Aflac 2006 Annual Report Download - page 44

Download and view the complete annual report

Please find page 44 of the 2006 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

40

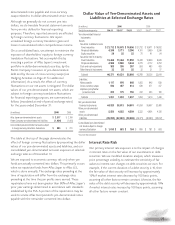

The following table presents the 10 largest unrealized loss

positions in our portfolio as of December 31, 2006.

The fair value of our investments in debt securities can

fluctuate as a result of changes in interest rates, foreign

currency exchange rates, and credit issues. Declines in fair

value noted above resulted from changes in interest rates,

yen/dollar exchange rates, and issuer credit status. However,

we believe that it would be inappropriate to recognize

impairment charges because we believe the changes in fair

value are temporary. Based on our evaluation and analysis of

specific issuers in accordance with our impairment policy,

impairment charges recognized in each of the years in the

three-year period ended December 31, 2006, were immaterial.

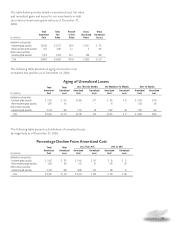

Realized losses on debt securities were as follows for the year

ended December 31, 2006:

Realized losses on below-investment-grade securities primarily

relate to the 2006 disposition of Cooper Tire & Rubber Co.

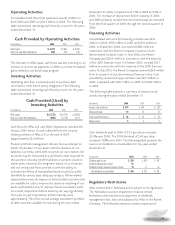

Cash, cash equivalents, and short-term investments totaled

$1.2 billion, or 2.3% of total investments and cash, as of

December 31, 2006, compared with $1.3 billion, or 2.6%, at

December 31, 2005.

For additional information concerning our investments, see

Notes 3 and 4 of the Notes to the Consolidated Financial

Statements.

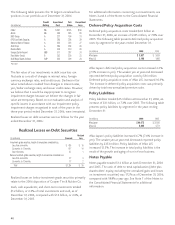

Deferred Policy Acquisition Costs

Deferred policy acquisition costs totaled $6.0 billion at

December 31, 2006, an increase of $435 million, or 7.8% over

2005. The following table presents deferred policy acquisition

costs by segment for the years ended December 31.

Aflac Japan’s deferred policy acquisition costs increased 6.4%

(7.4% increase in yen). The weaker yen at year-end decreased

reported deferred policy acquisition costs by $34 million.

Deferred policy acquisition costs of Aflac U.S. increased 10.3%.

The increase in deferred policy acquisition costs was primarily

driven by total new annualized premium sales.

Policy Liabilities

Policy liabilities totaled $45.4 billion at December 31, 2006, an

increase of $3.1 billion, or 7.3% over 2005. The following table

presents policy liabilities by segment for the years ending

December 31.

Aflac Japan’s policy liabilities increased 6.7% (7.6% increase in

yen). The weaker yen at year-end decreased reported policy

liabilities by $353 million. Policy liabilities of Aflac U.S.

increased 12.5%. The increase in total policy liabilities is the

result of the growth and aging of our in-force business.

Notes Payable

Notes payable totaled $1.4 billion at both December 31, 2006

and 2005. The ratio of debt to total capitalization (debt plus

shareholders’ equity, excluding the unrealized gains and losses

on investment securities) was 17.2% as of December 31, 2006,

compared with 18.8% a year ago. See Note 7 of the Notes to

the Consolidated Financial Statements for additional

information.

Credit Amortized Fair Unrealized

(In millions) Rating Cost Value Loss

CSAV BB $ 201 $ 145 $ 56

Ahold BB 300 245 55

KBC Group A 227 196 31

EFG Euro Bank Ergasias A 285 256 29

National Bank of Greece A 252 225 27

SLM Corp A 284 258 26

Nordea Bank A 336 310 26

Unique Zurich Airport BBB 311 287 24

Ford Motor Credit B 252 229 23

KLM Royal Dutch Airlines N/R* 252 229 23

*Not rated

Realized Losses on Debt Securities

Realized

(In millions)

Proceeds Loss

Investment-grade securities, length of consecutive unrealized loss:

Less than six months $ 426 $ 15

Six months to 12 months 617 14

Over 12 months 37 1

Below-investment-grade securities, length of consecutive unrealized loss:

Less than six months 37 3

Six months to 12 months 17 2

Total $ 1,134 $ 35

(In millions)

2006 2005

Aflac Japan $ 3,857 $ 3,624

Aflac U.S. 2,168 1,966

(In millions)

2006

2005

Aflac Japan $ 40,072 $ 37,556

Aflac U.S. 5,365 4,771