Aflac 2006 Annual Report Download - page 45

Download and view the complete annual report

Please find page 45 of the 2006 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

41

Benefit Plans

Aflac U.S. and Aflac Japan have various benefit plans. For

additional information on our U.S. and Japanese plans, see

Note 12 of the Notes to the Consolidated Financial

Statements.

Policyholder Protection Fund

The Japanese insurance industry has a policyholder protection

system that provides funds for the policyholders of insolvent

insurers. In 2002, the members of the Life Insurance

Policyholder Protection Corporation (LIPPC) approved the

Financial Services Agency’s proposal, which increased the

industry’s obligation to the policyholder protection fund. In

2005, legislation was enacted extending the LIPPC framework,

which included government fiscal measures supporting the

LIPPC through March 2009. These new measures do not

contemplate additional industry assessments through March

2009 absent an event requiring LIPPC funds. The likelihood

and timing of future assessments, if any, cannot be

determined at this time.

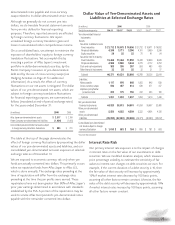

Hedging Activities

Aflac has limited hedging activities. Our primary exposure to

be hedged is our investment in Aflac Japan, which is affected

by changes in the yen/dollar exchange rate. To mitigate this

exposure, we have taken the following courses of action. First,

Aflac Japan owns dollar-denominated securities, which serve

as an economic currency hedge of a portion of our

investment in Aflac Japan. Second, we have designated the

Parent Company’s yen-denominated liabilities (Samurai and

Uridashi notes payable and cross-currency swaps) as a hedge

of our investment in Aflac Japan. If the total of these yen-

denominated liabilities is equal to or less than our net

investment in Aflac Japan, the hedge is deemed to be

effective and the related exchange effect is reported in the

unrealized foreign currency component of other

comprehensive income. Should these yen-denominated

liabilities exceed our investment in Aflac Japan, the portion of

the hedge that exceeds our investment in Aflac Japan would

be deemed ineffective. As required by SFAS No. 133, we

would then recognize the foreign exchange effect on the

ineffective portion in net earnings (other income). We

estimate that if the ineffective portion was ¥10 billion, we

would report a foreign exchange gain/loss of approximately

$1 million for every one yen weakening/strengthening in the

end-of-period yen/dollar exchange rate. At December 31,

2006, our hedge was effective with yen-denominated assets

exceeding yen-denominated liabilities by ¥105.4 billion,

compared with ¥92.3 billion at December 31, 2005.

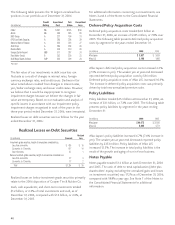

During the third quarter of 2006, we entered into interest rate

swap agreements related to the ¥20 billion variable interest

rate Uridashi notes. By entering into these contracts, we have

been able to lock in our interest rate at 1.52% in yen. We have

designated these interest rate swaps as a hedge of the

variability in our interest cash flows associated with the

variable interest rate Uridashi notes. The notional amounts

and terms of the swaps match the principal amount and terms

of the variable interest rate Uridashi notes, and the swaps had

no value at inception. Changes in the fair value of the swap

contracts are recorded in other comprehensive income. The

fair value of these swaps and related changes in fair value were

immaterial during the year ended December 31, 2006.

Off-Balance Sheet Arrangements

As of December 31, 2006, we had no material unconditional

purchase obligations that were not recorded on the balance

sheet. Additionally, we had no material letters of credit,

standby letters of credit, guarantees or standby repurchase

obligations.

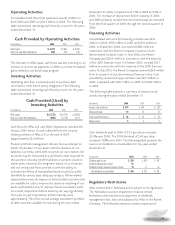

CAPITAL RESOURCES AND LIQUIDITY

Aflac provides the primary sources of liquidity to the Parent

Company through dividends and management fees. Aflac

declared dividends to the Parent Company in the amount of

$665 million in 2006, compared with $526 million in 2005

and $643 million in 2004. During 2006, Aflac paid $68 million

to the Parent Company for management fees, compared with

$73 million in 2005 and $33 million in 2004. The increase in

management fees in 2005 resulted from a change in the

allocation of expenses under the management fee agreement

between Aflac and the Parent Company. The primary uses of

cash by the Parent Company are shareholder dividends and

our share repurchase program. The Parent Company’s sources

and uses of cash are reasonably predictable and are not

expected to change materially in the future.

The Parent Company also accesses debt security markets to

provide additional sources of capital. Capital is primarily used

to fund business expansion and capital expenditures. In 2003,

we filed a Shelf Registration Statement (SRS) with Japanese

regulatory authorities to issue up to ¥100 billion of Samurai

notes in Japan. In July 2005, we issued ¥40 billion

(approximately $360 million) of these securities with a coupon

of .71% and a five-year maturity. These securities are not

available to U.S. persons. The remaining ¥60 billion of the

2003 SRS expired in December 2005. As a result, we filed a

new SRS with Japanese regulatory authorities in February

2006 to issue up to ¥100 billion (approximately $840 million

using the December 31, 2006, exchange rate) of Samurai