Audi 2011 Annual Report Download - page 229

Download and view the complete annual report

Please find page 229 of the 2011 Audi annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.-

1

1 -

2

2 -

3

3 -

4

4 -

5

5 -

6

6 -

7

7 -

8

8 -

9

9 -

10

10 -

11

11 -

12

12 -

13

13 -

14

14 -

15

15 -

16

16 -

17

17 -

18

18 -

19

19 -

20

20 -

21

21 -

22

22 -

23

23 -

24

24 -

25

25 -

26

26 -

27

27 -

28

28 -

29

29 -

30

30 -

31

31 -

32

32 -

33

33 -

34

34 -

35

35 -

36

36 -

37

37 -

38

38 -

39

39 -

40

40 -

41

41 -

42

42 -

43

43 -

44

44 -

45

45 -

46

46 -

47

47 -

48

48 -

49

49 -

50

50 -

51

51 -

52

52 -

53

53 -

54

54 -

55

55 -

56

56 -

57

57 -

58

58 -

59

59 -

60

60 -

61

61 -

62

62 -

63

63 -

64

64 -

65

65 -

66

66 -

67

67 -

68

68 -

69

69 -

70

70 -

71

71 -

72

72 -

73

73 -

74

74 -

75

75 -

76

76 -

77

77 -

78

78 -

79

79 -

80

80 -

81

81 -

82

82 -

83

83 -

84

84 -

85

85 -

86

86 -

87

87 -

88

88 -

89

89 -

90

90 -

91

91 -

92

92 -

93

93 -

94

94 -

95

95 -

96

96 -

97

97 -

98

98 -

99

99 -

100

100 -

101

101 -

102

102 -

103

103 -

104

104 -

105

105 -

106

106 -

107

107 -

108

108 -

109

109 -

110

110 -

111

111 -

112

112 -

113

113 -

114

114 -

115

115 -

116

116 -

117

117 -

118

118 -

119

119 -

120

120 -

121

121 -

122

122 -

123

123 -

124

124 -

125

125 -

126

126 -

127

127 -

128

128 -

129

129 -

130

130 -

131

131 -

132

132 -

133

133 -

134

134 -

135

135 -

136

136 -

137

137 -

138

138 -

139

139 -

140

140 -

141

141 -

142

142 -

143

143 -

144

144 -

145

145 -

146

146 -

147

147 -

148

148 -

149

149 -

150

150 -

151

151 -

152

152 -

153

153 -

154

154 -

155

155 -

156

156 -

157

157 -

158

158 -

159

159 -

160

160 -

161

161 -

162

162 -

163

163 -

164

164 -

165

165 -

166

166 -

167

167 -

168

168 -

169

169 -

170

170 -

171

171 -

172

172 -

173

173 -

174

174 -

175

175 -

176

176 -

177

177 -

178

178 -

179

179 -

180

180 -

181

181 -

182

182 -

183

183 -

184

184 -

185

185 -

186

186 -

187

187 -

188

188 -

189

189 -

190

190 -

191

191 -

192

192 -

193

193 -

194

194 -

195

195 -

196

196 -

197

197 -

198

198 -

199

199 -

200

200 -

201

201 -

202

202 -

203

203 -

204

204 -

205

205 -

206

206 -

207

207 -

208

208 -

209

209 -

210

210 -

211

211 -

212

212 -

213

213 -

214

214 -

215

215 -

216

216 -

217

217 -

218

218 -

219

219 -

220

220 -

221

221 -

222

222 -

223

223 -

224

224 -

225

225 -

226

226 -

227

227 -

228

228 -

229

229 -

230

230 -

231

231 -

232

232 -

233

233 -

234

234 -

235

235 -

236

236 -

237

237 -

238

238 -

239

239 -

240

240 -

241

241 -

242

242 -

243

243 -

244

244 -

245

245 -

246

246 -

247

247 -

248

248 -

249

249 -

250

250 -

251

251 -

252

252 -

253

253 -

254

254 -

255

255 -

256

256 -

257

257 -

258

258 -

259

259 -

260

260 -

261

261 -

262

262 -

263

263 -

264

264 -

265

265 -

266

266 -

267

267 -

268

268 -

269

269 -

270

270 -

271

271

|

|

226

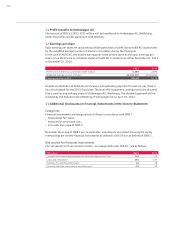

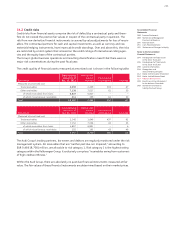

In detail, the calculation of the retirement benefit obligation for staff employed in Germany is

based on the following actuarial assumptions:

% Dec. 31, 2011 Dec. 31, 2010

Remuneration trend 2.80 2.70

Retirement benefit trend 1.60 1.60

Discount rate 4.60 4.90

Staff turnover rate 1.00 1.00

Anticipated yield on plan assets 3.75 4.25

The “2005 G Reference Tables” published by HEUBECK-RICHTTAFELN-GmbH, Cologne, served as

the biometric basis for calculation of retirement benefits.

29 Effective income tax obligations

Effective income tax obligations consist primarily of tax liabilities to Volkswagen AG, Wolfsburg,

under allocation plans.

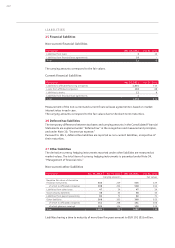

30 Other provisions

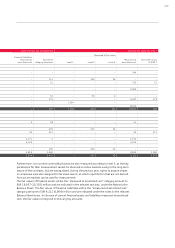

EUR million Dec. 31, 2011 Dec. 31, 2010

Total

Of which

due within

one year Total

Of which

due within

one year

Obligations from sales operations 5,020 1,806 4,651 1,459

Workforce-related provisions 937 249 570 194

Other provisions 1,135 802 901 702

Total 7,092 2,858 6,122 2,354

Obligations from sales operations primarily comprise warranty claims from the sale of vehicles,

components and genuine parts, including the disposal of end-of-life vehicles. Warranty claims

are determined on the basis of previous or estimated future loss experience. This item addition-

ally includes rebates, bonuses and similar discounts due to be granted and arising subsequent to

the balance sheet date but occasioned by revenue prior to the balance sheet date.

The workforce-related provisions are created for such purposes as service anniversary awards,

partial early retirement arrangements and proposals for improvements. The refund claims against

the German Federal Employment Agency as part of implementation of the partial early retirement

model are reported under other assets (Note 19, “Other receivables and other financial assets”).

The other provisions relate to various one-off obligations.

Anticipated outflows from other provisions are 40 percent in the following year, 50 percent in

the years 2013 through 2016 and 10 percent thereafter.

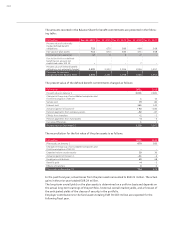

The provisions developed as follows:

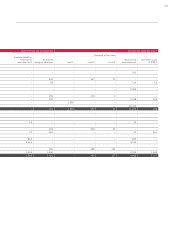

EUR million Jan. 1, 2011

Currency

differences

Changes in

the group of

consolidated

companies

Utili-

zation

Disso-

lution

Addi-

tion

Interest

effect from

measure-

ment Dec. 31, 2011

Obligations from

sales operations 4,651 31 41,425 117 1,846 30 5,020

Workforce-related

provisions 570 1 0 146 21 531 2 937

Other provisions 901 6 0 113 140 479 2 1,135

Total 6,122 37 51,683 278 2,856 33 7,092