Aflac 2006 Annual Report Download - page 28

Download and view the complete annual report

Please find page 28 of the 2006 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

24

FORWARD-LOOKING INFORMATION

The Private Securities Litigation Reform Act of 1995 provides

a “safe harbor” to encourage companies to provide

prospective information, so long as those informational

statements are identified as forward-looking and are

accompanied by meaningful cautionary statements identifying

important factors that could cause actual results to differ

materially from those included in the forward-looking

statements. We desire to take advantage of these provisions.

This report contains cautionary statements identifying

important factors that could cause actual results to differ

materially from those projected herein, and in any other

statements made by Company officials in communications

with the financial community and contained in documents

filed with the Securities and Exchange Commission (SEC).

Forward-looking statements are not based on historical

information and relate to future operations, strategies,

financial results or other developments. Furthermore, forward-

looking information is subject to numerous assumptions, risks,

and uncertainties. In particular, statements containing words

such as “expect,” “anticipate,” “believe,” “goal,” “objective,”

“may,” “should,” “estimate,” “intends,” “projects,” “will,”

“assumes,” “potential,” “target,” or similar words as well as

specific projections of future results, generally qualify as

forward-looking. Aflac undertakes no obligation to update

such forward-looking statements.

We caution readers that the following factors, in addition to

other factors mentioned from time to time, could cause actual

results to differ materially from those contemplated by the

forward-looking statements:

•legislative and regulatory developments

•assessments for insurance company insolvencies

•competitive conditions in the United States and Japan

•new product development and customer response to new

products and new marketing initiatives

•ability to attract and retain qualified sales associates and

employees

•ability to repatriate profits from Japan

•changes in U.S. and/or Japanese tax laws or accounting

requirements

•credit and other risks associated with Aflac’s investment

activities

•significant changes in investment yield rates

•fluctuations in foreign currency exchange rates

•deviations in actual experience from pricing and reserving

assumptions including, but not limited to, morbidity,

mortality, persistency, expenses, and investment yields

•level and outcome of litigation

•downgrades in the Company’s credit rating

•changes in rating agency policies or practices

•subsidiary’s ability to pay dividends to the Parent Company

•ineffectiveness of hedging strategies

•catastrophic events

•general economic conditions in the United States and Japan

COMPANY OVERVIEW

Aflac Incorporated (the Parent Company) and its subsidiaries

(the Company) primarily sell supplemental health and life

insurance in the United States and Japan. The Company’s

insurance business is marketed and administered through

American Family Life Assurance Company of Columbus

(Aflac), which operates in the United States (Aflac U.S.) and as

a branch in Japan (Aflac Japan). Most of Aflac’s policies are

individually underwritten and marketed through independent

agents. Our insurance operations in the United States and our

branch in Japan service the two markets for our insurance

business.

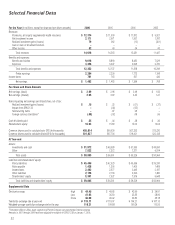

Management’s Discussion and Analysis of Financial Condition

and Results of Operations (MD&A) is intended to inform the

reader about matters affecting the financial condition and

results of operations of Aflac Incorporated and its subsidiaries

for the three-year period ended December 31, 2006. As a

result, the following discussion should be read in conjunction

with the related consolidated financial statements and notes.

This MD&A is divided into four primary sections. In the first

section, we discuss our critical accounting estimates. We then

follow with a discussion of the results of our operations on a

consolidated basis and by segment. The third section presents

an analysis of our financial condition as well as a discussion of

market risks of financial instruments. We conclude by

addressing the availability of capital and the sources and uses

of cash in the Capital Resources and Liquidity section.

CRITICAL ACCOUNTING ESTIMATES

We prepare our financial statements in accordance with U.S.

generally accepted accounting principles (GAAP). The

preparation of financial statements in conformity with GAAP

requires us to make estimates based on currently available

information when recording transactions resulting from

Management’s Discussion and Analysis of Financial Condition

and Results of Operations