Aflac 2006 Annual Report Download - page 9

Download and view the complete annual report

Please find page 9 of the 2006 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Total Assets

(In billions)

Aflac’s total assets reached

$59.8 billion, reflecting solid

growth in investments and cash.

97 98 99 00 01 02 03 04 05 06

2 9.5 31.2

37.0 37.2 37.9

45.1

51.0

59.3

56.4

$59.8

Japan U.S.

designed our ads in the last two years to

convey a message that gives people a better

sense of how our insurance works while still

entertaining consumers. Our research

suggests that message is resonating with

business owners and their employees.

Employers in the United States today face

the challenge of balancing a desire to offer

adequate medical coverage to employees

with a need to manage expenses. Employers

often find that a difficult task. We frequently

see newspaper articles that suggest

employers are forced to shift costs to their

workers, which often results in higher

deductibles or copayments, or lower

benefits. There are literally millions of U.S.

businesses facing that dilemma. As a greater

portion of the health care burden is

transferred to employees, we believe our

products become more relevant as a means

of mitigating that risk. And we also believe

that trend will lead more employers and

workers to view Aflac as a solution.

I am very pleased with our U.S. operation,

and I am convinced that we have been doing

all of the right things to lay the groundwork

for continued growth in the future. Over the

last several years, our U.S. business has had

quite a makeover, and I believe these

changes sparked the momentum we’ve

generated. We’ve expanded our sales

management infrastructure and

strengthened our distribution system by

providing better training. We’ve created new

products and introduced a new branding

message. We’re using technology to leverage

our resources to respond to our agents’ and

customers’ needs. And we believe we will

continue to find ways to tap into even more

of the vast potential of the U.S. market.

Aflac – Preparing for

Growth in 2007 and Beyond

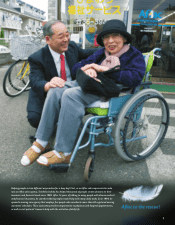

Even though the Japanese and U.S.

insurance markets are fundamentally

different and half a world apart, they both

share a common opportunity for growth.

With ever rising out-of-pocket expenses for

health care, both markets are very well

suited to the products we offer. Each market

has millions of potential customers who can

benefit from our coverage. And each has

tens of thousands of sales associates who are

dedicated to coming to the rescue when a

life-changing event turns a policyholder into

a claimant.

From a financial standpoint, we have a

strong balance sheet from which to grow.

Our investment portfolio is in excellent

shape. We’ve maintained high capital

adequacy ratios to support our ratings, and

we’re very comfortable with our capital

position. We’re also generating strong cash

flows that we can use to benefit our

shareholders in the form of cash dividends

and share repurchase. And we believe we are

in a very good position to achieve our

internal performance objective for earnings

per share growth in 2007.

Daniel P. Amos

Chairman and

Chief Executive Officer

5