Aflac 2006 Annual Report Download - page 7

Download and view the complete annual report

Please find page 7 of the 2006 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

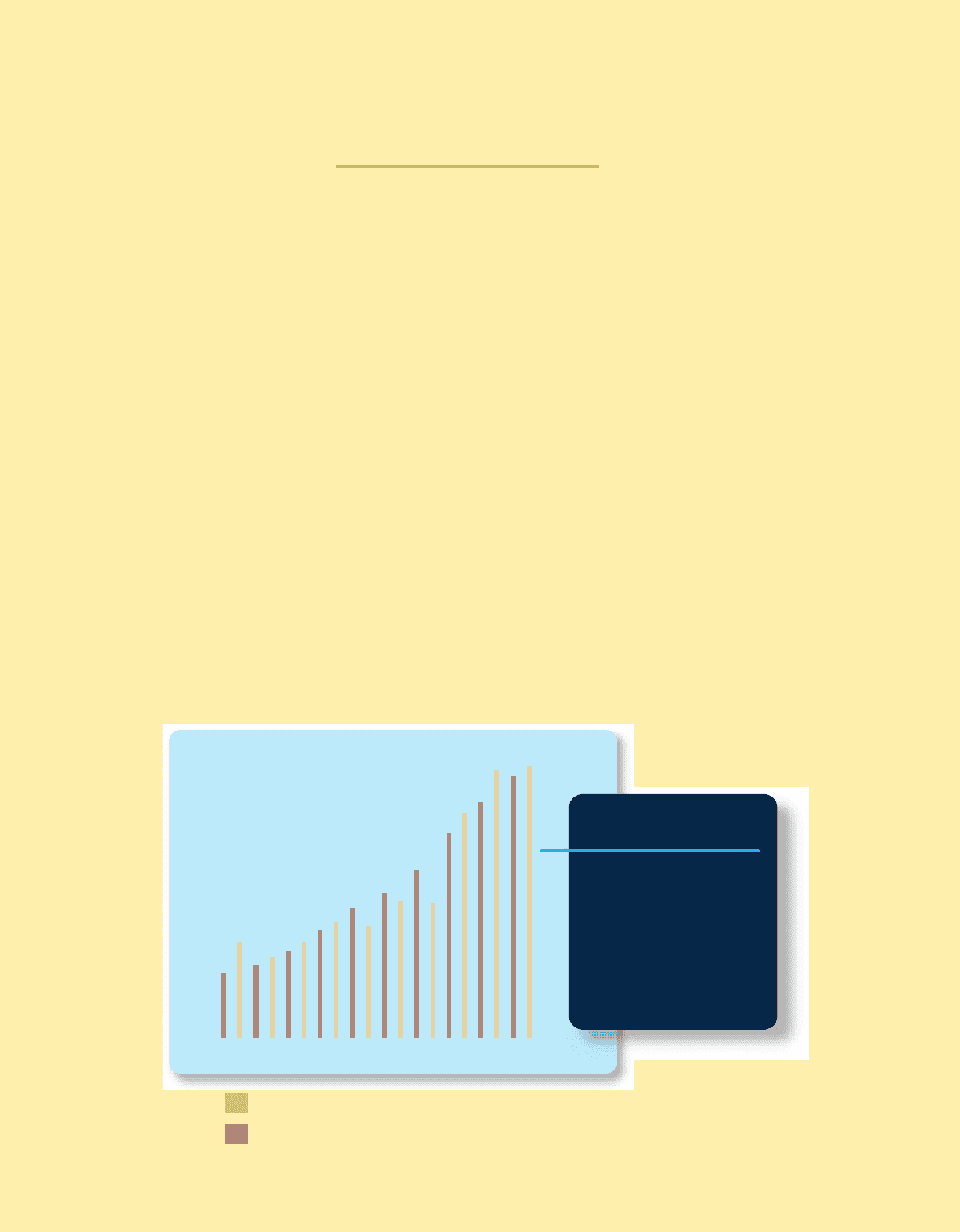

Net Earnings

Per Diluted Share

Net earnings per share reflected

record operating results, but lower

realized investment gains. Based on

the internal financial measure we use

to assess management’s

performance, which excludes items

that are either outside

management’s control or inherently

unpredictable, we achieved our

primary financial target in 2006.

97 98 99 00 01 02 03 04 05 06

1.04

.88

1.04

1.2 6 1.22

1.49 1.47

2.45

2.92 $2.95

Net Earnings Per Diluted Share

Internal Performance Measure

financial objective we use internally to assess

the growth of our business. We have

consistently defined that objective as the

growth of net earnings per diluted share,

excluding items that are inherently

unpredictable. We believe this objective is a

valuable measure for evaluating our

management and business performance.

And further, we believe that achieving our

objective is the primary driver of

shareholder value over the long term.

Another way we enhance shareholder value

is through dividends and our share

repurchase program. It has been our

objective to generally increase the cash

dividend in line with our internal

performance measure of earnings per share

growth. Reflecting a strong capital position

and confidence in our business model, we

raised the dividend twice in 2006. As a

result, cash dividends paid per share in 2006

were 25.0% higher than in 2005. We also

repurchased 10.3 million shares in 2006,

bringing the total number of shares we have

acquired since 1994 to more than 197

million. We believe that repurchasing Aflac

shares has proven to be a good use of excess

capital, and it has also enhanced our

per-share results.

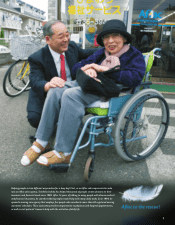

Aflac Japan – Adapting to a

Changing and Challenging Market

We have seen many changes in Japan’s

health care and insurance environment since

our entry in 1974. Health care costs have

steadily shifted to consumers for several

years as the country has tried to cope with

the effects of an aging population. That in

turn has led more insurance companies to

participate in the market for insurance

products like Aflac’s that pay “living

benefits” as opposed to more traditional

“death benefits.” As a result, we have seen a

more crowded market in recent years. Yet

despite the increase in competitors, we

believe we retain distinct strengths, including

our administrative efficiency, which allow us

to offer a very competitive product value to

consumers.

A major highlight in 2006 was the

introduction of WAYS, an innovative life

insurance product that gives consumers

significant flexibility by allowing them to

convert a portion of the policy’s death

benefits to either medical or nursing

coverage or annuity payments at retirement

age. The consumer response to WAYS led

to a strong year for our traditional life

insurance sales. However, due to weakness

in the medical product category, which

includes our EVER product line and Rider

MAX, total new sales declined for the year.

In addition to crowded market conditions,

consumer confidence in Japan’s insurance

industry deteriorated throughout the year.

Consumer skepticism was fueled by

widespread media coverage of business

suspensions and sanctions against non-life

insurance companies for claims payment

processing errors. It became clear in

mid-2006 that industrywide demand for

insurance products was being restrained by

the claims payment issue, especially for the

medical product segment where many of

the claims issues arose. In fact, research

conducted in December 2006 showed that

37% of consumers were not interested in

purchasing insurance due to their concerns

over the claims payment issue.

What has also become very clear in the

current environment is that to be effective

3

Amounts in 2001 through 2004 have been adjusted to reflect adoption of SFAS 123R on January 1, 2005.