time for comparable loans to unrelated persons and do not involve more... -

Page 72

... and interest rate risks on the transferred ï¬nancial assets. The investors and the trusts have no recourse to the Company's assets, other than the retained residual interests, if the off-balance sheet loans are not paid when due. The gain on sale recorded from off-balance sheet securitizations... -

Page 73

... charge-off rates used to determine the fair value of the retained interests. The Company acts as a servicing agent and receives contractual servicing fees of approximately 2% of the investor principal outstanding. The servicing revenues associated with transferred receivables adequately compensate... -

Page 74

... utilized by the Company effectively modify the Company's exposure to interest rate risk by converting ï¬,oating rate debt to a ï¬xed rate over the next ï¬ve years. The agreements involve the receipt of ï¬xed rate amounts in exchange for ï¬,oating rate interest payments over the life of the... -

Page 75

... Cash and cash equivalents The carrying amounts of cash and due from banks, federal funds sold and resale agreements and interest-bearing deposits at other banks approximated fair value. Securities available for sale The fair value of securities available for sale was determined using current market... -

Page 76

... Activities The Company's international activities are primarily performed through Capital One Bank (Europe) plc, a subsidiary bank of the Bank that provides consumer lending and other ï¬nancial products in Europe and Capital One Bank - Canada Branch, a foreign branch office of the Bank that... -

Page 77

... by management, which is maintained on a line of business level through allocations from legal entities. Note W Capital One Financial Corporation (Parent Company Only) Condensed Financial Information December 31 Balance Sheets Assets: Cash and cash equivalents Investment in subsidiaries Loans to... -

Page 78

...used for investing activities Financing Activities: (Decrease) increase in borrowings from subsidiaries Issuance of senior notes Issuance of mandatory convertible securities Dividends paid Purchases of treasury stock Net proceeds from issuances of common stock Proceeds from exercise of stock options... -

Page 79

This page intentionally left blank. -

Page 80

... and Chief Executive Officer Nigel W. Morris Nigel W. Morris President and Chief Operating Officer Capital One Financial Corporation President and Chief Operating Officer Gregor Bailar Executive Vice President and Chief Information Officer W. Ronald Dietz(1)(2) Managing Partner Customer Contact... -

Page 81

... York Stock Exchange Stock Symbol COF Member of S&P 500 Corporate Registrar/Transfer Agent Annual Meeting Thursday, April 24, 2003, 10:00 a.m. Eastern Time Fairview Park Marriott Hotel 3111 Fairview Park Drive Falls Church, VA 22042 EquiServe Trust Company, N.A. c/o EquiServe Share Holder Services...