Aflac 2006 Annual Report Download - page 35

Download and view the complete annual report

Please find page 35 of the 2006 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

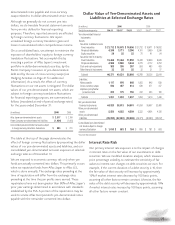

currency basis, dollar-denominated investment income

accounted for approximately 36% of Aflac Japan’s investment

income during 2006, compared with 32% in both 2005 and

2004. The following table illustrates the effect of translating

Aflac Japan’s dollar-denominated investment income and

related items into yen by comparing certain segment results

with those that would have been reported had yen/dollar

exchange rates remained unchanged from the prior year.

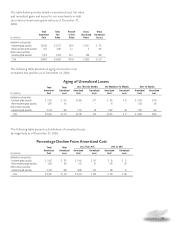

The following table presents a summary of operating ratios

for Aflac Japan.

The benefit ratio has declined over the past several years,

reflecting the impact of newer products with lower loss ratios.

We have also experienced favorable claim trends in our major

product lines. We expect the benefit ratio to continue to

decline in future years primarily reflecting the shift to newer

products and riders. However, this decline is partially offset by

the effect of low investment yields, which impacts our profit

margin by reducing the spread between investment yields and

required interest on policy reserves (see table and discussion

on Page 36). The operating expense ratio was higher in 2005

as a result of additional advertising expenditures and the

write-off of previously capitalized systems development costs.

We expect the operating expense ratio to be relatively stable

in 2007. Due to improvement in the benefit ratio, the pretax

operating profit margin expanded to 15.8% in 2006. We

expect continued expansion in the profit margin in 2007.

Aflac Japan Sales

Aflac Japan’s total new annualized premium sales declined

8.8% in 2006. The sales decline primarily reflected industry-

wide weakness in the market for stand-alone medical

insurance as well as continued declines in the sale of Rider

MAX. The following table presents Aflac Japan’s total new

annualized premium sales for the years ended December 31.

Aflac Japan’s sales mix has been shifting during the last few

years. The following table details the contributions to total

new annualized premium sales by major product for the years

ended December 31.

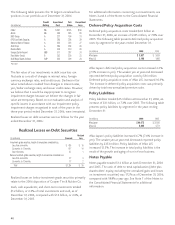

We believe the 2006 sales decline for our medical product

category primarily reflected consumers’ concern over the

claims-paying issues facing the industry in general. We expect

this weakness will continue into 2007. However, with

continued cost pressure on Japan’s health care system, we

expect demand for medical products will continue to rise in

the future and we remain encouraged about the outlook for

the medical insurance market. Although that market is very

competitive, Aflac Japan retains the distinction of being the

number one seller of stand-alone medical insurance in Japan.

We believe that our number one position benefits us in the

marketplace. As a result, we continue to believe that the

medical category will be an important part of our product

portfolio.

The ordinary life category increased 16.9% in 2006, benefiting

from the sale of WAYS, the innovative life insurance product

we introduced in January 2006. Unlike traditional life

insurance, WAYS allows a policyholder to convert a portion of

the life insurance coverage to medical, nursing care, or fixed

annuity benefits at retirement age. We remain very pleased

with the initial response to WAYS, which accounted for

approximately 8% of new sales in 2006.

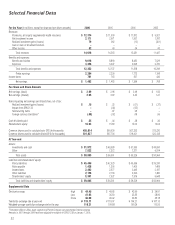

Ratios to total revenues in dollars: 2006 2005 2004

Benefits and claims 65.4% 66.2% 67.2%

Operating expenses:

Amortization of deferred policy acquisition costs 2.7 2.7 2.8

Insurance commissions 8.2 8.6 8.9

Insurance and other expenses 7.9 8.0 7.2

Total operating expenses 18.8 19.3 18.9

Pretax operating earnings* 15.8 14.5 13.9

*See Page 30 for our definition of segment operating earnings.

In Dollars In Yen

(In millions of dollars

and billions of yen) 2006 2005 2004 2006 2005 2004

Total new annualized

premium sales $ 1,010 $ 1,167 $ 1,133 ¥ 117.5 ¥ 128.8 ¥ 122.5

Percentage change

over prior year (13.5)% 3.0% 8.2% (8.8)% 5.1% 1.1%

2006 2005 2004

Medical policies 33% 37% 31%

Cancer life 28 26 23

Ordinary life 23 18 19

Rider MAX 10 11 20

Other 687

Total 100% 100% 100%

31

Aflac Japan Percentage

Changes Over Prior Year

(Yen Operating Results)

Including Foreign Excluding Foreign

Currency Changes *Currency Changes**

2006 2005 2004 2006 2005 2004

Net investment income 9.0% 7.0% 2.3% 6.8% 6.3% 4.5%

Total operating revenues 6.3 6.6 6.0 6.0 6.4 6.3

Pretax operating earnings* 15.4 11.5 14.7 13.3 10.8 15.3

*See Page 30 for our definition of segment operating earnings.

**Amounts excluding foreign currency changes on dollar-denominated items were determined using the same yen/dollar

**exchange rate for the current year as each respective prior year.