Aflac 2006 Annual Report Download - page 46

Download and view the complete annual report

Please find page 46 of the 2006 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

42

notes in Japan. If issued, these securities will

not be available to U.S. persons. We also filed

an SRS in August 2006 with Japanese

regulatory authorities to issue up to ¥100

billion (approximately $840 million using the

December 31, 2006, period-end exchange

rate) of Uridashi notes in Japan. In

September 2006, the Parent Company issued

¥45 billion of yen-denominated Uridashi

notes from this SRS. If issued, the remaining

¥55 billion of yen-denominated Uridashi

notes will not be available to U.S. persons.

We believe outside sources for additional

debt and equity capital, if needed, will

continue to be available. For additional information, see Note

7 of the Notes to the Consolidated Financial Statements.

The principal sources of cash for our insurance operations are

premiums and investment income. The primary uses of cash

by our insurance operations are policy claims, commissions,

operating expenses, income taxes and payments to the Parent

Company for management fees and dividends. Both the

sources and uses of cash are reasonably predictable.

When making an investment decision, our first consideration

is based on product needs. Our investment objectives provide

for liquidity through the purchase of investment-grade debt

securities. These objectives also take into account duration

matching, and because of the long-term nature of our

business, we have adequate time to react to changing cash

flow needs.

As a result of policyholder aging, claims payments are

expected to gradually increase over the life of a policy.

Therefore, future policy benefit reserves are accumulated in

the early years of a policy and are designed to help fund

future claims payments. We expect our future cash flows from

premiums and our investment portfolio to be sufficient to

meet our cash needs for benefits and

expenses.

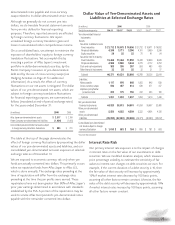

The table at the top of the page presents

the estimated payments by period of our

major contractual obligations as of

December 31, 2006. We translated our

yen-denominated obligations using the

December 31, 2006, exchange rate.

Actual future payments as reported in

dollars will fluctuate with changes in the

yen/dollar exchange rate.

The distribution of payments for future policy benefits is an

estimate of all future benefit payments for policies in force as

of December 31, 2006. These projected values contain

assumptions for future policy persistency, mortality and

morbidity. The distribution of payments for unpaid policy

claims includes assumptions as to the timing of policyholders

reporting claims for prior periods and the amount of those

claims. Actual amounts and timing of both future policy

benefits and unpaid policy claims payments may differ

significantly from the estimates above. We anticipate that the

future policy benefit liability of $40.8 billion at December 31,

2006, along with future net premiums and investment

income, will be sufficient to fund future policy benefit

payments.

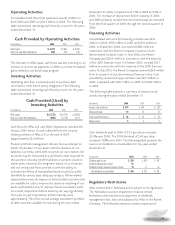

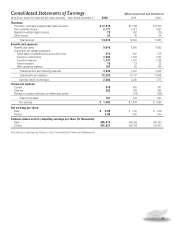

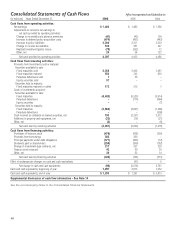

Consolidated Cash Flows

We translate cash flows for Aflac Japan’s yen-denominated

items into U.S. dollars using weighted-average exchange rates.

In years when the yen weakens, translating yen into dollars

causes fewer dollars to be reported. When the yen

strengthens, translating yen into dollars causes more dollars to

be reported. The following table summarizes consolidated

cash flows by activity for the years ended December 31.

Distribution of Payments by Period

Total Total Less Than One to Four to After

(In millions) *Liability* Payments One Year Three Years Five Years Five Years

Future policy benefits liability $ 40,841 $ 208,221 $ 6,403 $ 12,791 $ 12,496 $ 176,531

Unpaid policy claims liability 2,390 2,390 1,794 378 130 88

Long-term debt – principal 1,416 1,416 252 450 630 84

Long-term debt – interest 4 71 18 30 14 9

Policyholder protection fund 175 175 29 47 53 46

Operating service agreements N/A** 530 47 128 121 234

Operating lease obligations N/A** 143 42 36 19 46

Capitalized lease obligations 10 10 4 5 1 –

Total contractual obligations $ 44,836 $ 212,956 $ 8,589 $ 13,865 $ 13,464 $ 177,038

* *Liability amounts are those reported on the consolidated balance sheet as of December 31, 2006.

**Not applicable

Consolidated Cash Flows by Activity

(In millions) 2006 2005

2004

Operating activities $ 4,397 $ 4,433 $ 4,486

Investing activities (4,057) (6,692) (1,418)

Financing activities (434) (196) (313)

Exchange effect on cash and cash equivalents –(61) 6

Net change in cash and cash equivalents $ (94) $ (2,516) $ 2,761