Audi 2011 Annual Report Download - page 208

Download and view the complete annual report

Please find page 208 of the 2011 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

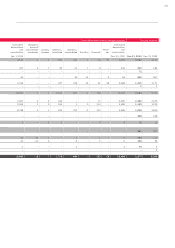

205

Consolidated Financial

Statements

188 Income Statement

189 Statement of Recognized

Income and Expense

190 Balance Sheet

191 Cash Flow Statement

192 Statement of Changes in Equity

Notes to the Consolidated

Financial Statements

194 Development of fixed assets

in the 2011 fiscal year

196 Development of fixed assets

in the 2010 fiscal year

198 General information

204 Recognition and

measurement principles

204 Recognition of income

and expenses

204 Intangible assets

205 Property, plant

and equipment

205 Investment property

206 Investments accounted for

using the equity method

206 Impairment tests

206 Financial instruments

209 Other receivables and

financial assets

209 Deferred tax

209 Inventories

210 Securities, cash and

cash equivalents

210 Provisions for pensions

210 Other provisions

210 Liabilities

210 Management’s estimates

and assessments

212 Notes to the Income Statement

218 Notes to the Balance Sheet

227 Additional disclosures

248 Events occurring subsequent

to the balance sheet date

249 Statement of Interests

held by the Audi Group

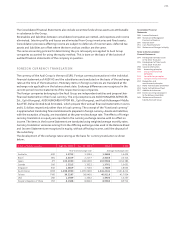

PROPERTY, PLANT AND EQUIPMENT

Property, plant and equipment are measured at acquisition cost or cost of construction, with

scheduled straight-line depreciation applied pro rata temporis over the expected useful life.

The costs of purchase include the purchase price, ancillary costs and cost reductions. Investment

subsidies are as a general rule deducted from the acquisition cost or cost of construction.

In the case of self-constructed fixed assets, the cost of construction includes both the directly

attributable cost of materials and cost of labor as well as indirect materials and indirect labor,

which must be capitalized, together with pro rata depreciation. No interest was capitalized in

relation to borrowing costs due to the fact that there were no significant borrowings as defined

in the criteria of IAS 23 given that the Audi Group maintains sufficient levels of net liquidity at

all times. The depreciation plan is generally based on the following useful lives, which are re-

assessed yearly:

Useful life

Buildings 14–50 years

Land improvements 10–33 years

Plant and machinery 6–12 years

Plant and office equipment including special tools 3–15 years

In accordance with IAS 17, property, plant and equipment used on the basis of lease agreements

is capitalized in the Balance Sheet if the conditions of a finance lease are met (in other words, if

the significant risks and opportunities which result from its use have passed to the lessee). Capi-

talization is performed at the time of the agreement, at the lower of fair value or present value

of the minimum lease payments. The straight-line depreciation method is based on the shorter

of economic life or term of lease contract. The payment obligations resulting from the future

lease installments are recognized as a liability at the present value of the leasing installments.

Where Group companies have entered into operating leases as the lessee, in other words if not

all risks and opportunities associated with title have passed to them, leasing installments and

rents are expensed directly in the Income Statement.

INVESTMENT PROPERTY

Investment property comprises real estate held as a financial investment and vehicles leased as

part of operating lease agreements with a contractual term of more than one year.

Real estate held as investment property is reported in the Balance Sheet at amortized cost.

Buildings are depreciated on a straight-line basis over a useful life of 33 years.

Leased vehicles, in the case of operating lease agreements, are capitalized at cost of sales and

depreciated to the calculated residual value on a straight-line basis over the contractual term.

Unscheduled reductions for impairment and adjustments to depreciation rates are made to take

account of impairment losses calculated on the basis of impairment testing pursuant to IAS 36.

Based on local factors and historical values from used car marketing, updated internal and ex-

ternal information on residual value developments is incorporated into the residual value fore-

casts on an ongoing basis.