Audi 2011 Annual Report Download - page 238

Download and view the complete annual report

Please find page 238 of the 2011 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271

|

|

235

Consolidated Financial

Statements

188 Income Statement

189 Statement of Recognized

Income and Expense

190 Balance Sheet

191 Cash Flow Statement

192 Statement of Changes in Equity

Notes to the Consolidated

Financial Statements

194 Development of fixed assets

in the 2011 fiscal year

196 Development of fixed assets

in the 2010 fiscal year

198 General information

204 Recognition and

measurement principles

212 Notes to the Income Statement

218 Notes to the Balance Sheet

227 Additional disclosures

248 Events occurring subsequent

to the balance sheet date

249 Statement of Interests

held by the Audi Group

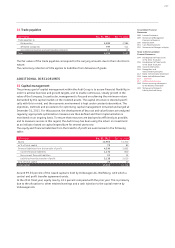

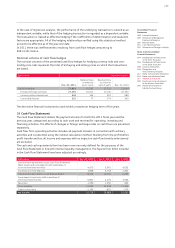

Analysis by maturity date of undiscounted cash used for financial liabilities

The undiscounted, contractually agreed cash used for financial instruments is categorized sepa-

rately by maturity date in the following table:

EUR million Total Residual contractual maturities

Dec. 31, 2011 Up to 1 year 1 to 5 years Over 5 years

Financial liabilities 1,198 1,173 13 12

Trade payables 4,193 4,193 ––

Other financial liabilities and obligations 4,070 4,041 24 –

Derivative financial instruments 28,221 10,422 17,799 –

Total 37,682 19,829 17,836 12

EUR million Total Residual contractual maturities

Dec. 31, 2010 Up to 1 year 1 to 5 years Over 5 years

Financial liabilities 825 810 15 –

Trade payables 3,510 3,510 00

Other financial liabilities and obligations 2,742 2,720 22 –

Derivative financial instruments 21,370 6,310 15,047 13

Total 28,447 13,350 15,084 13

The cash used for derivatives where gross settlement has been agreed is offset by cash received.

These cash receipts are not presented in the analysis by maturity date. Had the cash receipts

also been taken into account, the cash used would have been significantly lower in the analysis

by maturity date.

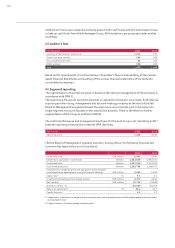

Collateral

The Audi Group recorded financial assets as collateral for liabilities in the amount of

EUR 234 (211) million. This collateral is used by contractual parties primarily as soon

as credit periods for secured liabilities are exceeded.

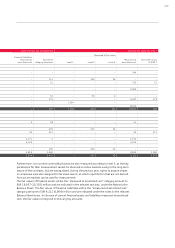

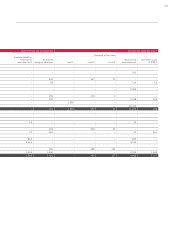

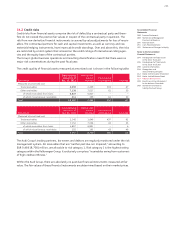

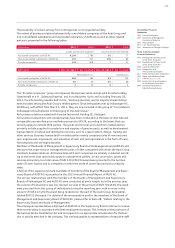

34.4 Market risks

Given the global nature of its operations, the Audi Group is exposed to various market risks, which

are described below. The individual risk types and the respective risk management measures are

also described. Additionally, these risks are quantified by means of sensitivity analyses.

Hedging policy and financial derivatives

The market risks to which the Audi Group is exposed include, in particular, currency, interest

rate, commodity price and fund price risks. As part of the risk management process, these risks

are limited by entering into hedging transactions. All necessary hedging measures are imple-

mented centrally by the Group Treasury of Volkswagen AG, Wolfsburg, or coordinated via the

Group Treasury of AUDI AG. There were no risk concentrations during the past fiscal year.

The market price risks associated with derivative and non-derivative financial instruments pur-

suant to IFRS 7 are calculated in the Audi Group using sensitivity analyses. Changes to the risk

variables within the respective market price risks are used to calculate the impact on equity and

on profit after tax.