Aflac 2006 Annual Report Download - page 56

Download and view the complete annual report

Please find page 56 of the 2006 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

52

We review the estimated liability for policyholder protection

fund contributions on an annual basis and report any

adjustments in Aflac Japan’s expenses.

In the United States, each state has a guaranty association that

supports insolvent insurers operating in those states. To date,

our state guaranty association assessments have not been

material.

Treasury Stock: Treasury stock is reflected as a reduction of

shareholders’ equity at cost. We use the weighted-average

purchase cost to determine the cost of treasury stock that is

reissued. We include any gains and losses in additional paid-in

capital when treasury stock is reissued.

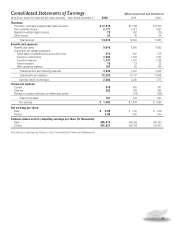

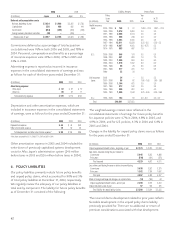

Earnings Per Share: We compute basic earnings per share

(EPS) by dividing net earnings by the weighted-average

number of unrestricted shares outstanding for the period.

Diluted EPS is computed by dividing net earnings by the

weighted-average number of shares outstanding for the

period plus the shares representing the dilutive effect of

share-based awards.

New Accounting Pronouncements: In September 2006, the

FASB issued Statement of Financial Accounting Standards

(SFAS) No. 158, Employers’ Accounting for Defined Benefit

Pension and Other Postretirement Plans, an amendment of

FASB Statements No. 87, 88, 106, and 132(R) (SFAS 158). The

provisions of SFAS 158 apply to all plan sponsors who offer

defined benefit postretirement plans. SFAS 158 requires a plan

sponsor to recognize the plan’s funded status as an asset or

liability in its balance sheet, and to measure plan assets and

liabilities as of the end of the sponsor’s fiscal year. It also

requires an entity to recognize changes in the funded status of

a defined benefit postretirement plan in comprehensive

income in the year in which the changes occur. However, SFAS

158 does not change the amount of net periodic benefit cost,

or expense, included in net earnings. The recognition and

disclosure requirements of SFAS 158 are effective as of the

end of the fiscal year ending after December 15, 2006. The

measurement date provisions are effective for fiscal years

ending after December 15, 2008. Earlier application of the

measurement date provisions is encouraged. We adopted the

recognition and measurement date provisions of this standard

effective December 31, 2006. The adoption of this standard

increased our pension plans’ projected benefit obligation by

$64 million; and resulted in a charge to other comprehensive

income of $64 million before taxes to reflect the increase in

pension liabilities and an opening adjustment to retained

earnings in the amount of $2 million.

In September 2006, the FASB issued SFAS No. 157, Fair Value

Measurements (SFAS 157). SFAS 157 defines fair value,

establishes a framework for measuring fair value under GAAP,

and expands disclosures about fair value measurements. This

standard applies to other accounting pronouncements that

require or permit fair value measurements, the FASB having

previously concluded in those accounting pronouncements

that fair value is the relevant measurement attribute.

Accordingly, SFAS 157 does not require any new fair value

measurements. Where applicable, this standard simplifies and

codifies related guidance within GAAP. SFAS 157 is effective for

fiscal years beginning after November 15, 2007, with earlier

application encouraged under limited circumstances. We do

not expect the adoption of this standard to have a material

effect on our financial position or results of operations.

In June 2006, the FASB issued FASB Interpretation No. 48

(FIN 48), Accounting for Uncertainty in Income Taxes, an

Interpretation of FASB Statement No. 109. The provisions of

FIN 48 clarify the accounting for uncertainty in income taxes

recognized in an enterprise’s financial statements in

accordance with SFAS No. 109, Accounting for Income Taxes.

FIN 48 prescribes a recognition threshold and measurement

attribute for the financial statement recognition and

measurement of a tax position taken or expected to be taken

in a tax return. The evaluation of a tax position in accordance

with FIN 48 is a two-step process. Under the first step, the

enterprise determines whether it is more-likely-than-not that

a tax position will be sustained upon examination by taxing

authorities. The second step is measurement, whereby a tax

position that meets the more-likely-than-not recognition

threshold is measured to determine the amount of benefit to

recognize in the financial statements. The tax position is

measured at the largest amount of benefit that is greater than

50% likely of being realized upon ultimate settlement. FIN 48

also provides guidance on derecognition, classification,

interest and penalties, accounting in interim periods,

disclosure, and transition. FIN 48 is effective for fiscal years

beginning after December 15, 2006, with earlier application

encouraged. We do not expect the adoption of this

interpretation to have a material effect on our financial

position or results of operations.

In February 2006, the FASB issued SFAS No. 155, Accounting

for Certain Hybrid Financial Instruments, an amendment of

FASB Statements No. 133 and 140 (SFAS 155). The provisions

of SFAS 155 are effective for all financial instruments acquired

or issued after the beginning of the first fiscal year after

September 15, 2006. Earlier adoption is permitted. SFAS 155

amends the accounting for hybrid financial instruments and

eliminates the exclusion of beneficial interests in securitized

financial assets from the guidance under SFAS 133. It also

eliminates the prohibition on the type of derivative

instruments that qualified special purpose entities may hold

under SFAS 140. Furthermore, SFAS 155 clarifies that