Aflac 2006 Annual Report Download - page 57

Download and view the complete annual report

Please find page 57 of the 2006 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

53

concentrations of credit risk in the form of subordination are

not embedded derivatives. In accordance with the standard’s

early adoption provisions, we adopted the provisions of SFAS

155 on January 1, 2006. The adoption of this standard did not

have any impact on our financial position or results of

operations.

In November 2005, the FASB issued Staff Position Number

FAS 115-1, The Meaning of Other-Than-Temporary

Impairment and Its Application to Certain Investments (FSP

115-1). FSP 115-1 addresses the determination as to when an

investment is considered impaired, whether that impairment is

other than temporary, and the measurement of an

impairment loss. It also includes accounting considerations

subsequent to the recognition of an other-than-temporary

impairment and requires certain disclosures about unrealized

losses that have not been recognized as other-than-temporary

impairments. The guidance in FSP 115-1 amends SFAS No.

115, Accounting for Certain Investments in Debt and Equity

Securities, and became effective January 1, 2006. The

adoption of this staff position did not have a material effect

on our financial position or results of operations.

In September 2005, the Accounting Standards Executive

Committee of the AICPA issued Statement of Position (SOP)

05-1, Accounting by Insurance Enterprises for Deferred

Acquisition Costs in Connection with Modifications or

Exchanges of Insurance Contracts (SOP 05-1). SOP 05-1

provides accounting guidance on internal replacements of

insurance and investment contracts other than those

specifically described in SFAS No. 97, Accounting and

Reporting by Insurance Enterprises for Certain Long-Duration

Contracts and for Realized Gains and Losses from the Sale of

Investments. SOP 05-1 is effective for internal replacements

occurring in fiscal years beginning after December 15, 2006,

with earlier adoption encouraged. Retrospective application of

this SOP to previously issued financial statements is not

permitted. The adoption of this standard is not expected to

have a significant impact on our financial position or results of

operations.

In December 2004, the FASB issued SFAS No. 123 (revised),

Share-Based Payment (SFAS 123R). This standard amends

SFAS No. 123, Accounting for Stock-Based Compensation, and

supercedes APB Opinion No. 25, Accounting for Stock Issued

to Employees, and its related implementation guidance. SFAS

123R establishes the accounting for grants of share-based

awards in which an entity exchanges its equity instruments for

goods or services. It also addresses transactions in which an

entity incurs liabilities in exchange for goods or services that

are based on the fair value of the entity’s equity instruments

or transactions that may be settled by the issuance of those

equity instruments. SFAS 123R requires that companies use a

fair value method to value share-based awards and recognize

the related compensation expense in net earnings. The

provisions of SFAS 123R, as amended by the Securities and

Exchange Commission, were effective as of the beginning of

the first fiscal year after June 15, 2005, although earlier

application was encouraged. In accordance with the standard’s

early adoption provisions, we began accounting for share-

based awards using the modified-retrospective application

method effective January 1, 2005.

Recent accounting pronouncements that were not discussed

above are not applicable to our business.

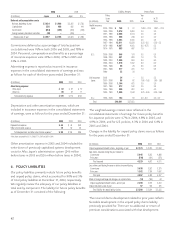

Securities and Exchange Commission Guidance: In

September 2006, the Securities and Exchange Commission

(SEC) issued Staff Accounting Bulletin No. 108 (SAB 108). SAB

108 addresses quantifying the financial statement effects of

misstatements, specifically, how the effects of prior year

uncorrected errors must be considered in quantifying

misstatements in current year financial statements. Under the

provisions of SAB 108, a reporting entity must quantify and

evaluate errors using a balance sheet approach and an income

statement approach. After considering all relevant quantitative

and qualitative factors, if either approach results in a

misstatement that is material, a reporting entity’s financial

statements must be adjusted. SAB 108 applies to SEC

registrants and is effective for fiscal years ending after

November 15, 2006. In the course of evaluating balance sheet

amounts in accordance with the provisions of SAB 108, we

have identified the following amounts that we have adjusted

for as of January 1, 2006: a tax liability in the amount of $87

million related to deferred tax asset valuation allowances that

were not utilized; a tax liability in the amount of $45 million

related to various provisions for taxes that were not utilized;

and a litigation liability in the amount of $11 million related to

provisions for various pending law suits that were not utilized.

These liabilities were recorded in immaterial amounts prior to

2004 over a period ranging from 10 to 15 years. However,

using the dual evaluation approach prescribed by SAB 108,

correction of the above amounts would be material to current

year earnings. In accordance with the provisions of SAB 108,

the following amounts, net of tax where applicable, have been

reflected as an opening adjustment to retained earnings as of

January 1, 2006: a reduction of tax liabilities in the amount of

$132 million; a reduction of litigation reserves in the amount

of $11 million; and a reduction in deferred tax assets in the

amount of $4 million. These three adjustments resulted in a

net addition to retained earnings in the amount of $139

million.