Aflac 2006 Annual Report Download - page 59

Download and view the complete annual report

Please find page 59 of the 2006 Aflac annual report below. You can navigate through the pages in the report by either clicking on the pages listed below, or by using the keyword search tool below to find specific information within the annual report.

55

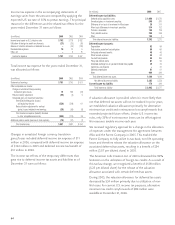

Japan. The dollar values of our yen-denominated net assets,

which are subject to foreign currency translation fluctuations

for financial reporting purposes, are summarized as follows at

December 31 (translated at end-of-period exchange rates):

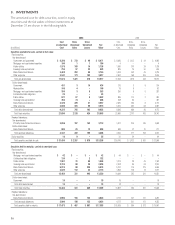

(In millions) 2006 2005

Aflac Japan net assets $ 5,782 $ 5,494

Aflac Japan dollar-denominated net assets (3,465) (3,310)

Aflac Japan yen-denominated net assets 2,317 2,184

Parent Company yen-denominated net liabilities (1,434) (1,403)

Consolidated yen-denominated net assets subject to

foreign currency translation fluctuations $ 883 $ 781

Transfers of funds from Aflac Japan: Aflac Japan makes

payments to the Parent Company for management fees and

to Aflac U.S. for allocated expenses and profit repatriations.

Information on transfers for each of the years ended

December 31 is shown below. See Note 11 for information

concerning restrictions on transfers from Aflac Japan.

(In millions) 2006 2005 2004

Management fees $25 $28 $24

Allocated expenses 32 30 26

Profit repatriation 442 374 220

Total transfers from Aflac Japan $ 499 $ 432 $ 270

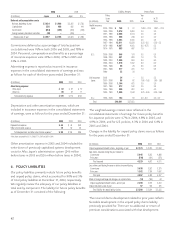

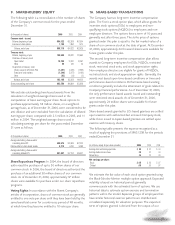

Policyholder Protection Fund: The total liability accrued for

our obligations to the Japanese life insurance policyholder

fund was $175 million (¥20.8 billion) at December 31, 2006,

compared with $203 million (¥23.9 billion) a year ago. The

obligation is payable in semi-annual installments through 2013.

Property and Equipment: The costs of buildings, furniture

and equipment are depreciated principally on a straight-line

basis over their estimated useful lives (maximum of 45 years

for buildings and 10 years for furniture and equipment).

Expenditures for maintenance and repairs are expensed as

incurred; expenditures for betterments are capitalized and

depreciated. Classes of property and equipment as of

December 31 were as follows:

(In millions) 2006 2005 2004

Property and equipment:

Land $ 118 $ 119 $ 146

Buildings 379 361 404

Equipment 224 226 225

Total property and equipment 721 706 775

Less accumulated depreciation 263 258 260

Net property and equipment $ 458 $ 448 $ 515

Receivables: Receivables consisted primarily of monthly

insurance premiums due from individual policyholders or their

employers for payroll deduction of premiums. At December

31, 2006, $221 million, or 41.4% of total receivables, were

related to Aflac Japan’s operations, compared with $192

million, or 40.0%, at December 31, 2005.