Audi 2011 Annual Report Download - page 235

Download and view the complete annual report

Please find page 235 of the 2011 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

232

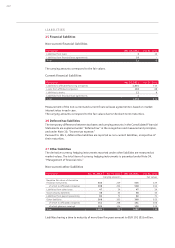

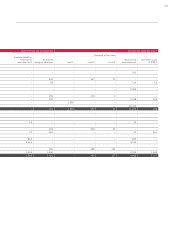

Reconciliation statement for financial instruments measured according to level 3

EUR million 2011 2010

Positive fair values of level 3 derivative financial instruments as of Jan. 1 71 55

Income and expense (–) recognized in the operating profit 34 56

Income and expense (–) recognized in the financial result 3 0

Income and expense (–) recognized in equity 27 4

Reclassification from level 3 to level 2 – 33 – 45

Positive fair values of level 3 derivative financial instruments as of Dec. 31 102 71

Income and expense (–) recognized in the operating profit from

level 3 derivative financial instruments still held at Dec. 31 34 56

Income and expense (–) recognized in the financial result from

level 3 derivative financial instruments still held at Dec. 31 – 1

Negative fair values of level 3 derivative financial instruments as of Jan. 1 – 127 – 224

Income and expense (–) recognized in the operating profit 11 43

Income and expense (–) recognized in the financial result – 17 – 2

Income and expense (–) recognized in equity 6 0

Realizations 83 55

Reclassification from level 3 to level 2 6 2

Negative fair values of level 3 derivative financial instruments as of Dec. 31 – 49 – 127

Income and expense (–) recognized in the operating profit from

level 3 derivative financial instruments still held at Dec. 31 14 43

Income and expense (–) recognized in the financial result from

level 3 derivative financial instruments still held at Dec. 31 11 –

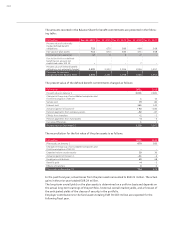

The residual value hedging model is categorically allocated to level 3. The reclassifications from

level 3 to level 2 contain commodity futures for whose measurement it is no longer necessary to

extrapolate the exchange rates because these can now be observed again on the active market.

The effects of changes in the market price of used cars resulting from hedging arrangements are

shown in detail under Note 34.4, “Market risks.”

Risks resulting from fair value fluctuations in the derivative financial instruments measured

according to level 3 are calculated within the Audi Group by means of sensitivity analyses. In this

way, effects of changes in commodity price listings on profit and equity are shown. A 10 percent

rise (fall) in the commodity prices of commodity futures measured according to level 3 at

December 31, 2011 would impact on equity in the amount of EUR 12 (14) million. The effect on

profit of this rise (fall) would be EUR 11 (2) million.

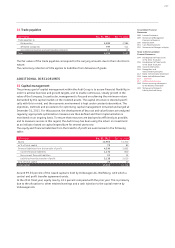

34 Management of financial risks

34.1 Hedging guidelines and principles of financial risk management

The principles and responsibilities involved in managing and controlling risks associated with

financial instruments are stipulated by the Board of Management in accordance with the

Volkswagen Group guidelines and statutory parameters, and monitored by the Supervisory

Board.

Operational risk management is carried out by the Group Treasury, as well as by AUDI AG and

Volkswagen AG, Wolfsburg. The Board of Management and Supervisory Board of AUDI AG are

regularly briefed on the current risk situation. Additionally, the Volkswagen Executive Committee

for Liquidity and Foreign Currency is regularly updated on the current financial risks.

Further details are provided in the Management Report on page 182.