Audi 2011 Annual Report Download - page 182

Download and view the complete annual report

Please find page 182 of the 2011 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

179

Management Report

134 Audi Group

143 Business and underlying

situation

159 Financial performance

indicators

162 Social and ecological aspects

175 Risks, opportunities

and outlook

175 Risk report

183 Report on post-balance sheet

date events

183 Report on expected

developments

187 Disclaimer

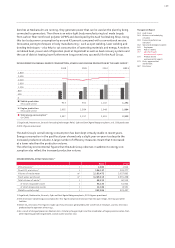

The upturn in the global economy continued in the past fiscal year, although the upswing lost

momentum in the second half, especially in Western Europe. Global demand for cars benefited

from the positive economic trend and reached a new record level in 2011. While Japan and a

number of Western European markets reported lower levels of new registrations, demand for

automobiles particularly in China, Russia and the United States was a key driver of global market

growth.

In particular the emerging Asian and Latin American car markets are likely to continue posting

high growth rates in the next few years, whereas a downturn in demand for passenger cars is

expected in Western Europe in 2012. However, new risks could fundamentally arise as a result of

changing framework conditions, such as increased customs, tax and trade barriers.

Extensive risk early-warning indicators are used and the market is continually monitored so as to

plan production in accordance with demand and also adjust it at short notice to fluctuations in

demand. The ability to transfer production between the various locations under the production

turntable principle and the effective use of timebanking also bring increased flexibility.

The continual monitoring of all relevant commodity markets is an important activity for the Audi

Group, because this helps to secure adequate supplies of production materials while simulta-

neously minimizing the cost risks and paving the way for comprehensive hedging strategies.

Oil price movements present a further risk for a carmaker such as the Audi Group. A permanent

rise in the price not only leads to increased energy and production costs, but also pushes up fuel

prices and therefore ultimately makes customers more reluctant to buy cars. The Audi Group

aims to respond to growing calls for efficiency by swiftly developing and introducing fuel economy

technologies for conventional combustion engines. For example, the Audi brand already has a

comprehensive product range featuring high-efficiency, progressive vehicle concepts that use

technologies from the modular efficiency platform. Meanwhile, alternative forms of drive such

as hybrid and electric vehicles are a central component of the Company’s strategy of diversified

drive principles.

The continuing internationalization of the Audi Group is resulting in increased revenue denomi-

nated in foreign currency. The growing volatility of currency markets, exacerbated in particular

by sovereign debt crises in various countries, is creating risks that are difficult to anticipate and

could adversely affect the profit performance of the Audi Group. Movements in the U.S. dollar,

the Japanese yen, the pound sterling and the Chinese renminbi against the euro are of particular

significance for the Audi Group. To counter the potential risks, the Company employs appropriate

hedging instruments to an economically reasonable extent and in close, continuous consultation

with the Volkswagen Group.

Finally, events that cannot be anticipated such as political intervention in the economy, terror

attacks, escalating political conflicts, natural disasters and emerging pandemics can adversely

affect economic activity and the international financial and capital markets. These could also

have a detrimental effect on the Audi Group’s business performance. The Company restricts such

risks by preparing emergency plans or, where appropriate, by taking out adequate insurance

cover.

Industry risks

The increasingly volatile and varied development of car markets worldwide, rising technological

demands and ever tougher efficiency requirements are creating a more demanding environment

for the entire automotive industry.