Audi 2011 Annual Report Download - page 226

Download and view the complete annual report

Please find page 226 of the 2011 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

223

Consolidated Financial

Statements

188 Income Statement

189 Statement of Recognized

Income and Expense

190 Balance Sheet

191 Cash Flow Statement

192 Statement of Changes in Equity

Notes to the Consolidated

Financial Statements

194 Development of fixed assets

in the 2011 fiscal year

196 Development of fixed assets

in the 2010 fiscal year

198 General information

204 Recognition and

measurement principles

212 Notes to the Income Statement

218 Notes to the Balance Sheet

222 Liabilities

227 Additional disclosures

248 Events occurring subsequent

to the balance sheet date

249 Statement of Interests

held by the Audi Group

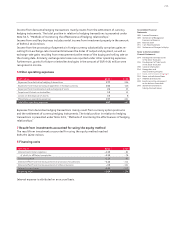

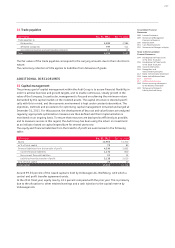

Current other liabilities

EUR million Dec. 31, 2011 Dec. 31, 2010

Liabilities from the transfer of profit 3,138 2,010

of which to affiliated companies 3,138 2,010

Advances received 685 544

of which from affiliated companies 864

of which from associated companies 76 112

Negative fair values of derivative financial instruments 461 291

of which to affiliated companies 435 188

Liabilities from other taxes 131 205

of which to affiliated companies 67 56

Social security liabilities 118 121

Liabilities from payroll accounting 1,104 742

Other liabilities 719 535

of which to affiliated companies 441 340

Total 6,355 4,447

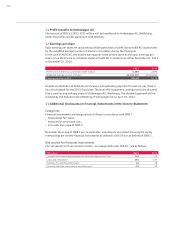

The negative fair values of derivative financial instruments are composed as follows:

EUR million Dec. 31, 2011 Dec. 31, 2010

Cash flow hedges to hedge against

currency risks from future payment streams 871 389

commodity price risks from future payment streams (cash flow hedges) 10 0

Other derivative financial instruments 125 132

Negative fair values of derivative financial instruments 1,005 521

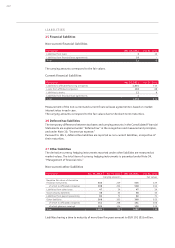

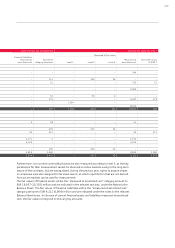

28 Provisions for pensions

Provisions for pensions are created on the basis of plans to provide retirement, disability and

surviving dependant benefits. The benefit amounts are generally contingent on the length of

service and the remuneration of the employees.

Both defined contribution and defined benefit plans exist within the Audi Group for retirement

benefit arrangements. In the case of defined contribution plans, the Company pays contribu-

tions to public or private-sector pension plans on the basis of statutory or contractual require-

ments, or on a voluntary basis. Payment of these contributions releases the Company from any

other benefit obligations. Current contribution payments are reported as an expense for the year

in question. With regard to the Audi Group they total EUR 281 (269) million. Of this, contribu-

tions of EUR 268 (251) million were paid in Germany toward statutory pension insurance.

The retirement benefit systems are based predominantly on defined benefit plans, with a distinc-

tion being made between systems based on provisions and externally financed benefit systems.

The domestic and foreign benefit claims of those with entitlement to a pension from the company

pension scheme are calculated in accordance with IAS 19 (Employee Benefits) on the basis of

the projected unit credit method. This measures future obligations on the basis of the pro rata

benefit entitlements acquired as of the balance sheet date. For purposes of measurement, trend

assumptions are used for the relevant variables affecting the level of benefits.

The retirement benefit scheme within the Audi Group was evolved into a pension fund model in

Germany on January 1, 2001. The retirement benefit commitments for this model are also clas-

sified as defined benefits in accordance with the requirements of IAS 19. The remuneration-

based annual cost of providing employee benefits is invested in mutual funds on a fiduciary

basis by Volkswagen Pension Trust e.V., Wolfsburg. This model offers employees the opportunity

of increasing their pension entitlements, while providing full risk coverage. As the mutual fund

units administered on a fiduciary basis satisfy the requirements of IAS 19 as plan assets, these

funds were offset against the derived retirement benefit obligations.