Aflac 2006 Annual Report Download - page 74

Download and view the complete annual report

Please find page 74 of the 2006 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

70

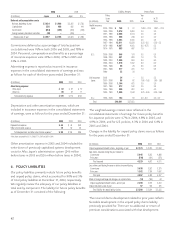

We base the long-term rate of return on U.S. plan assets on

the historical rates of return over the last 15 years and the

expectation of similar returns over the long-term investment

goals and objectives of U.S. plan assets. We base the long-term

rate of return on the Japanese plan assets on the historical

rates of return over the last 10 years.

In addition to the benefit obligations for funded employee

plans, we also maintain unfunded supplemental retirement

plans for certain officers and beneficiaries. Retirement expense

for these unfunded supplemental plans was $16 million in

2006, $20 million in 2005, and $32 million in 2004. The

accrued retirement liability for the unfunded supplemental

retirement plans was $209 million at December 31, 2006,

compared with $203 million a year ago. The assumptions used

in the valuation of these plans were the same as for the

funded plans.

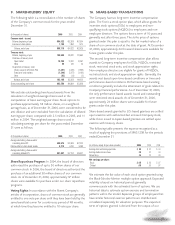

Stock Bonus Plan: Aflac U.S. maintains a stock bonus plan for

eligible U.S. sales associates. Plan participants receive shares of

Aflac Incorporated common stock based on their new

annualized premium sales and their first-year persistency of

substantially all new insurance policies. The cost of this plan,

which is included in deferred policy acquisition costs,

amounted to $40 million in 2006, $37 million in 2005, and

$35 million in 2004.

13. COMMITMENTS AND CONTINGENT

LIABILITIES

We have entered into two outsourcing agreements with IBM

to provide mainframe computer operations and support for

Aflac Japan. The first agreement that began in 2006 has a

remaining term of nine years and an aggregate remaining cost

of ¥26.0 billion ($218 million using the December 31, 2006,

exchange rate). The second agreement begins in 2007 with a

term of nine years and an aggregate cost of ¥31.8 billion ($267

million using the December 31, 2006, exchange rate).

We have also entered into an outsourcing agreement with

Accenture to provide application maintenance and

development services for our Japanese operation. The

agreement has a term of seven years with an aggregate cost

of ¥5.3 billion ($45 million using the December 31, 2006,

exchange rate).

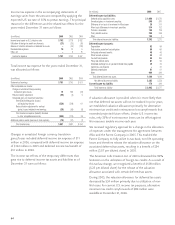

We lease office space and equipment under various

agreements that expire in various years through 2021. Future

minimum lease payments due under non-cancelable operating

leases at December 31, 2006, were as follows:

(In millions)

2007 $ 42

2008 24

2009 12

2010 10

2011 9

Thereafter 46

Total future minimum lease payments $ 143

In 2005, we announced a multiyear building project for

additional office space in Columbus, Georgia. The initial phase

is to be completed in mid-2007 and is expected to cost

approximately $26 million. The next phase of the expansion is

anticipated to begin in mid-2007.

We are a defendant in various lawsuits considered to be in the

normal course of business. Senior legal and financial

management review litigation on a quarterly and annual basis.

The final results of any litigation cannot be predicted with

certainty. Although some of this litigation is pending in states

where large punitive damages bearing little relation to the

actual damages sustained by plaintiffs have been awarded in

recent years, we believe the outcome of pending litigation will

not have a material adverse effect on our financial position,

results of operations, or cash flows.

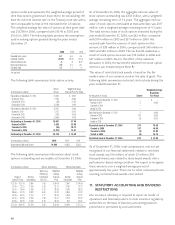

14. SUPPLEMENTARY INFORMATION

(In millions) 2006 2005 2004

Supplemental disclosures of

cash flow information:

Income taxes paid $ 569 $ 360 $ 160

Interest paid 15 21 22

Impairment losses included in realized investment

gains (losses) 1–1

Noncash financing activities:

Capitalized lease obligations 946

Dividends declared 91 ––

Treasury shares issued to AFL Stock Plan for:

Associate stock bonus 35 33 32

Shareholder dividend reinvestment 15 11 10