Aflac 2006 Annual Report Download - page 16

Download and view the complete annual report

Please find page 16 of the 2006 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

Aflac Japan

Sales Results

Despite weaker than expected

sales in 2006, annualized

premiums in force rose 5.4%.

Empowering Our

Sales Force for Action

We continued to build on our multi-faceted

distribution system in 2006. Our broad sales

network includes affiliated corporate

agencies, independent corporate agencies

and individual agencies. In 2006, we

recruited about 3,400 new sales agencies. At

the end of the year, Aflac Japan was

represented by more than 18,400 sales

agencies, including more than 90,000

licensed sales associates.

Sales through our affiliated corporate agency

channel have slowed for several years due to

changed employment patterns and

consumers’ desire for consultation on how

the products meet their specific needs.

However, we still consider the affiliated

corporate channel an important part of our

distribution system and believe it is a

valuable means for reaching workers at large

employers. To rejuvenate this channel, we

are encouraging our affiliated agencies to

move away from passive, or “pull” sales

tactics, like direct mailings and newspaper

ads, and instead adopt active, or “push”

techniques that involve more follow-up calls

and face-to-face sales consultations.

To improve the overall effectiveness of our

sales force, we started a new training

initiative. This new training program uses six

months of classroom training and practical

field training to equip sales associates with

the skills necessary for their success. By the

end of 2006, we had trained more than 700

of Aflac Japan’s field employees, who in

turn, are now positioned to train primarily

newly recruited sales associates.

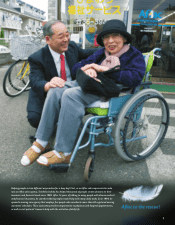

Aflac Service Shops, which are primarily

owned and operated by individual sales

agencies, are gaining in popularity as many

consumers in Japan seek one-on-one

consultation and convenience in handling

their insurance needs. By the end of 2006,

we had 570 Aflac Service Shops throughout

Japan.

We also continued to reach consumers

through our strategic marketing alliance with

Dai-ichi Mutual Life. We believe our alliance

has been one of the most successful

partnerships in the insurance industry. In

2006, Dai-ichi Life sold nearly 270,000 of

our market leading cancer life policies,

enabling Dai-ichi Life to retain its distinction

as the number two seller of cancer insurance

behind only Aflac Japan.

We expect that our distribution will

continue to evolve in Japan, especially with

the prospects for expanding our business

when the bank distribution channel opens

up for our type of products, which is

scheduled for the end of December 2007.

Although there will undoubtedly be a lot of

competition for bank distribution, we have

established long-term relationships with

many banks throughout Japan, and we’re

excited about the opportunity to grow our

business through this channel beginning

in 2008.

Technology Creates

Efficiencies of Heroic Proportion

Technology has been a key component of

Aflac Japan’s most noteworthy competitive

strength – administrative efficiency. Our

maintenance expenses per policy in force

are significantly lower than every other life

insurance company in Japan, allowing us to

12

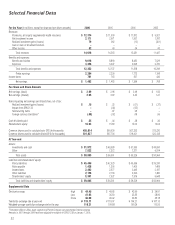

Policies Annualized Total New Total

and Riders Premiums Annualized Number of

In Force* In Force** Premiums** Agencies

2006 27,334 ¥1,083,127 ¥117,455 18,432

2005 26,014 1,027,762 128,784 17,960

2004 24,477 961,895 122,525 16,410

2003 23,097 900,251 121,170 14,643

2002 21,867 834,424 108,320 12,056

2001 20,802 782,249 91,865 9,839

2000 19,674 740,445 99,755 8,938

1999 18,510 696,622 87,043 8,283

1998 16,963 640,796 75,425 7,010

1997 15,800 597,823 62,884 5,427

*In thousands **In millions