Aflac 2006 Annual Report Download - page 43

Download and view the complete annual report

Please find page 43 of the 2006 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

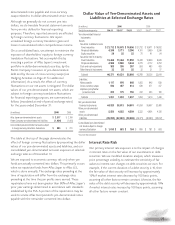

The table below provides details on amortized cost, fair value

and unrealized gains and losses for our investments in debt

securities by investment-grade status as of December 31,

2006.

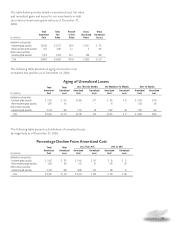

The following table presents an aging of securities in an

unrealized loss position as of December 31, 2006.

The following table presents a distribution of unrealized losses

by magnitude as of December 31, 2006.

Total Total Percent Gross Gross

Amortized Fair of Fair Unrealized Unrealized

(In millions) Cost Value Value Gains Losses

Available-for-sale securities:

Investment-grade securities $ 30,165 $ 32,127 63.5% $ 2,341 $ 379

Below-investment-grade securities 1,275 1,086 2.1 6 195

Held-to-maturity securities:

Investment-grade securities 17,473 17,393 34.4 488 568

Total $ 48,913 $ 50,606 100.0% $ 2,835 $ 1,142

Aging of Unrealized Losses

Total Total Less Than Six Months Six Months to 12 Months Over 12 Months

Amortized Unrealized Amortized Unrealized Amortized Unrealized Amortized Unrealized

(In millions) Cost Loss Cost Loss Cost Loss Cost Loss

Available-for-sale securities:

Investment-grade securities $ 9,163 $ 379 $ 1,965 $ 17 $ 782 $ 19 $ 6,416 $ 343

Below-investment-grade securities 1,209 195 – – 16 – 1,193 195

Held-to-maturity securities:

Investment-grade securities 10,148 568 1,221 58 1,692 58 7,235 452

Total $ 20,520 $ 1,142 $ 3,186 $ 75 $ 2,490 $ 77 $ 14,844 $ 990

39

Percentage Decline From Amortized Cost

Total Total Less Than 20% 20% to 28%

Amortized Unrealized Amortized Unrealized Amortized Unrealized

(In millions) Cost Loss Cost Loss Cost Loss

Available-for-sale securities:

Investment-grade securities $ 9,163 $ 379 $ 9,104 $ 367 $ 59 $ 12

Below-investment-grade securities 1,209 195 643 61 566 134

Held-to-maturity securities:

Investment-grade securities 10,148 568 9,980 534 168 34

Total $ 20,520 $ 1,142 $ 19,727 $ 962 $ 793 $ 180