Aflac 2006 Annual Report Download - page 58

Download and view the complete annual report

Please find page 58 of the 2006 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

54

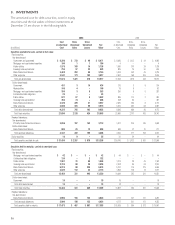

2. BUSINESS SEGMENT AND FOREIGN

INFORMATION

The Company consists of two reportable insurance business

segments: Aflac Japan and Aflac U.S., both of which sell

individual supplemental health and life insurance.

Operating business segments that are not individually

reportable are included in the “Other business segments”

category. We do not allocate corporate overhead expenses to

business segments. We evaluate and manage our business

segments using a financial performance measure called pretax

operating earnings. Our definition of operating earnings

excludes the following items from net earnings on an after-tax

basis: realized investment gains/losses, the impact from SFAS

133, and nonrecurring items. We then exclude income taxes

related to operations to arrive at pretax operating earnings.

Information regarding operations by segment for the years

ended December 31 follows:

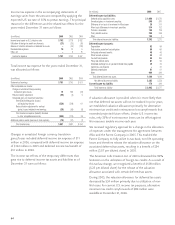

(In millions) 2006 2005 2004

Revenues:

Aflac Japan:

Earned premiums:

Cancer life $ 4,923 $ 5,147 $ 5,223

Other accident and health 2,755 2,577 2,220

Life insurance 1,084 1,021 925

Net investment income 1,688 1,635 1,557

Other income 25 31 18

Total Aflac Japan 10,475 10,411 9,943

Aflac U.S.:

Earned premiums:

Accident/disability 1,580 1,424 1,261

Cancer expense 1,041 982 918

Other health 801 721 649

Life insurance 130 118 107

Net investment income 465 421 396

Other income 10 10 9

Total Aflac U.S. 4,027 3,676 3,340

Other business segments 42 39 33

Total business segments 14,544 14,126 13,316

Realized investment gains (losses) 79 262 (12)

Japanese pension obligation transfer ––6

Corporate 87 74 24

Intercompany eliminations (94) (99) (53)

Total revenues $ 14,616 $ 14,363 $ 13,281

(In millions) 2006 2005 2004

Pretax Earnings:

Aflac Japan $ 1,652 $ 1,515* $ 1,379*

Aflac U.S. 585 525 497

Other business segments 5––

Total business segments 2,242 2,040 1,876

Interest expense, noninsurance operations (17) (20) (20)

Corporate and eliminations (40) (41) (62)

Pretax operating earnings 2,185 1,979 1,794

Realized investment gains (losses) 79 262 (12)

Impact from SFAS 133 –(15) (15)

Japanese pension obligation transfer ––6

Total earnings before income taxes $ 2,264 $ 2,226 $ 1,773

Income taxes applicable to pretax operating earnings $ 753 $ 687 $ 641

Effect of foreign currency translation on

operating earnings (39) (8) 39

*Includes charges of $46 in 2005 and $26 in 2004 related to the write-down of previously capitalized systems development

costs for Aflac Japan’s administration system.

Assets as of December 31 were as follows:

(In millions) 2006 2005

Assets:

Aflac Japan $ 48,850 $ 46,200

Aflac U.S. 10,249 9,547

Other business segments 110 90

Total business segments 59,209 55,837

Corporate 10,023 9,559

Intercompany eliminations (9,427) (9,035)

Total assets $ 59,805 $ 56,361

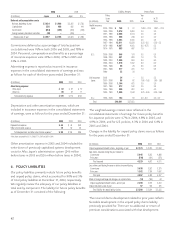

Yen-Translation Effects: The following table shows the

yen/dollar exchange rates used for or during the periods

ended December 31. Exchange effects were calculated using

the same yen/dollar exchange rate for the current year as for

each respective prior year.

2006 2005 2004

Statements of Earnings:

Weighted-average yen/dollar exchange rate 116.31 109.88 108.26

Yen percent strengthening (weakening) (5.5)% (1.5)% 7.1%

Exchange effect on net earnings (millions) $ (41) $ (16) $ 39

2006 2005

Balance Sheets:

Yen/dollar exchange rate at December 31 119.11 118.07

Yen percent strengthening (weakening) (.9)% (11.7)%

Exchange effect on total assets (millions) $ (400) $ (5,703)

Exchange effect on total liabilities (millions) (392) (5,599)

Aflac Japan maintains a portfolio of dollar-denominated

securities, which serves as an economic currency hedge of a

portion of our investment in Aflac Japan. We have designated

the Parent Company’s yen-denominated notes payable and

cross-currency swaps as a hedge of our investment in Aflac