Aflac 2006 Annual Report Download - page 65

Download and view the complete annual report

Please find page 65 of the 2006 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

61

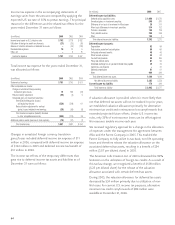

that we would receive or pay to terminate the swaps, taking

into account current interest rates, foreign currency rates and

the current creditworthiness of the swap counterparties. The

fair value of the Japanese policyholder protection fund is our

estimated share of the industry’s obligation calculated on a pro

rata basis by projecting our percentage of the industry’s

premiums and reserves and applying that percentage to the

total industry obligation payable in future years.

The carrying amounts for cash and cash equivalents,

receivables, accrued investment income, accounts payable, cash

collateral and payables for security transactions approximated

their fair values due to the short-term nature of these

instruments. Consequently, such instruments are not included

in the above table. The preceding table also excludes liabilities

for future policy benefits and unpaid policy claims as these

liabilities are not financial instruments as defined by GAAP.

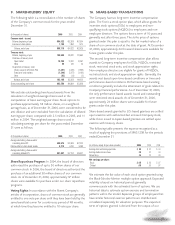

We have outstanding cross-currency swap agreements related

to the $450 million senior notes (see Note 7). We have

designated the foreign currency component of these cross-

currency swaps as a hedge of the foreign currency exposure of

our investment in Aflac Japan. The notional amounts and

terms of the swaps match the principal amount and terms of

the senior notes.

We entered into cross-currency swaps to minimize the impact

of foreign currency translation on shareholders’ equity and to

reduce interest expense by converting the dollar-denominated

principal and interest on the senior notes we issued into yen-

denominated obligations. By entering into these cross-currency

swaps, we have been able to reduce our interest rate from

6.5% in dollars to 1.67% in yen. See Note 1 for information on

the accounting policy for cross-currency swaps.

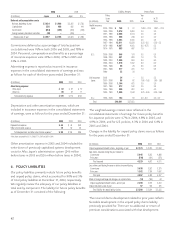

The components of the fair value of the cross-currency swaps

were reflected as an asset or (liability) in the balance sheet as

of December 31 as follows:

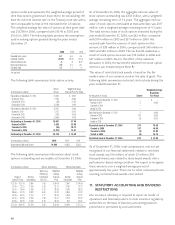

(In millions) 2006 2005

Interest rate component $6 $ 6

Foreign currency component (17) (22)

Accrued interest component 44

Total fair value of cross-currency swaps $ (7) $ (12)

The following is a reconciliation of the foreign currency

component of the cross-currency swaps as included in

accumulated other comprehensive income for the years

ended December 31.

(In millions) 2006 2005 2004

Balance, beginning of year $ (22) $ (91) $ (69)

Increase (decrease) in fair value of cross-currency swaps 554 (37)

Interest rate component not qualifying for hedge accounting

reclassified to net earnings –15 15

Balance, end of year $ (17) $ (22) $ (91)

We have entered into interest rate swap agreements related to

the ¥20 billion variable interest rate Uridashi notes (see Note

7). By entering into these contracts, we have been able to lock

in the interest rate at 1.52% in yen. We have designated these

interest rate swaps as a hedge of the variability in our interest

cash flows associated with the variable interest rate Uridashi

notes. The notional amounts and terms of the swaps match

the principal amount and terms of the variable interest rate

Uridashi notes. The swaps had no value at inception. Changes

in the fair value of the swap contracts are recorded in other

comprehensive income. The fair value of these swaps and

related changes in fair value were immaterial during the year

ended December 31, 2006.

We are exposed to credit risk in the event of nonperformance

by counterparties to our cross-currency and interest rate

swaps. The counterparties to our swap agreements are U.S.

and Japanese financial institutions with the following credit

ratings as of December 31:

(In millions) 2006 2005

Counterparty Fair Value Notional Amount Fair Value Notional Amount

Credit Rating of Swaps of Swaps of Swaps of Swaps

AA $ (7) $ 459 $ (11) $ 375

A– 159 (1) 75

Total $ (7) $ 618 $ (12) $ 450

We have also designated our yen-denominated Samurai and

Uridashi notes (see Note 7) as hedges of the foreign currency

exposure of our investment in Aflac Japan.

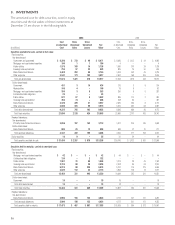

5. DEFERRED POLICY ACQUISITION COSTS AND

INSURANCE EXPENSES

Deferred Policy Acquisition Costs and Insurance Expenses:

Consolidated policy acquisition costs deferred were $1.05

billion in 2006, compared with $1.00 billion in 2005, and $962

million in 2004. The table at the top left of the following page

presents a rollforward of deferred policy acquisition costs by

segment for the years ended December 31.